CDMOs Shine When Inflation Clouds Innovation

By Louis Garguilo, Chief Editor, Outsourced Pharma

Rather than those regularly tagged for any deceleraton of innovation (e.g., poor corporate culture; diminishing funding, revenues and/or profits), today CEOs say inflation specifically is the leading culprit.

“C-level executives universally cite one major factor impacting their innovation plans in 2023: inflation,” says the 2023 State of Revenue Report, from Model N, which focuses on high-tech, pharma and med-device executives.

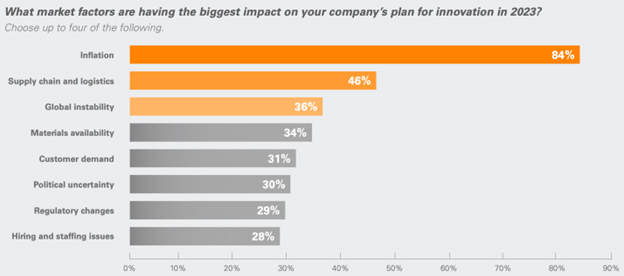

“Eighty-four percent of executives indicate that inflation is affecting strategic decision-making; that’s more than the next two factors combined – supply chain and logistics (46%) and global instability (36%).”

This chart lays that out nicely (and includes combined responses from high-tech, pharma and med-device executives).

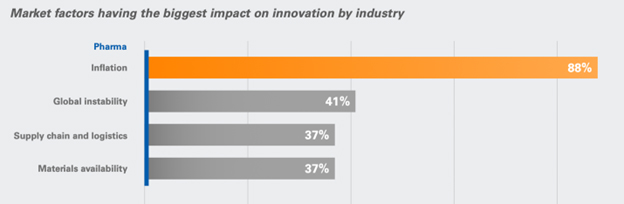

The report goes on to say that regardless of the industry, no other factor “comes close” to the issue of inflation for executives.

This next chart from the report does break out our pharma industry professionals specifically.

Let’s do a bit of extrapolation:

War in Europe, fears of others starting in Asia; an increasingly aggressive communist regime attempting to influence world commerce and business practices; COVID reverberations on supply chains and materials availability; worker shortages, and the like, all are of concern.

CEOs should cogitate over risks near and far.

Those risks include – and apologies for employing this unwieldy terminology – known unknowns, and unknown unknowns (i.e., risks you can identify that may be out there, versus those from wholly unidentified or unexpected events.)

Inflation, we might say, are both these at once.

Inflation brings its own brand of uncertainty to the future, as far as duration and severity. There's the potential for unseen reversals, or a lingering cloud over business, markets and consumers. And there is danger in how we try to tame it (high interest rates, specifically).

Yes, Pfizer can still afford to purchase Seagen, but for the other 99% of bio/pharma sponsors and marketers in our industry, inflation today is a steely stalker of innovation.

A lion’s share of that innovation occurs in the labs and facilities of CDMOs and other third parties. Can biotechs, struggling with inflation, and the high interest rates and tightening money trying to tame it, weather the storm?

We’ll see. For certain is inflation spills into our outsourcing industry, and that can tamp down innovation. And while it may have slowed down currently, inflation remains stubbornly among us.

How It Works

How does an inflationary environment kill off innovation?

If you want to get into some weighty details – I’m talking economic and mathematical equations – download this pdf with a report that models what happens.

Our own common sense, though, tells us if everything costs more, so does R&D. Funding (via higher interest rates and more cautious investors) is viewed differently. R&D starts to feel like a money sinkhole when more funds are needed just to meet today’s inflation.

The Model M report states there is a direct negative effect between inflation and the demand for R&D, and hence the rate of technological progress.

To reconstruct the two prevailing hurdles:

- High inflation increases the difficulty for companies to commit to long-term investments in research and development, because they must (re)allocate resources for managing the impact of inflation on their day-to-day operations.

- Higher costs for inputs (raw materials, equipment/facility upgrades, energy, skilled workers) sharpens the focus on maintaining or increasing current revenue streams, enacting cost reductions, and the upholding of profitability – not the furthering of funding R&D.

In other words, make payroll, keep the lights on, work with what we have.

Revenue And Technology Management

What measures are CEOs taking to make it through this inflationary environment?

According to the Model N report, they are focusing on effectively managing revenue, capital and funding.

That includes finding, perhaps somewhat ironically, innovations to economize company-dependent innovations.

From the report:

“Regardless of the industry they operate in, companies must stay innovative

if they want to continue to grow and remain relevant. Innovation spans many different areas – from product and service development, to technology and digital transformation, to process improvements and many more.

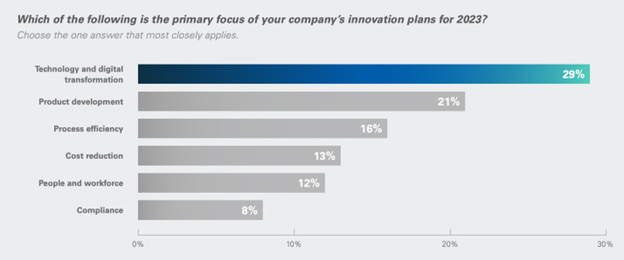

“When asked to identify the single top area of focus for innovation plans in 2023, 29% of respondents selected technology and digital transformation ahead of product development, process efficiency, cost reduction, people and workforce, and compliance … digital transformation could deliver process efficiencies, which may result in reduced costs.”

The report notes companies are actually hiring more bodies to help with these initiatives, even though there is always the predilection to lessen the payroll in an inflationary environment.

What we want to know: Does revenue and technology management include outsourcing strategy?

Back To Outsourcing

First, and briefly, how the heck did all that inflation get here?

Besides the human tragedies and suffering, and the de facto altering of how we lived for a couple of years, COVID unleashed factors that we may have already been trying to break free of, and/or catalyzed policies that have proved ill advised.

Beyond the usual push and pull of markets and economics, unleashed was unusual monetary (Federal Reserve) and fiscal (government largesse) policy, and what might be described as tainted economic analysis and hardcore politics itself.

If that sounds a bit jaded, does anyone recall “transitory inflation”?

Hopefully, C-suite operatives do, particularly if they made decisions based on the theory.

What, then, will the next phase of economic suspense bring to drug and therapy development – and our modus operandi of outsourcing?

To answer that one, let’s first acknowledge this: Outsourcing is innovation in situ.

A recession to slow inflation no more helps innovation than inflation does. It does not make it easier for business leaders to manage capital, revenue and funding, as we’ve been discussing here.

Neither does it facilitate decision-making regarding drug development or manufacturing outsourcing.

For biotechs, pulling back on programs – innovation – cannot benefit the overall mission. Delayed innovation is itself an existential threat. Pharma can (potentially) weather any storm, but bio can’t be whipsawed and survive.

Our entire ecosystem takes a hit.

Therefore, even with today’s (still) tight capacity, and increased competition at CDMOs from a still growing number of biotech start-ups, we should all appreciate that more drug development and manufacturing means more innovations pushing through more pipelines. And remedies reaching more patients.

Somehow, the ecosystem of service providers and development sponsors needs to maintain the overall pace of innovation in the face of inflation, and whatever unknown economic realities lie in wait.

CDMOs have been saying all along they are your innovation partners in times of challenge.

It’s their time to shine.