Small Molecules And The Cost Of CDMO Services

By Louis Garguilo, Chief Editor, Outsourced Pharma

Alas, we incessantly chase the new

While neglecting the tried and true

Above is the extent of my poetic prowess (readers can breathe a sigh of relief). But this verse of sorts arose organically from my investigation into two reports on the state of small-molecule outsourcing, one focused on API, and the other drug product.

The reports are from my colleagues at ISR Reports and based on well-designed industry surveys released to clients this spring.

The reports are from my colleagues at ISR Reports and based on well-designed industry surveys released to clients this spring.

That it’s taken me this long to get this out to Outsourced Pharma readers suggests, among other things, a certain back-burner status some of us in the industry have assigned to small molecules (SM) – those tried-and-true of verse.

I say, “some of us,” because SM drugs still comprise ~90% of all commercial medicines sold, and three-quarters of new medicines approved in the U.S., are SM.

Make no mistake; plenty of our contemporaneous professionals are directly involved in the continuing research, development and commercialization of small molecules of all kinds.

At the same time, and for valid reasons, a growing number of us in media and elsewhere have been busy focusing on everything cell-and-gene therapy, or other newer spaces like mRNA or siRNA, and tracking evolving business models, overall capacity, and supply-chain challenges, and in our case of course, strategies for working with CDMOs in the field of biologics, etc.

All along, though, interesting developments are continuing in the SM world, offering exciting and helpful medicines, with innovative technologies. (see for example: A Star Is Born To Deliver Drugs: Can It Be Outsourced?)

And let’s add a crucial note: As a good bit of recent “vaccine hesitancy,” and slow COVID-therapy uptakes reaffirm, patients (and the market) will always prefer the pill to the needle if given a choice.

And so back to those two reports I mention above, namely:

Small Molecule Drug Product CDMO Benchmarking (5th Ed.)

Small Molecule API CDMO Benchmarking (7th Ed.)

First, I should inform those who aren’t familiar yet, ISR Reports prepares all its surveys/reports with the aim of helping biopharmaceutical companies make more informed CDMO selection decisions, and in turn assisting CDMOs in optimizing operational and marketing strategies, and customer service.

The Price Point

An interesting point in the surveys has to do with the importance of price when securing outsourcing help in the SM arena.

According to executives and other professionals whose companies are involved in outsourcing in this space, and who replied to the ISR survey investigating small molecule outsourcing, the answer to that question has recently changed.

We’ve heard many times before that the price CDMOs charge is relatively less important than other factors (e.g., quality, reliability) when deciding on which external partners to work with. Although faithfully reporting this, I for one have remained a stubborn skeptic.

According to these new reports, I was correct in exercising skepticism … until now.

From the report:

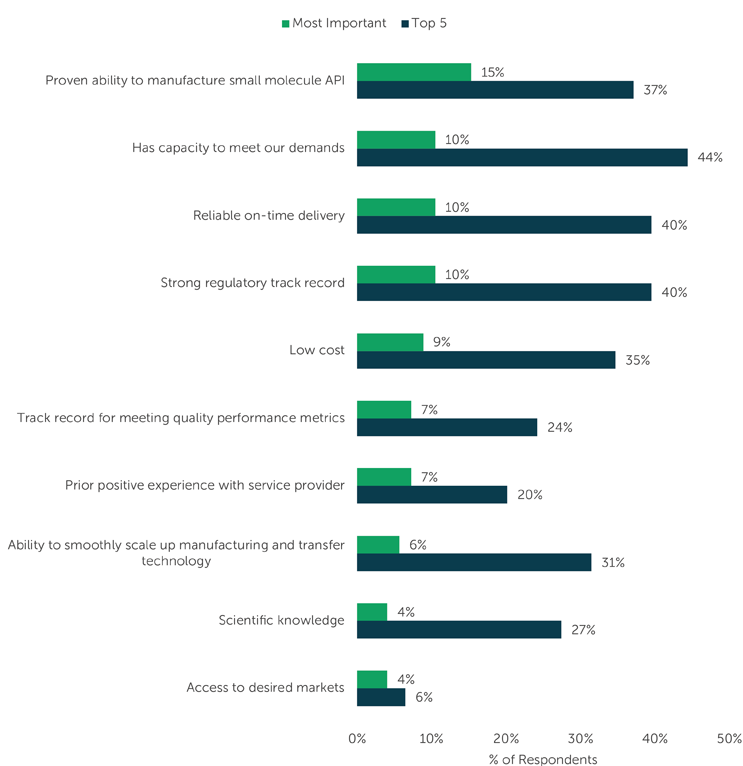

Survey participants reported that “Reliable on-time delivery” has increased most in importance over the last 12 months with 36% of votes. This broke the 3-year running streak of “Low cost” in the lead, relegated to second place with 25% of votes, and “Capacity to meet demands” maintains third position as an attribute gaining importance, selected by 21% of respondents.

This inversion of important factors may very well be the cumulative result of the scars drug sponsors accrued during the tumultuous two years or more we’ve just experienced (e.g., COVID- epidemic turned-pandemic when workers could not work; then hiring challenges on both side of the sponsor-provider equation; backlogs and delays in development and manufacturing programs; systemic raw (and other) materials shortages; etc.)

As one drug sponsor – with the money to back up his assertion – said to me a while ago during a conversation on related subjects, “It doesn’t matter what you offer to pay the CDMOs; they simply can’t deliver the services or materials as contracted.”

Thus, we see in the above chart that 44% of survey respondents – the highest percentage – selected “Has capacity to meet our demands” as a top option of importantance when selecting a CDMO, followed closely by “Reliable on time delivery” at 40% (tied with “Strong regulatory track record”).

As for cost?

My conjecture is drug sponsors today are either satisfied to a degree, or resigned to pay what they must for external materials and services – if those prices are in some defined range of “reasonableness.”

Perhaps, as another part of the survey covers, this is partly a result of the momentum of drug sponsors to more strategic and “preferred-provider status” when it comes to CDMO relationships. Perhaps these stable relationships allow CDMOs to provide better pricing models and options.

There’s another way to look at this as well.

Executives at various drug sponsors have informed me that even through the heart of the pandemic, CDMOs replying to requests for proposals almost all came within a "narrow range" of pricing for their services. This includes pricing from “Big CMDO” as well as smaller providers.

It suggests CDMOs may have found a price equilibrium that pays their bills, affords a certain profitability, and sufficiently brings in the customers they need to keep their facilities humming.

While we certainly did hear of increasing prices at CDMOs during the pandemic, it was mostly attributed to the cost of specific materials, and the overall crush of capacity needed to get the vaccines out, and less apparent in the simple boosting by CDMOs of overall service costs.

So with exceptions – many reported within these pages – there might be the feeling there is less price inflation from CDMOs than sponsors are seeing throughout the rest of their business operations (and personal lives). The ISR Reports surveys tell us drug sponsors are focused on that capacity availability, performance, and quality, instead of costs as their top outsourcing consideration at this point. They simply may have no other choice.

How long will this last? With another round of high inflation, wage gains, rising interest rates, and a potentially slowing economy, we’ll have to wait and see. (NOTE: I’ll look into the impacts of the economy in upcoming editorials.)

For now, we have some reliable data points in these reports suggesting we have a rather mature, trustworthy, and increasingly partner-led outsourcing industry.

Costs be damned, you might say.