As Your CDMOs Grow In Value, Their Challenges Pile Up

By Louis Garguilo, Chief Editor, Outsourced Pharma

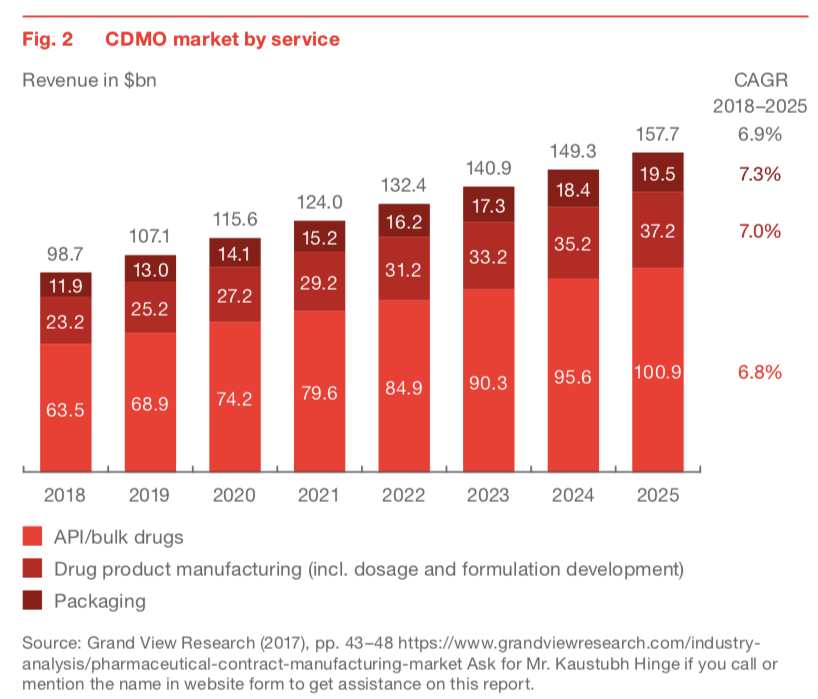

The CDMO market is estimated to grow to $157.7 billion in 2025, a compound annual growth rate (CAGR) of 6.9% since 2018, outpacing the pharmaceutical industry as a whole, according to Grand View Research in a new PwC report.

Even for the biggest pharma companies, CDMOs have graduated from supply chain to more rarified value chain partners – no minor attitudinal adjustment.

“I need to accomplish this by then” is now: “How can we accomplish this and by when?”

But according to the report, Current trends and strategic options in the pharma CDMO market, assembled by Prof. Dr. Nikolas Beutin, Partner and Customer Practice Leader PwC Europe, and Dr. Heiko Schmidt, Senior Manager PwC Management Consulting, Head of Customer Pharma & Life Sciences, “while the industry as a whole is thriving, many CDMOs are finding themselves confronted with unprecedented challenges.”

“Fierce competition, cost pressure, constant technological innovations and increasing consolidation activities raise the question of which steps [CDMOs] can take to secure or expand their position in this contested market,” says the report.

“Should they focus on their core business or broaden their range of services? Should they follow the market trend and consolidate or try to grow organically?”

Which of these options would most benefit Outsourced Pharma readers?

Widespread Growth

Here’s a look at that estimated 6.9% CAGR growth by service sector.

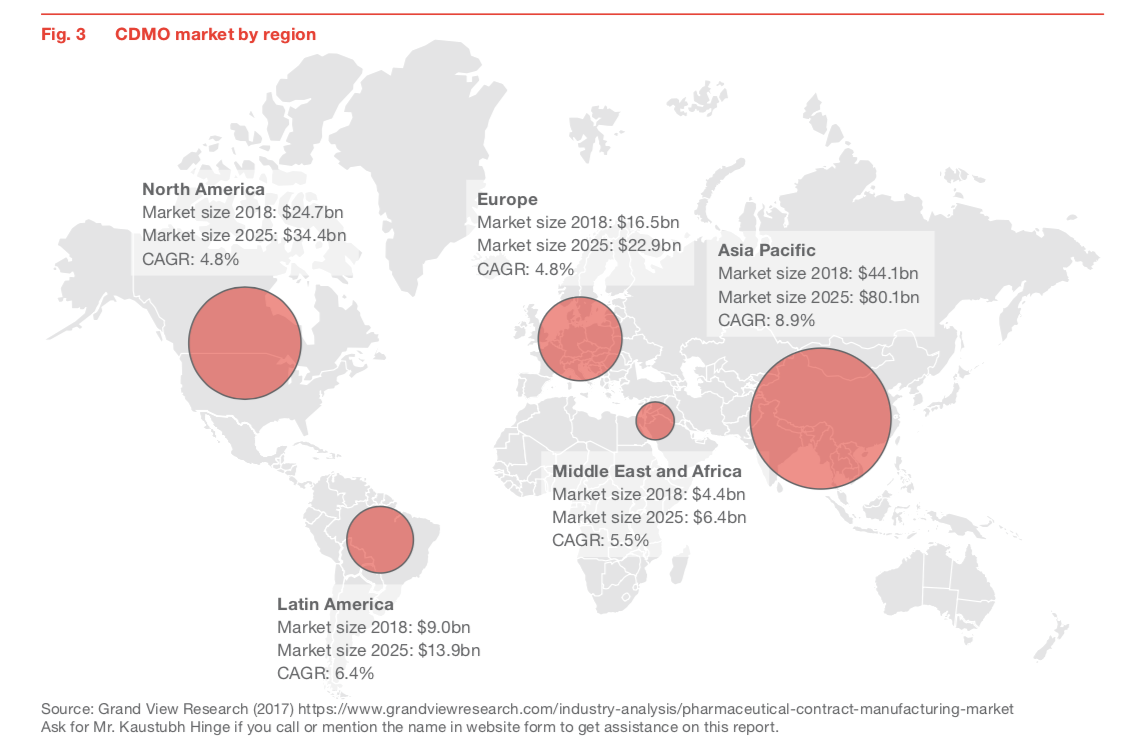

You can see consistent growth across the board. Next here’s a look at where it’s taking place.

These charts were assembled just prior to the coronavirus pandemic. Will any of that Asia Pacific growth diminish? That remains to be seen.

But report co-author Beutin reminded me the CDMO market is “generally characterized by great fragmentation,” despite the strong merger and acquisition activities in recent years.

“And it’s not only CDMOs acquiring their competitors,” adds co-author Schmidt.

“Large life sciences companies and private equity firms were responsible for some of the largest deals in the sector (e.g., in 2017, Thermo Fisher Scientific paid 18.2 times Patheon’s earnings before interest, taxes, depreciation and amortization (EBITDA) to acquire the leading CDMO.”

Nonetheless, as we stood at the precipice of 2020, the CDMO market remained “highly fragmented, with more than 75% of participants having revenues below $50 million, and the five leading CDMOs holding only 15% of the total market share.”

Which can only mean one thing: More changes are coming to a CDMO near you.

Facing Growth Imperatives

With some exceptions, today Big Pharma tends to want fewer, more integrated partners, and so that is a path to survival for many CDMOs.

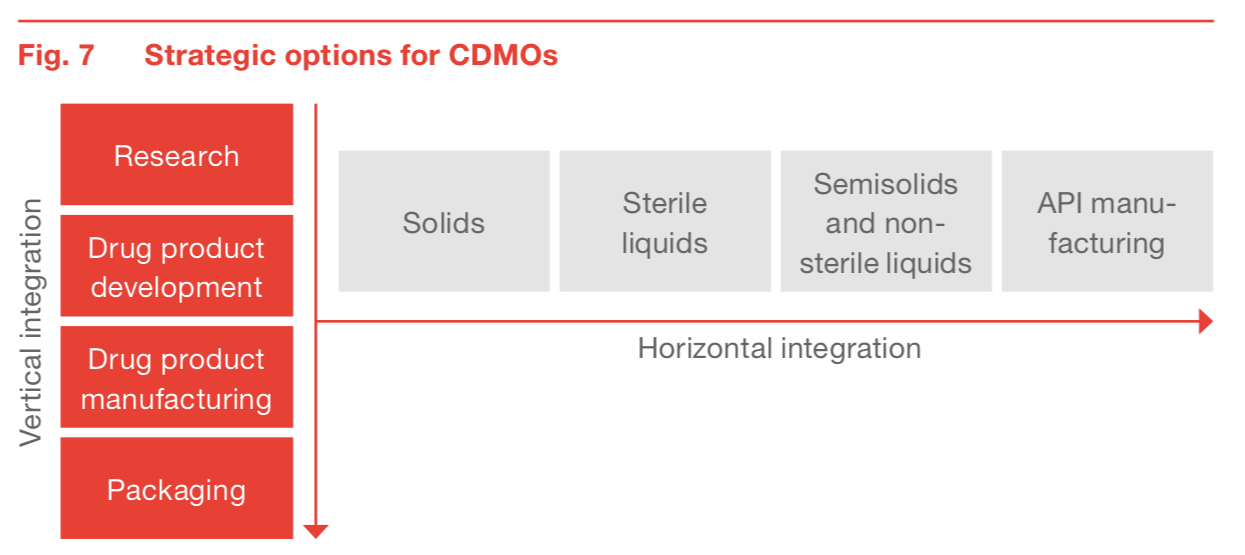

According to the PwC report, branches in the decision-making tree for those CDMOs are: vertical or horizontal integration, and acquisition or organic growth.

Vertical Integration

CDMOs can strengthen core areas and establish themselves by extending their service portfolio. In general, says the report, this kind of expansion “is less costly and involves lower initial risks than horizontal integration, because the CDMO can build on existing knowledge. It also fulfills most regulatory requirements and enables cross-selling to existing customers.”

With 25% of APIs under development highly potent and trending up, offering HP services is a logical step for many CDMOs, although building HP facilities can be a costly investment.

The study also predicts the pharmaceutical-packaging outsourcing market will grow at 7.3%, due to new and more rigorous packaging and handling requirements. New technologies – think “smart packaging – allow for improved functionality and help a CDMO stand out from the competition.

Horizontal Integration

CDMOs that want to diversify their risk or position themselves as fully integrated service providers can start offering services for other dosage forms.” However, points out the report, “expanding into a new dosage form tends to be an expensive and risky endeavor.” Barriers to entry include high upfront costs, lack of expertise and reputation, and finding qualified employees.

Interestingly, the report says sterile liquids are the fastest-growing dosage form in the CDMO market. Profit margins are highest in this segment, making it an attractive dosage form for new market entrants.

Solid dosage forms are becoming less attractive (compared to liquid forms), but “remain a profitable and growing segment,” as this remains the most common dosage form for newly approved drugs.

Acquisition Or Organic Growth

The report states: “Considerations about whether organic growth or acquisition is the more suitable method of expansion should be factored in right from the beginning, as they are closely intertwined with the feasibility of different strategic options [facing CDMOs].”

Acquisitions allow CDMOs to expand relatively quickly. They add new technologies to portfolios and access to new customers, again opening opportunities for cross selling. Some CDMOs are also looking to gain a more global footprint through a merger.

The caveat: Only ~50% of mergers across all industries succeed, according to the report, “and the choice of acquisition or organic growth is strongly linked to the financial means of the CDMO.”

What Do You Want?

So what ruminations are your CDMOs going through? It’s probably a good idea to find out.

And to inform them of your preferences for their growth. Consider with them how increased cooperation could achieve mutual outcomes.

In some cases you’ll want to tell your CDMOs that for the most part, the status quo gets your thumbs up; stability adds to the prognosis for relationship longevity. Despite all the above, staying put can still be a viable strategy.

But readers may be asking themselves, “How much influence do I really have?”

Of course size matters, and often Big Pharma drives the business bus.

Still, smaller organizations should recognize how the era of virtual biotech and development start-ups have already changed the face of outsourcing.

A good deal of this change from command-and-control to value-added partnerships was driven by biotech. So make your voice heard at your CDMO.

And today many Outsourced Pharma readers may prefer a more restrained, service-by-service evolution. Smaller – perhaps more localized – expansion may still suite you better. Moreover, not all CDMOs may seek major growth.

In either case, here are two recommendations:

- Continuously assess your current and future needs, and understand internally which external service models are best for you.

- Take the time to discuss the pressures facing your CDMOs, the directions they are being pulled in, and where they may be heading.

Because value should remain in the eye of the supply-chain holder.

-------------------------

Editor’s Note: Thanks to co-authors Prof. Dr. Nikolas Beutin and Dr. Heiko Schmidt, for their additional insight into the report. Download the full PwC report here.