Are You – And Your CMOs – Ready For The Second Coming Of DSCSA?

By Louis Garguilo, Chief Editor, Outsourced Pharma

Recall the beginning: A law enacted in 2013 to replace a 50-state “patchwork of pedigree requirements with one federal solution to track prescription medications through the supply chain,” as the Healthcare Distribution Alliance (HDA) describes it.

HDA helped lead the charge through that process, and has helped guide supply-chain stakeholders through implementation of the Drug Supply Chain Security Act (DSCSA). (Full compliance is mandated for November 27, 2023.)

Among the Arlington, Virginia-based organization’s members are 35 distributors, some 130 manufacturers, and 50 service-provider and international members. (see part one for more on the HDA.)

They were among those surveyed on their readiness for the initial deadline for serialization compliance as a part of DSCSA, which was originally set as November 27, 2018.

For me — a habitual seeker of the counterintuitive glimmer — it is again instructive to revisit that “Manufacturer Serialization Readiness Survey” as we now approach this year’s November deadline, this time for full compliance regarding “saleable returns” particularly.

So let’s consider:

Where were you last November, and where do you plan to be next month with meeting your product serialization requirements?

Report Back

As of November 27, 2018, the FDA mandated what we might call part one of DSCSA: all pharma manufacturers and repackagers include a product identifier to each drug package and “homogenous case of product” transacted as commerce in the U.S.

Beginning November 27 of this year, before reselling a returned serialized product (estimates are this is some 2% of all product shipped), wholesale distributors must verify that the identifier on that returned product is in fact the one affixed by the manufacturer – a shared burden of confirmation including the CMOs Outsourced Pharma readers employ for your manufacturing and packaging needs.

For its part in aiding the process, the HDA has been facilitating a group of industry participants focused on creating a Verification Router Service (VRS) to help meet the “saleable returns” requirement. (I’ve reported on other potential verification plans of action as well.)

Last year, the HDA Research Foundation conducted its third Manufacturer Serialization Readiness Survey to provide members with “unbiased, objective data about the current readiness of manufacturers and repackagers to meet the DSCSA’s product serialization requirements, and when distributors can expect to begin receiving serialized product and associated data.”

Confidential questionnaires were distributed last June utilizing the HDA database. In all, 57 manufacturers and nine repackagers responded to the survey, including 15 of the 2017 top 20 pharmaceutical manufacturers by sales, and 10 of the top 20 pharmaceutical companies by prescriptions dispensed (as listed by IQVIA).

Ready, Set, Survey

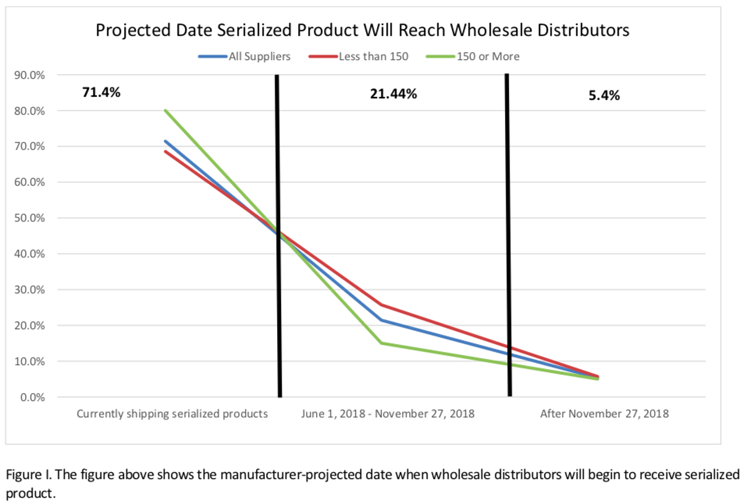

As shown in the chart below, at the time of the survey, 71% of manufacturers indicated they were already sending “serialized product” to wholesale distributors.

In the case of the larger manufacturers — those with 150 or more product lines — that number was 80%. The HDA report pointed out that among respondents, only 5% indicated wholesale distributors would receive their first serialized product after November 27, 2018.

At the time, these numbers were certainly reassuring. Kudos to the many thousands of professionals — from C-suite executives to the legions of IT consultants hired to get this done — had roles in attaining this level of accomplishment and compliance.

Yet as that report also indicated, whether we similarly cross this next November finish line will have a lot to do with your supply-chain partners.

CMOs A Sobering Concern?

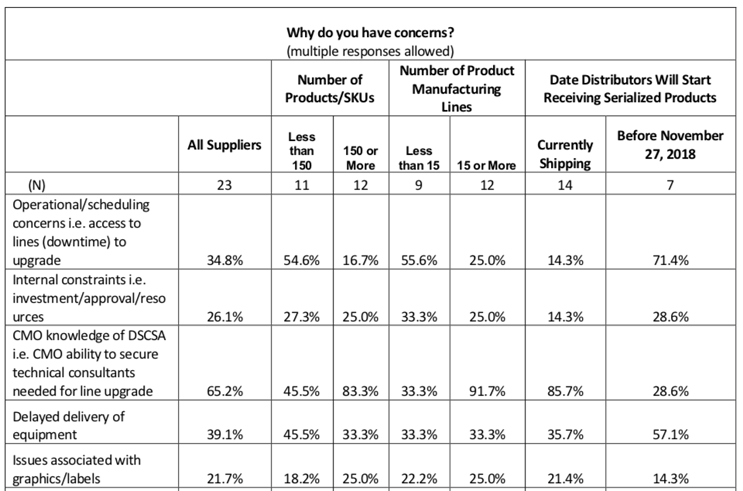

The HDA survey noted that “the top stated concerns that impact manufacturers’ ability to serialize product include CMO knowledge and delayed delivery of equipment.”

This and other concerns are presented in this (slightly abbreviated) chart:

Of all responders already shipping DSCSA-compatible product, some 83% of the largest manufacturers were concerned by (a lack of) CMO knowledge of DSCSA, and for example, the ability to bring in the professionals to bring production lines up to requirements.

I’d suggest an additional (or at least overlapping) factor regarding CMO-related challenges: Consider the concern in this chart regarding operational/scheduling and access to DSCSA-ready production lines. This sentiment would certainly include outsourcing challenges as well. If we look at the biggest respondents again (150 or more SKUs), nearly 17% were anticipating these lingering issues at manufacturing partners.

So much for the big-guy worries. For those many Outsourced Pharma readers who fall into the far-smaller commercial-product-line category, and who employ a varied group of smaller or mid-sized contract development and manufacturing organizations and partners:

This chart tells us that of the manufacturers who identified themselves as having less than 15 product lines, a full one-third (33.3%) registered concerns that CMOs would not be fully “knowledgeable,” or DSCSA-reliable, when the bell tolled on compliance.

And so, the here-and-now would indeed be a very good time for all readers – including those aspiring to your first commercial success – to get some final assessments from all your supply-chain partners … if indeed you haven’t already.

Look Back To See Forward

Here are some other findings from this “legacy” survey, again with the goal to provide perspective to what may be in store for you at this second November reckoning.

Manufacturers reported that their generic and/or branded product portfolios would be in varying states of readiness. Just under half (48%) of responding manufacturers and repackagers of generic product portfolios, and 61% of manufacturers of branded product portfolios, indicated that all (100%) of products would have been serialized by November last year.

And all repackagers indicated they had varying concerns with or obstacles to serializing product by the deadline.

Forty-one percent indicated they would send serialized data between November 27, 2018 and November 27, 2019.

Twenty-one percent indicated they would send serialized data between November 28, 2020, and November 27, 2023.

Fifty-six percent of respondents had fundamental concerns with verifying the product identifier to meet the 2019 saleable returns requirements. Among those, 71% reported “concerns with viability of the Verification Router Service”; 58% reported “unsure of which method my company will use to verify saleable returns.” Nearly one-third noted “quality of EPCIS messages”; “not currently on-boarded with trading partner”; “operational concerns”; or “ability to expose product identifier data for responding to requests,” respectively.

Have these issues cleared up? Two months and counting to find out for sure …

------------------------------

Editor’s Note: HDA’s newest survey will be released the middle of October 2019.

Part one of this editorial is here.