CPHI Report Presents Shifting Outsourcing Realities

By Louis Garguilo, Chief Editor, Outsourced Pharma

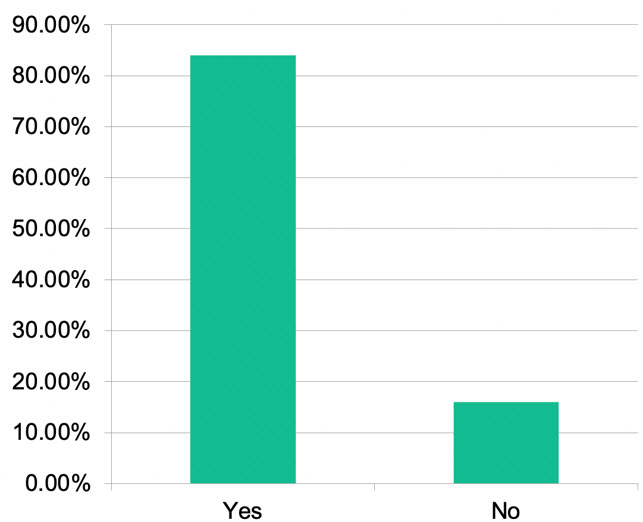

I’d just published this editorial on the struggles at CDMOs to find and maintain skilled workers, and concerns from customers that it is affecting relative performance, when I started perusing the 2022 CPHI Annual Survey, and saw this chart:

Will a shortage of experienced CMC personnel continue to be a major challenge for the industry in the next 2-3 years?

Quite a confirmation of concern, you might say. Professionals across the industry expect years more of worker shortages specific to CMC positions. That means outsourcing overall could face widespread constraints.

This year’s report, issued during CPHI’s convention in Frankfurt, Germany (November 1-3, 2022), includes perspectives of some 400 pharma executives, and analysis from global experts.

Overall – for the entire drug industry and markets – despite economic and other headwinds, the narrative in the report is positive.

“Economists and analysts globally expect 2023 to be a tough year for the majority of [industry] sectors … Yet, despite this pessimistic outlook, pharma could potentially buck wider economic trends. Contract services in particular remain in extremely high demand and with biotechs still sitting on record levels of cash – they cannot sit on this indefinitely – there is likely to be a sudden rush of development inside the next 18-months.”

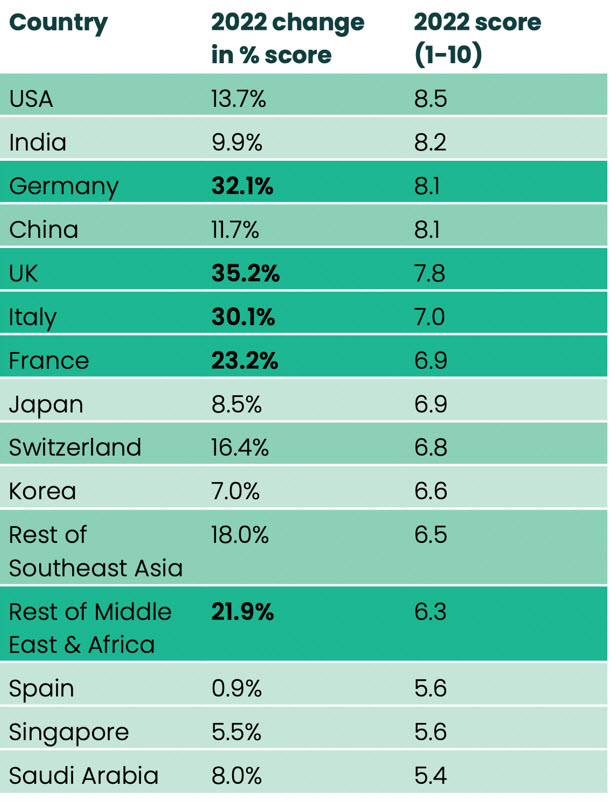

While that’s a broad laudatory of the industry, the next chart I found of particular interest provides a more nuanced country-by-country perspective.

2022 Changes in score and 2022 score (1-10) by region.

“Last year was the first year in the survey’s history that the United States had topped the prospective ‘growth potential’ category, surpassing both India and, historically the surveys’ fastest growing country, China,” explains the report.

It goes on to say notable in 2022 is that all countries have improved their growth potential scores, “suggesting the industry is much more positive about its prospects in 2023. In fact, growth scores this year are by far and away the highest in the surveys’ history – which many may find surprising.”

Register me as one of those surprised.

Shifting Services

Our reporting at Outsourced Pharma has uncovered a wall of drug-developer concern over: shrinking investor dollars and risk-appetite; capacity mismatches; as mentioned above, a lack of skilled workers, and increasing wages; the costs of materials and services; lingering COVID; actions of the China Communist Party; war and energy shortages in Europe. I could go on.

These factors are certainly contributing (both negatively and positively) to the relatively rosier picture of the industry in the U.S. as per the CPHI Survey, which also informs us the U.S. “cemented its surprise lead from last year and now has one of the highest growth scores in the survey’s history. China by contrast, although posting a strong growth potential score, has a fallen a little behind the other two members (USA and India) of the big three.”

(There’s also this sidebar: “Significantly, the UK has improved its growth potential score again – to a pre-Brexit level – coming in narrowly behind Germany who are the other big mover in 2022.”)

I’d describe this as:

Comparative stability in the U.S.; a topsy-turvy climate for business, mixed with geopolitical and internal stresses in China; a continuation of uncertainty in Europe regarding energy (and Ukraine); and an India picking up some of the pieces. All these global factors sift through to influence your drug development and manufacturing outlooks, marketing/sales or those with products, and valuations and profits.

The report states that one of the interesting economic side-effects of inflationary uncertainty is that the U.S. dollar has strengthened against virtually all other major currencies – meaning manufacturing options in this country have become more expensive to overseas companies, "potentially making manufacturing and contract services options outside the US more appealing to US- based companies (at least in the short term).”

The Year Of CDMOs

Unlike other industry reports we’ve noted previously (see: ATMP Report Identifies Outsourcing Realities), a significant portion of the 2022 annual survey is (thankfully and correctly) devoted specifically to contract development and manufacturing.

The report states last year might be considered “the year of contract manufacturing in many ways, with CDMOs greatly benefiting from Covid contracts, private equity renewing and strengthening its interests and predicted growth rates that seem to defy the present realities of global economies.”

I’m not one to wager a lot on continuing to “defy present realities,” and the report does circle back to some countervailing concerns.

“CDMO capacity, particularly with Covid contracts continuing, has remained an issue through the last 12-months – with access to commercial scale production most strained. Looking ahead for the next 12-month, the industry again identified biological CDMOs as those most likely to see the largest capacity constraints, with API CDMO resources also potentially strained."

(One trend reversal: cell and gene therapy capacity constraints “appear less of concern for executives – which may reflect both the building of increased capacity and also a slowing of the development pipeline.’)

Regarding reshoring (also see: CDMO Performance, The Workforce, And Reshoring ), the CPHI Survey says, “In last year’s report, both the United States (58%) and Europe (60%) were identified as the biggest winners of macro changes in manufacturing strategies [over the next 12-months].”

“However,” it goes on to say, “this year, when we asked for a slightly longer-term outlook – over the next 3-years – we saw a very different perspective. The scores for the United States and Europe have both fallen by some 50% and India emerged as the survey’s clear winner. Executives believe India (60%) will see the greatest benefits from shifts in manufacturing supply chains, but surprisingly, China (50%) has also recovered much of its Covid loses and, in the medium term, is once again seen as an extremely strong manufacturing hub.”

“This perhaps poses the question as to whether the market will sustain ... manufacturing moving in the United States and Western markets.” We've said as much in this publication as well.

Finally, the report notes that despite the world’s “economic and social strains … our drug development and manufacturing industry can be more resilient” than other sectors.

Part of that “economic and logistic resiliency has been favored over the years by the ability to outsource (around the world), and help drug and therapy sponsors remain lean and capital-investment light.”

“Nonetheless, like other industries – the semiconductor industry comes to mind – global stability and a diverse and widespread skilled workforce is necessary to maintain the ecosystem.”