The Global CDMO Model: Value Creation Is Not Just A Matter Of Integrating The Pieces

By Brian Scanlan, managing partner, Freedom Bioscience Partners

Business velocity in the individual service lines is often overlooked.

I recently talked to a good friend who sold his company, a midsize service provider, to a much larger global end-to-end CDMO. His experience was not atypical of the trend that has been going on for the better part of the past decade. Namely, that the industry is consolidating, moving to a more strategic outsourcing relationship where end-to-end service offerings seem to dominate over the traditional focused-service model. To accomplish this end, the larger CDMOs are broadening their scale and scope of services to fill strategic gaps by building a mosaic comprised of smaller, focused-service providers. This trend is effectively increasing the size and scope of the large global end-to-end CDMOs, while reducing the number of small and midsize service providers. I can’t help but wonder if a void has been created here.

Interestingly, the smaller service providers themselves create value by maintaining a focus on a specific service offering, and they do a really good job within their vertical. Once acquired and integrated into the larger organization, some of those things that made the smaller company really attractive begin to fade away. Those attractive features are related to the entrepreneurial culture of the smaller firm, such as speed, flexibility, narrow service focus/expertise, and an entrepreneurial service culture, which are all very important to their customers. It’s the cultural element that leads those customers to them. This is particularly important to small and midsize pharma clients because it mirrors their own culture as they outsource required services to advance their drug development or manufacturing programs.

That friend who sold his company to the large CDMO described an experience that has been echoed by numerous other business owners. Prior to the deal close, much emphasis was placed on the entrepreneurial spirit, deep customer relationships, and focused technical expertise that will help provide a healthy funnel of new opportunities to feed the large CDMO engine. However, once the deal closed, the focus turned to practical integration matters, and a different scene unfolded. My friend described a scenario where speed was replaced with excessive analysis, where flexibility was replaced with rigid systems, and where a focused depth of expertise was replaced with a dilutive set of technology solutions that had various business units fighting for relevance. For my friend’s former company, the result was a drop in the entrepreneurial service culture, a reduction in overall customer experience, and in some cases a loss of the customer relationship altogether.

Now, don’t get me wrong; I’m not against industry consolidation or the large, strategic end-to-end CDMO model. In fact, I’ve been a champion of the concept for many years. After more than a decade of analyzing just how many of these consolidations have unfolded and speaking to a variety of small and midsize business owners, I’ve seen very little acknowledgement of the importance that each individual business needs to continue to run as a flexible, focused-service provider within the larger CDMO ecosystem, focusing on how the individual businesses can maintain or increase the speed at which they do business after being acquired. After all, it will make those integrated, end-to-end programs even more attractive. In contrast, what I’ve seen is an almost singular focus on the integrated model, supported by active marketing programs and a variety of research reports outlining the theoretical time and cost advantages of the end-to-end solutions provider.

The process of integrating a new business can get focused on global systems, finding answers to integration questions like: “How will program management systems handle flow from API to drug product assets?”; “How will our sales teams and CRMs work together?”; and “How will my quality systems be managed across service lines?”. The processes are focused on creating synergies and tying together the various pieces of the puzzle. While these are all really important to get right, of equal importance is the maintenance of customer service effectiveness in the individual service lines (i.e., newly acquired businesses).

The Challenge — Maintaining Business Velocity With Each New Acquisition

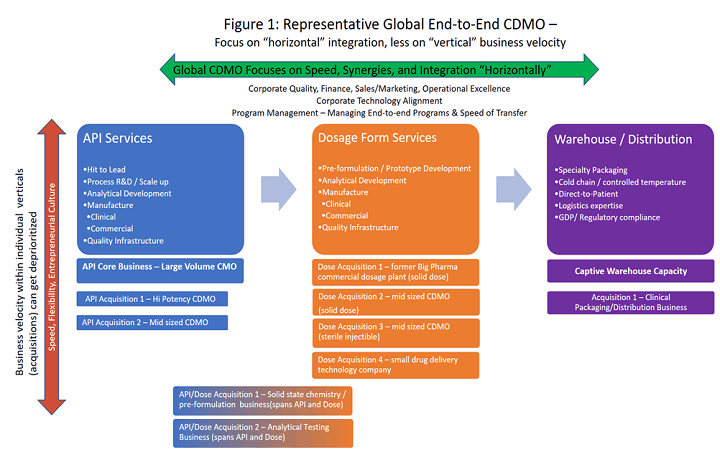

Figure 1 shows a representative global end-to-end CDMO that contains a mosaic of legacy and acquired businesses. Focus is typically on the “horizontal” integration issues (green). One of the most important, and sometimes overlooked, factors when integrating newly acquired service organizations into the large CDMO is “business velocity” (Figure 1, red). This is the cadence at which the acquired company (or vertical) does business, and it is one of the keys to customer service effectiveness, particularly to those pharma companies that have programs in early and middle phases of development. Priority should also be given to developing business velocity metrics (BVMs) to ensure the pace of business remains at a high level, giving continued confidence to existing customers of the newly acquired business and at the pace they’ve come to expect. Tracking and maintaining BVMs as part of the integration process also reinforces the expectations with staff that the individual businesses need to maintain speed and flexibility during the integration process. Integration teams need to be reviewing key integration metrics and progress alongside the BVMs and striking a balance between these two items that maintains positive momentum on both ends.

So how should this be addressed? In essence, a concerted effort should be made to understand and measure BVMs at the time of acquisition to gain baseline knowledge of the speed of business. Once understood, make maintaining its business velocity an equal priority to integrating that company into the broader organization. A sampling of some very basic but important BVMs to consider for a new CDMO acquisition includes:

- Turnaround time on NDAs – A wise man once said, “Never let the business get in the way of the chemistry.” This BVM is a simple measure of how much the bureaucracy (within administrative/legal and within the sales organization) has taken priority over customer engagement.

- Turnaround time on proposals – This presents a more complicated story. Turnaround time on proposals measures not only the speed and level of bureaucracy within the sales organization, but it is also impacted by the level of financial sign-offs, as well as input from other departments that contribute to the proposal. If sales bureaucracy is the key contributor to a slowdown in proposal turnaround, this can be remedied fairly quickly. If operations, EHS (environmental health and safety), or quality are negatively impacting the BVM, this could be a function of how the new owners are managing risk in these areas, and more assessment time may be necessary. If the technology team’s contribution to the technical proposal begins to slow, it could be the sign of a bigger issue. Likely there are now multiple technical solutions within the large CDMO, and various technical experts/sites are weighing in on a solution. While this theoretically is good news, if the process slows down too much, the customer (particularly those in early/mid-stage development) might consider going to a competitor that can offer speed over the optimal technical solution. While this not optimal in the long run, it could mean a project or relationship is lost and may never come back. Be careful to consider time spent to find the optimal technical solution versus BVM.

- Response times to client request – Providing rapid response to clients makes them feel in control and that they are a priority. This is a key to a solid ongoing customer relationship during integration. This BVM should apply to sales, customer service, and project management. It is a simple measure of how much the bureaucracy within those functions has taken priority over customer engagement.

- Frequency of client update calls – After being acquired and going into integration, it is imperative to overcommunicate with your client. Keep the client update call frequency at least at the level it was prior to acquisition.

- Turnaround time on development or campaign reports – Of equal importance to delivery of actual product is the corresponding development or campaign report. It is really important to track and maintain consistent BVMs on the back end of the project, too.

While seemingly basic, these simple measures help take the pulse of the organization while going through the integration process. Also, maintaining speed in these areas will help keep client engagement high and help dampen any other integration-related slowdowns that might occur.

Areas where business velocity can be more difficult to maintain are those related to quality, EHS, and operations where, understandably, the larger organizations tend to have more rigorous systems and generally take a more conservative approach to managing risk than the smaller companies they’ve acquired. These added processes and procedures can be offset in the longer term by the migration to more automated systems and IT infrastructure, which is where the large CDMOs have an advantage.

Conclusion

In a perfect world, the large end-to-end CDMO realizes vast efficiencies horizontally across the integrated programs, while individual service lines (acquired companies) continue to maintain the business velocity they enjoyed before the acquisition. The reality is that the focused-service providers that are acquired can become slower, less responsive, and lose their entrepreneurial edge; their competitive advantage drops in a head-to-head matchup with a smaller focused-service competitor. On the other hand, if the large end-to-end CDMOs make a concerted effort to measure M&A integration progress against the ability to maintain individual business BVMs, striking a balance in both areas, the CDMO has an even more powerful and differentiated competitive advantage. Maintaining business velocity means a more robust flow of individual projects, increasing the likelihood that more of those lucrative, integrated, end-to-end programs might materialize. And after all, isn’t this why large end-to-end CDMOs are buying up all those smaller companies in the first place?

About The Author:

Brian Scanlan has spent nearly three decades in the pharmaceutical services sector. He is currently founder and managing partner of Freedom Bioscience Partners, a consultancy firm focused on M&A and strategic business advisory to the CDMO and fine chemical industries. Prior to launching Freedom Bioscience Partners, he served as CEO at Cambridge Major Laboratories, a global CDMO focused on active pharmaceutical ingredients. He currently serves as a non-executive director at Callery LLC and has also served on numerous industry and community boards and task forces, including the Leukemia & Lymphoma Society, Bulk Pharmaceutical Task Force (SOCMA), Board of Directors at BioForward, and founder of SE Wisconsin BioNet. You can email him at bscanlan@freedombsp.com or connect with him on LinkedIn.

Brian Scanlan has spent nearly three decades in the pharmaceutical services sector. He is currently founder and managing partner of Freedom Bioscience Partners, a consultancy firm focused on M&A and strategic business advisory to the CDMO and fine chemical industries. Prior to launching Freedom Bioscience Partners, he served as CEO at Cambridge Major Laboratories, a global CDMO focused on active pharmaceutical ingredients. He currently serves as a non-executive director at Callery LLC and has also served on numerous industry and community boards and task forces, including the Leukemia & Lymphoma Society, Bulk Pharmaceutical Task Force (SOCMA), Board of Directors at BioForward, and founder of SE Wisconsin BioNet. You can email him at bscanlan@freedombsp.com or connect with him on LinkedIn.