The 4 Trends Affecting Blockbuster Drug Status

By Mike Ward, global head of life sciences and healthcare thought leadership, Clarivate

Although the billion-dollar mark will remain one of the principal benchmarks to define the success of pharmaceutical products, new indicators are emerging. Wide-reaching industry changes have impacted the way that companies select pharmaceutical assets, identify target markets, and approach market access and reimbursement conversations for new products.

To highlight the evolving factors affecting success, this article looks at the drugs identified in the Drugs to Watch series1 from 2015 and 2016,2,3 analyzing the trends and challenges that occurred over the past five years. The analysis identified the following four key trends:

- Increased emphasis on establishing the value proposition of a new therapy

- Greater focus on targeted therapies

- Ongoing challenges in the neuroscience space

- Increasing interest in therapy development for rare diseases

Increased Emphasis On Establishing The Value Proposition Of A New Therapy

Demonstrating safety and efficacy is necessary but not sufficient to guarantee market success, forcing pharma to rethink pricing and show how a new therapy will improve patient quality of life and offer good value. There are many ways to assess value, and pricing models built around achievable health or financial outcomes will need strong supporting data and data-sharing capabilities to make them work. Transparent data are at the heart of the pricing conversation and remain essential to ensuring trust between all stakeholders.

Establishing the value proposition of a new drug is particularly important if it is intended to displace an already approved and clinically accepted treatment. For example, payers were not convinced of the value propositions presented by Sanofi/Regeneron Pharmaceuticals Inc. and Amgen/Astellas Pharma Inc. for their PCSK9 inhibitors PRALUENT and Repatha, respectively. Value for the cost, in comparison with existing lipid-lowering medicines, was questioned, limiting their traction and resulting in sales far short of their forecasted $4.4 billion and $1.9 billion a year, respectively, by 2019.

Because the focus on cost-effectiveness of new therapies will only increase, it is important to plan for pharmacoeconomic data collection early in development. Drug companies can more routinely consider the inclusion of head-to-head studies to prove value above and beyond the standard of care. A compelling narrative that includes clinical trials with endpoints that validate areas of differentiation and meet the nuanced needs of various stakeholders and markets is essential.

A Greater Focus On Targeted Therapies

Pharma’s increasing focus on developing therapies that treat specific sub-groups of a disease population is creating innovation in areas of unmet need. Mechanistically targeted therapies can lead to better outcomes, especially when a biomarker is available to precisely match patients with drugs. In addition, because only those patients who will benefit from a targeted therapy will be administered it, the value proposition will be more transparent and underpin pharma's opportunity to secure reimbursement at appropriate levels and recoup R&D investments.

A 2015 launch that Drugs to Watch highlighted to achieve blockbuster status was Pfizer’s IBRANCE, a cyclin-dependent kinase 4 and 6 (CDK4/6) inhibitor for postmenopausal women with ER+ HER2-advanced breast cancer not previously treated with systemic therapy. Following accelerated approval, IBRANCE was launched in February 2015, with $2.8 billion in revenues forecast by 2019. In 2020, IBRANCE made $5.4 billion and is firmly established as a leader in breast cancer therapy. The drug class is now a cornerstone of treatment in that breast cancer subtype.4

Ensuring the right drug focuses on the right target and right patient is going to be a mainstay for pharma development going forward. With such targeting, pharma companies will not only find the R&D process more efficient but also be able to pinpoint the value proposition for patients and payers.

Ongoing Challenges In The Neuroscience Space

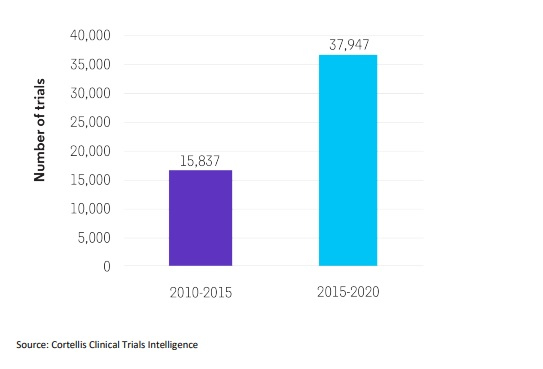

Despite an increase in the number of clinical trials being conducted for neurodegenerative diseases in the last five years, from 15,837 in 2010-2015 to 37,947 in 2015-2020,5 few game-changing therapies have reached the market. Challenges include knowledge gaps in the biological understanding of neurodegenerative diseases, heterogeneous patient populations who are often grouped by clinical symptomatology rather than measurable pathophysiology, a paucity of validated targets, a dearth of translatable animal models, a lack of biomarkers, and poorly defined clinically meaningful endpoints.

The number of clinical trials for neurological diseases has more than doubled.

Progress in the field of Alzheimer’s disease (AD) research is especially challenged given that understanding of the biology of the disease is still maturing. However, in June 2021, Biogen Inc. and Eisai Co. Ltd. were granted FDA approval for the amyloid beta-directed antibody ADUHELM, the first AD treatment to address a defining disease pathology.6 Three other drugs that work in a similar manner, Roche’s gantenerumab, Eli Lilly and Company’s donanemab, and Eisai Co. Ltd. and Biogen Inc.’s lecanemab, are all in late-stage development or have been submitted to the FDA for approval and — depending on the level of differentiation that can be established — could emerge as the disease-modifying treatments of choice.

In 2016, the FDA approved Acadia Pharmaceuticals’ NUPLAZID for Parkinson’s disease psychosis (PDP), which is still the only approved drug in the United States for PDP.7 Although NUPLAZID was being evaluated in other psychosis settings, the company has since focused development on dementia-related psychosis. Expanded labeling would have widened the addressable market, but high costs constrain its uptake in PDP and several clinical and regulatory setbacks have occurred. While its sales were forecast to rise from $74 million in 2016 to $1.41 billion in 2020, NUPLAZID only made $441.8 million in 2020.8

Going forward, anticipated advances in understanding the cause of many neurological diseases are likely to catalyze developments of new medicines for current unmet but devastating needs.

Increasing Interest In Developing Therapies For Rare Diseases

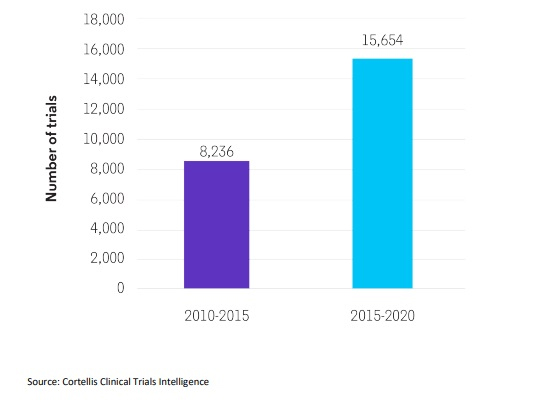

Various national and international orphan drug regulations have incentivized development of medicines for rare diseases. Consequently, drug developers are increasingly focused on therapeutic innovations in niche populations with high unmet need or limited competition, and the number of clinical trials for rare diseases has almost doubled, from 8,236 in 2010-2015 to 15,654 in 2015-2020.5

The number of clinical trials for rare diseases has almost doubled.

Orphan drugs now comprise a cornerstone of the pharmaceutical market, and the orphan drug category is predicted to increase its presence in company pipelines. However, this strategy does come with challenges. Rare disease drug prices make payers hesitate at the cost and question their cost-effectiveness. In response, drug developers are gaining a greater patient understanding and amassing real-world evidence to ensure the best entry for new therapies that can bring the greatest benefit to patients. This, coupled with new realms of scientific understanding, make the rare disease space exciting to watch.

This area still has great potential for future blockbusters. Only a small proportion of the 7,000 recognized rare diseases is currently treatable, leaving plenty of opportunity for R&D and advances.

Real-Time Data For Forecasting Accuracy

Forecasting the future revenues of a clinical asset is as much an art as a science. In the ever-evolving drug development landscape, the outlook for an asset can change in an instant based on a new discovery in that space; regulatory decisions or guidance; payer perspectives; or game-changing partnerships, mergers, or acquisitions. Reflecting on the status and success of previously forecasted blockbusters is important to improve the accuracy of predictions — it can serve as an opportunity to address methodological limitations and determine if new and evolving data should be folded into subsequent forecasts. Ensuring that the data sources at the heart of the methodology provide real-time, accurate data for population size and opportunity, current treatment paradigms, the payer/formulary landscape, and competition is a key step in addressing the challenges inherent to anticipating what the future holds.

References

- The Key Drugs to Watch in 2021. Clarivate, [online], Available at: https://clarivate.com/drugs-to-watch/. (accessed on November 1, 2021).

- Jago, C. (2015). 2015 Drugs To Watch. Thomson Reuters, [online], Available at: https://archive.annual-report.thomsonreuters.com/2015/assets/media/pages/downloads/drugs-to-watch-2015.pdf. (accessed October 28, 2021).

- Drugs To Watch 2016 (2016). Thomson Reuters

- Pfizer Reports Fourth-Quarter And Full-Year 2020 Results And Releases 5-Year Pipeline Metrics. (February 2, 2021). Pfizer, [online], Available at: https://s21.q4cdn.com/317678438/files/doc_financials/2020/q4/Q4-2020-PFE-Earnings-Release.pdf. (accessed on August 23, 2021).

- Cortellis Clinical Trials Intelligence. Clarivate, [online], Available at: https://clarivate.com/cortellis/solutions/trials-intelligence-analytics/. (accessed on December 15, 2021).

- FDA grants accelerated approval for ADUHELM™ as the first and only Alzheimer’s disease treatment to address a defining pathology of the disease (June 7, 2021). Biogen, [online], Available at: https://investors.biogen.com/news-releases/news-release-details/fda-grants-accelerated-approval-aduhelmtm-first-and-only. (accessed on August 25, 2021).

- FDA Approves ACADIA Pharmaceuticals’ NUPLAZID (pimavanserin) - The First Drug Approved for the Treatment of Hallucinations and Delusions Associated with Parkinson’s Disease Psychosis. (April 29, 2016). Acadia Pharmaceuticals, [online], Available at: https://ir.acadia-pharm.com/news-releases/news-release-details/fda-approves-acadia-pharmaceuticals-nuplazidtm-pimavanserin. (accessed on August 25, 2021).

- Acadia Pharmaceuticals Reports Fourth Quarter and Full Year 2020 Financial Results. (February 24, 2021). Acadia Pharmaceuticals, [online], Available at: https://www.businesswire.com/news/home/20210224006043/en/Acadia-Pharmaceuticals-Reports-Fourth-Quarter-and-Full-Year-2020-Financial-Results. (accessed on August 25, 2021).

About The Author:

Mike Ward serves as global head of thought leadership at Clarivate. As both a journalist and analyst, Mike has been writing, analyzing, and commenting on the life sciences industry for more than 35 years. He has held editorial and content leadership roles at various publications and organizations across the industry.

Mike Ward serves as global head of thought leadership at Clarivate. As both a journalist and analyst, Mike has been writing, analyzing, and commenting on the life sciences industry for more than 35 years. He has held editorial and content leadership roles at various publications and organizations across the industry.