The Mighty CDMOs Producing API

By Louis Garguilo, Chief Editor, Outsourced Pharma

CDMO focused on active pharmaceutical ingredients (APIs) have long been vital components in the supply chain of modern medicines.

Today, these CDMO are more than your enablers. They’ve become strategic actors helping to reshape global outsourcing markets, and are buoyed by a new wave of forces, including:

- shifting geopolitical imperatives

- surging expectations for flexibility

- rising demand for complex and innovative drug production

For both sponsors and these production centers, navigating this landscape demands elevated levels of creativity, and rigorous execution.

This moment in time can be taken as an opportunity for optimizing relationships and production.

That is, if the risks are adequately addressed on both sides of the outsourcing equation.

Up As Far As We Can Predict

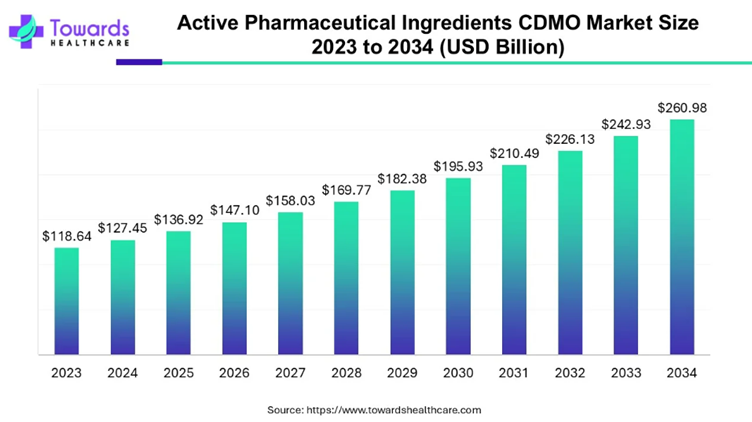

Steady, elongated growth, says the chart above, which comes from a recent Towards Healthcare report titled: Active Pharmaceutical Ingredients CDMO Market Size & Trends in CDMO Partnerships.

The global API CDMO market was valued at $127.45 billion last year, according to the report, and this year should scale to $136.92 billion, with a projected trajectory toward nearly $261 billion by 2034 – a steady 7.4% CAGR.

The Towards Healthcare report stipulates much of the boom is driven by a potent mix of chronic disease prevalence, the ongoing push for affordable generics (and we’ll add new drugs as well), and continued biopharma ingenuity, among other factors.

There is also a discernible parallel narrative, where the location of production, the quality of external partnerships, regulatory excellence, and the mental and physical capacity for innovation will increasingly separate CDMO winners from also-rans.

Winning Regions

Despite tariff traumas and vulnerabilites the global pandemic exposed (e.g., over-concentrated supply chains and national insecurities), India and China continue to dominate API production through scale, cost advantages, and a large and skilled workforce.

The Towards Healthcare report says that India, spurred by government initiatives and a post-pandemic sense of urgency, is driving toward greater self-reliance and reduced dependence on Chinese imports.

Nonetheless, China remains a powerhouse, but perhaps one operating with increasing uncertainty in complex trade and political environments.

Meanwhile, North America does appear to be gaining strength, driven by the U.S. government activating reshoring and affecting global positioning for U.S. manufacturing.

And as hinted at above, lingering are the COVID-driven, heightened concerns for national behaviors and security risks around critical materials and medicines.

High-profile investments such as Eli Lilly’s recent $5.3 billion commitment to build out its Indiana API facilities (see here) is one of increasing examples of this direction.

Trends To Consider

The Towards Healthcare CDMO API report focuses on four trends to watch as the next decade plays out.

1. AI, Personalization, and Flexible Manufacturing

CDMO with the most effective application of technology, and activity modeling allowing for flexibility at production sites, added to the specific implementation of artificial intelligence (e.g., AI agents) throughout their organizations, will produce the the winners of the future.

Already, AI-driven design, process optimization, and adaptive manufacturing are compressing timelines and improving efficiency and quality.

Moreover, AI should greatly enhance communication between CDMO and sponsor, including a frictionless and safe transfer of more complete and accurate data.

The report also mentions the importance of patnerhsip flexibility as the industry moves toward personalized therapies and more targeted delivery mechanisms.

2. Big Pharma On The Move, New Entrants Move In

Leading CDMO and new players as well are repositioning for this new environment.

Saudi Arabia’s Lifera — a major new CDMO-initiative backed by the country’s Public Investment Fund — reflects a broader global trend: nations and companies alike eager for control and visibility over API sourcing.

3. Similar Efforts Across Europe and in Canada

Germany continues to set a high bar with precision manufacturing and regulatory excellence, and France is gaining ground through targeted healthcare initiatives, according to the report.

Canada is becoming an increasingly attractive player, offering proximity to U.S. markets and a growing R&D base. (Let’s footnote this with the assumption the U.S. and Canada get over the current tariff war (and war of words).

In short, regions and individual countries will continue to compete hard for API production, and consider this a component of national economic security.

4. Oncology, Generics, and Complex APIs

Market segments are evolving rapidly, says the report. Oncology APIs continue to lead demand, as cancer incidence rises globally.

Meanwhile, nearly 190 drugs are expected to lose exclusivity by 2030, unlocking a new era of opportunity for CDMOs focused on generics – and innovation to replace those drugs.

Antibody-drug conjugates (ADCs) and biotech APIs — once niche categories — are today front-and-center as the demand for biologics and targeted therapies grows.

The report does point out, though, that synthetic APIs still hold the lion’s share of production, offering proven scalability and regulatory familiarity. Never, we might say, count out small- molecule drug development.

The Growing Challenge of Regulation

The cavernous caveat: Outsourcing API production can introduce (often unavoidable) regulatory complexity.

It’s an inherent complexity (to all outsourcing) that must be met with a practiced, heightened awareness of quality aspects and controls, and vigilance of jurisdictions with varying regulatory parameters.

Thus, the CDMOs you select should have and continue to invest in quality and regulatory expertise.

And a word to the wise:

Any concern regarding the regulatory prowess of your CDMO should be offset by the hiring of internal expertise, or of quality and regulatory consultants (now ubiquitous in our industry and plenty available).

Winners And The Others

The long and short of our discussion is that API CDMOs must evolve from production partners to full-spectrum innovation partners to stay in (or start) business.

The expansion of biologics, biosimilars, personalized and complex therapies demand more than manufacturing capabilities. So does the prevailing economic and political environment.

Today, deep collaborations are a winning formula. The report names some CDMOs currently considered market leaders who are investing to meet rising demand:

Cambrex

Recipharm

Thermo Fisher (Patheon)

Corden Pharma

Samsung Biologics

Lonza

Catalent

Siegfried

Piramal

Boehringer Ingelheim

CDMOs will increasingly need to combine scale with agility; establish a pathway to evolving capabilities; consistently demonstrate operational excellence; and in the vernacular of the day, offer global reach with local insight.

For those of us who closely follow the outsourcing of drug development and manufacturing, the API CDMO storyline will continue to provide chapters of consequence.