U.S. The "Destination" For Outsourcing: Will CDMO Capacity Hold Up?

By Louis Garguilo, Chief Editor, Outsourced Pharma

Considerable energies and varying pots of money have been devoted to further persuading U.S.-based biotechnology and pharmaceutical companies to stay at home when outsourcing.

That appears to be working.

An experienced business development professional recently told me this about her CDMO:

“We have facilities in Europe and the U.S., but today the biotechs here all have the same prerequisite: The work has to be done stateside.”

Now we learn this from a comprehensive report and survey of global biopharmaceutical companies:

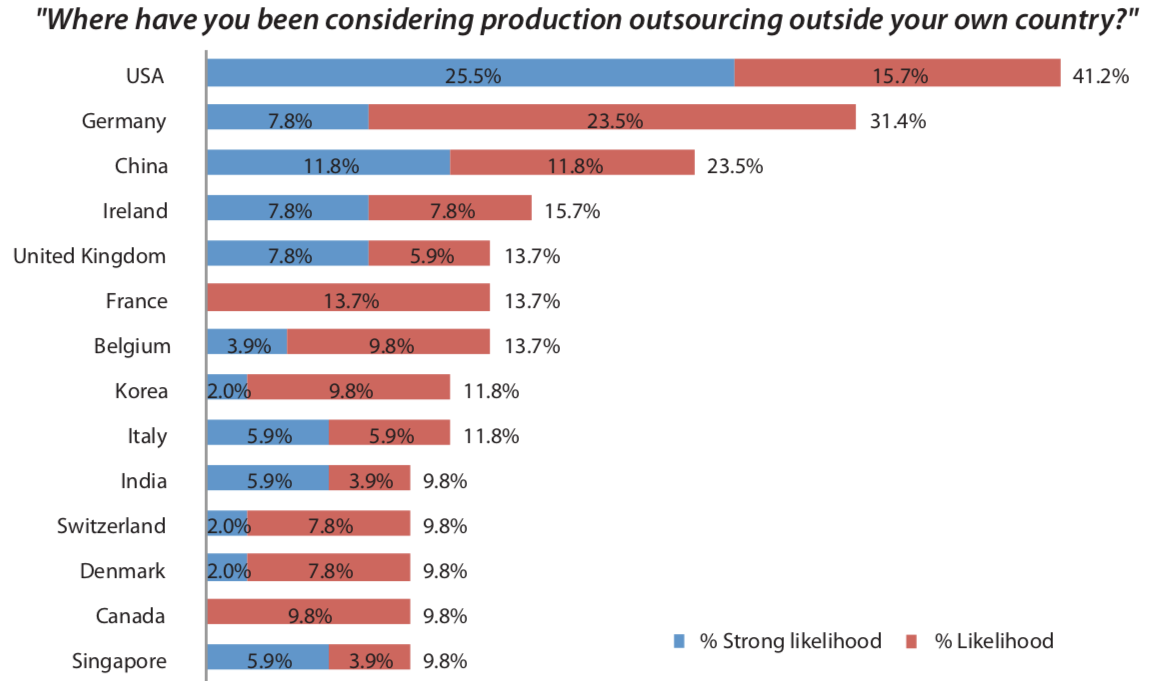

Of the non-U.S.-based respondents, 41.2% selected the U.S. for increasing their biomanufacturing activities.

That was revealed in BioPlan’s 17th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production: A Study of Biotherapeutic Developers and Contract Manufacturing Organizations (April 2020).

All things taken together, it looks increasing safe to say we’ll see:

- increased workloads for U.S.-based CDMOs;

- continuation of new CDMO formation and existing CDMO expansions;

- more M&A and co-marketing by CDMOs;

- even increased federal, state and local investments in CDMOs, adding to abundant private equity and venture capital allocations.

As they say in the travel industry: We are a destination.

But let’s not go overboard.

This realism was made particularly poignant in a recent front-page Wall Street Journal article, citing Britain’s Medicine and Healthcare Products Regulatory Agency:

“Overall, China makes nearly half of the planet’s API.”

The Journal was mainly referencing antibiotics and common generic medicines. The overreliance there is critical, and dangerous health-wise and geopolitically.

But for Outsourced Pharma readers looking to U.S.-based CDMOs for assistance with your new drug development and manufacturing – particularly bioprocessing – the BioPlan report provides different, potentially significant implications for you.

Top Destinations For Outsourcing

First, a thank you to BioPlan Associates, Inc. for making available to Outsourced Pharma its over 500-page annual report.

I’ve selected for readers a specific area of the report where respondents (130 individuals at biopharmaceutical manufacturers and CMOs in 33 countries, plus 150 industry vendors and direct suppliers of materials, services, and equipment) were asked to consider a five-year horizon (to 2025) to evaluate their plans for international (not domestic) outsourcing of bioprocessing.

According to the report, among non-US respondents citing use of foreign-based CMOs, the U.S. again ranked highest as a potential outsourcing destination, with 41.2% indicating a likelihood or strong likelihood they would outsource production to U.S.-based facilities. (That was virtually unchanged from last year’s report.)

As you can see – did you immediately scan to locate China? – Germany is now the second destination for any offshore outsourcing.

China moved to #3 with 23.5%, down from 29.0% in 2019.

China remains the most popular developing country as an outsourcing destination, “but patent and IP issues also come into play.”

According to the report, both China and India suffer from multiple cases of IP theft alleged by developing country-based companies, and both countries’ bioprocessing facilities “have continuing problems with data fraud and related regulatory inspection failures.”

The report states: “The Chinese government or other organizations in China have been associated with hacking and theft of IP from U.S. and other Western companies, with these cases rarely, if ever, publicly reported, and even less frequently brought to trial by the targeted companies. Besides the signals it sends to U.S. industry about the appropriateness (or not) of doing business with Chinese firms, the current U.S. ‘trade war” with China will likely decrease U.S. developers’ interest in outsourcing to China, e.g., if they have to pay an additional 30% to import CMO-manufactured products into the U.S.”

Overall, “regulatory concerns in outsourcing” weigh heavily on the minds of biomanufacturers today.

According to the report, “the necessary [regulatory] expertise primarily exists in more established markets. A lack of demonstrated or perceived regulatory and GMP manufacturing expertise within CMOs relevant to developed country markets may be creating a considerable hurdle for these CMOs to increase the services they provide to major market clients.”

Thus, U.S.-based (and Europe-based) CDMOs are in a strong position.

Is it so strong that capacity becomes an issue for readers relying on these service providers for new drug programs?

Cell And Gene Concerns

According to the report, most readers can rest easily (if that’s ever possible in this business): The capacity is there for the most part.

The other part is in the cell and gene arena.

There is much more detail in the report on capacity, but I’ve selected this passage for our immediate purpose of initial and overall understanding:

“This year’s survey data generally align with other industry analyses that agree there is likely sufficient capacity worldwide to meet production requirements for biopharmaceuticals now, and likely will be through at least the next five years (other than likely for special needs, such as Covid/pandemic response products).

“Much new capacity has been added in recent years and much is under construction, much of this now single-use, and neither developers nor CMOs are overall currently experiencing shortages of capacity.”

In fact, concludes the report’s authors, “most everything in terms of capacity supply and demand appears in rather healthy equilibrium,” with the exception of where “a few specialties or niches, notably cell and gene therapy manufacturing, have severe and persisting capacity shortfalls, with much more capacity needing to be constructed.”

So, like any popular destination, there are some areas harder to get into than others.

Overall the environment trends fairly well for CDMOs in the U.S. Though that’s not perfect solace for cell-and-gene therapy developers, it should mean a positive future for all areas of our industry looking for CDMO assistance.

In fact, readers may recall we’ve already covered a number of new cell-and-gene capacity additions over the past months, some of which I’ll list here for further reading: