Japan Pharma: Top Tier With Tons Of Opportunity

By Louis Garguilo, Chief Editor, Outsourced Pharma

Opportunities related to the world’s third largest pharmaceutical industry tend to get drowned out by U.S. domestic events, and news from Europe, China, and even India.

That’s unfortunate. Not only because those opportunities are numerous, but also because there’s much to perceive globally about biopharma business when paying closer attention to Japan’s industry and market.

And the timing seems right. According to the just-released CPhI PharmaInsights Japan Report : 2018 – A Big Year For Japanese Pharma, Japan is again enjoying a sustained period of growth, “and the pharmaceutical sector in the country is forecast to reach $72 billion by 2021, representing 17% growth between 2011–2020.”

The report points out there are over 100 domestic Japanese biopharma companies. There very well may be just as many international companies looking to explore new partnerships and opportunities in the land of the rising sun.

Start With Cultural Skepticism

One area to initially look at is generics. Regarding the prescribing, development, and manufacture of generics, the CPhI report says, “Opportunities for both Japanese and international generic companies are clear, especially with [Japanese] public attitudes shifting away from cultural skepticism of generic medicines.”

Direct experience in the market informs this editor that “cultural skepticism” is an anodyne description. Perhaps never have the citizens of an advanced country pushed harder against generics than the Japanese. For decades, this affluent, consumer- and brand-conscious population, homogeneous and urban, simply would not accept “copies” of the real thing. Likewise, it wasn’t precisely freely “attitudes shifting” that altered the market; more like a governmental-mandated reversal of policy.

Where once the Japanese government protected its growing biopharma industry from generics competition, its national health agency changed direction (officially in 2007) with what amounted to a “percentage-of-market-target” for the prescribing of generics. The about face was an effort to begin rescuing the drowning national health-care system from a sea of debt.

The report mentions another reason for the reversal. “Japan has long been a bastion of patented drug consumption, with a strong innovative pharma industry, but as an impending patent cliff has loomed, many companies are now forced to reconsider their long- and medium- term strategies.”

But the report recognizes opportunities among these challenges. “Through diverging strategies there is clearly room for innovative big pharma to invest in its pipeline and grow exports. Active Pharmaceutical Ingredient (API) and generic finished dosage suppliers who recognize this potential and understand the unique needs and challenges of the Japanese market are well set for significant growth over the coming years.”

The report goes on to say: “The Japanese pharma industry has long been a sizable presence in the innovative part of the global market. Anticancer drugs have been at the forefront of Japanese development of biopharmaceutical products, as well as enhanced immune class drugs, including cutting edge technologies such as checkpoint inhibitors (e.g. PD1), chimeric antigen receptor (CAR)-T-cell therapies, antibody- drug conjugates (ADCs) and monoclonal antibodies (mAbs). However, focus on generics and biosimilars is increasing.”

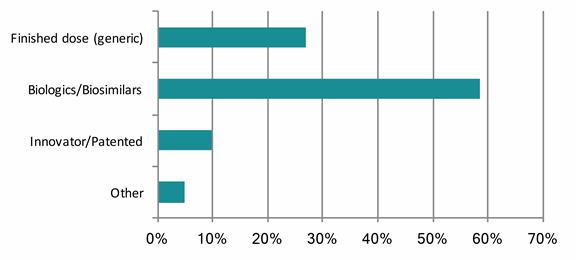

Where then are the opportunities? Based on research collected by CPhI via in-depth surveys, both domestic and international responses by sector showed finished dose/generics and biologics/ biosimilars are experiencing the fastest growth in the Japanese pharma industry.

Domestic respondents (CHART 1) believe the segments that will grow fastest are biologics (59%), finished dose (27%) and patented (10%).

CHART 1

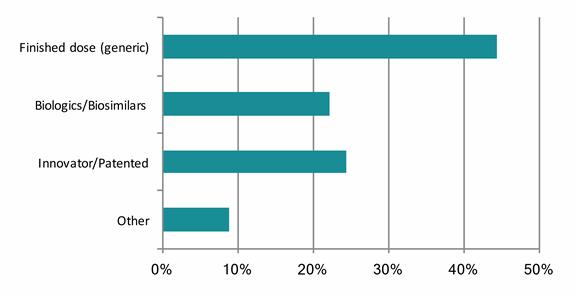

International respondents saw a differing emphasis – finished dose (44%), patented (24%), and biologics (22%) – but the overall trend, according to the report, “is clear.”

CHART 2

Summing up here, these results demonstrate that newer markets for lower cost and branded generics, coupled with advance biological products, “offer the greatest returns over the traditionally successful innovative solid dose formulations, where the majority of domestic pharma companies have expertise.”

Home But Not Alone

Unsurprisingly, Japan pharma companies surveyed by CPhI “overwhelmingly preferred the domestic environment.” Even today, the report finds only 18% of Japanese pharma business is undertaken in foreign markets.

At the same time, according to the report, nearly 75% of domestic respondents said they intend to work with foreign partners in the next year. “Companies are looking to increase their knowledge bases as well as to sell Japanese-made products abroad.”

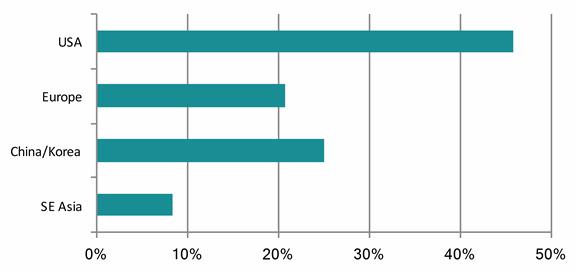

Responses in CHART 3 showed that over two-thirds of the companies surveyed look to target international markets; just under half are targeting the U.S., and 27% China and Korea. “This may be due to the favorable reimbursement system within the U.S., and the proximity of high-growth economies such as China and Korea,” states the report.

CHART 3

A reason I’ve pulled this particular tidbit out of the report is to disprove that Japan always seems to do things differently than the rest of the world. While differences to abound, ask yourself here: What biopharma wouldn’t hope to first target and make good in their home country (especially with a market size as big as Japan’s); target the biggest market in the world (U.S.), and also look to neighboring countries for opportunities … all with an open mind for partnering with domestic and foreign companies to accomplish these goals?

Comparative Strength

Finally, let’s turn to some international comparisons to gain further insight from this glimpse of Japan today.

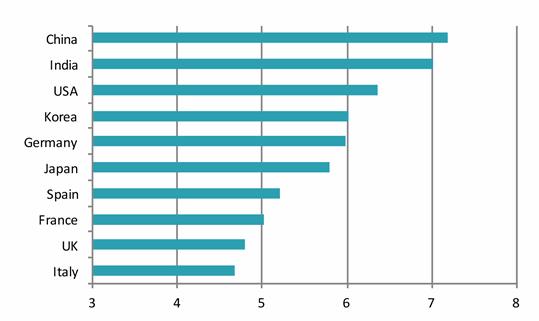

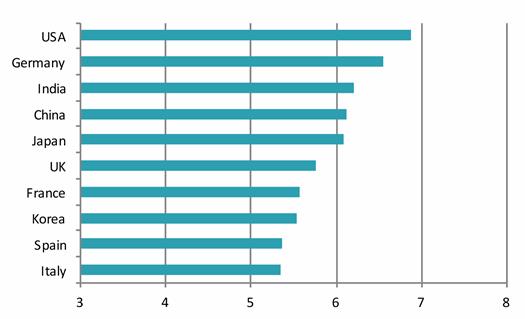

From the report: “While Germany is akin to Japan in having a mature and innovative market, historically centered on domestic growth opportunities, unlike Japan it has benefitted from European Union membership trade links that significantly boosted its international market growth. Even so, Japan is only one ranking behind Germany in a measurement of “pharma market growth potential” (CHART 4), demonstrating how recent efforts by the Japanese pharma industry to internationalize and increase global exports is seemingly paying off and being more fully recognized.

CHART 4

Additionally, 24% of foreign companies surveyed in the CPhI report said they were currently exporting to Japan. “What is unclear, however, are the long-term implications of the impending Trans-Pacific Partnership (TPP) trade pact between Japan and 10 other countries in Asia and the Pacific.”

The report goes on to say, “Overall, our research indicates that Japan has generally performed very well as a tier one pharma nation, and even better than expected in growth and competitiveness compared to some of the other mature pharmaceutical markets (such as France and the UK), and likely because of Japan’s recent efforts to globalize and diversify its market offerings (e.g. pro-generics policies).” CHART 5 provides and “overall competitiveness score.”

CHART 5

All told, the CPhI PharmaInsights Japan Report suggests to this observer (and former direct participant) an interesting pairing for the drug industry and market in Japan.

On the one hand, we have a mature industry and market in an affluent and fully democratic and consumer-based country, not unlike that of the U.S., the U.K., or Germany. Yet on the other hand, there’s still tremendous room for growth on almost all fronts – for partnering and providing services to Japan Pharma, and for market penetration starting with generics but including innovative drugs – comparative to that in much less advanced countries.

So if you haven’t been, it’s time to start paying attention to Japan again.