Supplier Selection In The Time Of Brexit: How To Get It Right

By Ray Sison, xCell Strategic Consulting, LLC

The ongoing Brexit negotiations between the British Parliament and the EU has left pharma supply chain managers scrambling for cover. As recently as October 2018, the probability of a no-deal scenario was low and it made little sense to invest in or commit to alternate plans, but this changed when Parliament rejected Prime Minister Theresa May's deal in December. The politics are not as important to business as the conclusion: The best way to mitigate disruption is to more heavily weigh finding alternate ex-U.K. suppliers versus waiting it out. Negotiating deals and supply agreements takes time, as does the logistics of tech transfer and moving materials. So risk management, timing, and terms are key success factors.

scrambling for cover. As recently as October 2018, the probability of a no-deal scenario was low and it made little sense to invest in or commit to alternate plans, but this changed when Parliament rejected Prime Minister Theresa May's deal in December. The politics are not as important to business as the conclusion: The best way to mitigate disruption is to more heavily weigh finding alternate ex-U.K. suppliers versus waiting it out. Negotiating deals and supply agreements takes time, as does the logistics of tech transfer and moving materials. So risk management, timing, and terms are key success factors.

The urgency of finding alternate suppliers makes it as critical as ever to take a methodical approach. Driving a supplier selection process without clearly stated objectives and criteria is like leading without mission, vision, or values. When bidding out a project to prospective vendors for manufacture and distribution, it is critical to enshrine a set of selection criteria in a living document. This will remove subjectivity from the process and enable better comparisons across categories. To develop a methodical approach:

- determine key success factors for your project

- consider unique or desired product attributes, technical challenges, and constraints

- take a cross-functional view.

After determining key success factors, consider any unique product attributes or technical challenges that could constrain the field of prospective bidders. If, for example, the product is a high-volume, spray-dried material that requires processing on a specific type of equipment, clearly this reduces the bid pool and would make tech transfer impossible within the required timeframe. In this case, second-supplier qualification would become a priority, but the window for avoiding the Brexit deadline may have passed. On the other hand, if the product is cold chain and will not tolerate temperature excursions while in transit, expected delays in customs clearances, confusion with the World Trade Organization’s rules, etc., the decision to move immediately is easily defensible despite the effort and short-term pain.

A thorough decision matrix is not complete without input from others operating outside a single function. Moving a distribution operation will require additional filings (regulatory), a study of the tax implications (legal/finance), qualified person release requirements (quality/regulatory), etc. Assemble an internal team to provide input on a preliminary list of selection criteria.

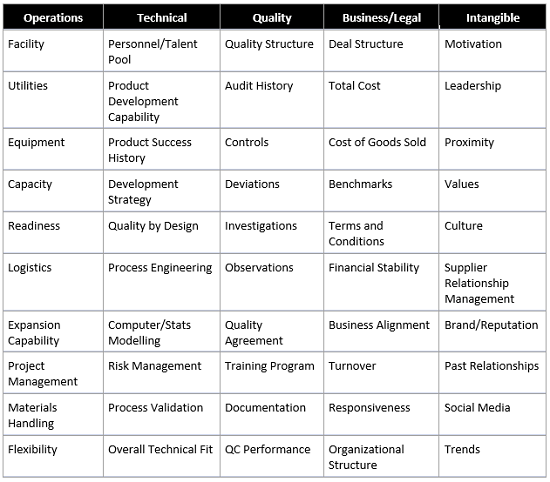

As a next step, go granular. Break down the selection criteria into detailed specifics from the perspective of the three points above. In most cases, the following categorization works well:

- Operations — The site characteristics and its capabilities in the context of the overall business and the specific needs for the project

- Technical — The resident skillsets and their applications to the project

- Quality — The audit history and systems in place to address the regulatory environment and requirements

- Business — The underlying business and the financials and terms and conditions of the negotiated deal

- Intangible — Uncategorized subjective measures relevant to selection

Working through this categorical exercise is particularly useful after a whiteboard brainstorming session because it will help uncover the additional layers of complexity below the top-line requirements. Below is a selected list of keyword criteria. Every search will produce its own unique criteria; the objective is to ensure the list of criteria is cross-functional, iterative, and dynamic to incoming information. Avoid falling into an inflexible template; instead, look to identify critical areas that will drive success and weigh them accordingly.

This list of criteria provides talking points for early discussions and technical calls, followed by site visits and negotiations. If extensive lists appear too cumbersome, streamline the process to approximately 10 key areas. For a commercial packaging operation, the total score criteria list may look more like this:

Operations:

- Timeline/Readiness (15 percent)

- Personnel/Customer Service (10 percent)

- Customs and International Shipping Experience (10 percent)

- Language/Communications (5 percent)

Technical:

- Cold Chain Capabilities (15 percent)

- Serialization Support (10 percent)

Quality:

- Audit/Regulatory History (10 percent)

- Quality Technical Agreement (5 percent)

Business/Legal:

- Total Cost (5 percent)

- Financial Stability (5 percent)

Intangible:

- Proximity to Airport (5 percent)

- Political Stability of Host Country (5 percent)

A mistake I often see is that sponsors begin talks with vendors before building their criteria, or they build the criteria and then do not reference it before, during, or after each interaction. Use the criteria list as a primer for discussions and a basis for note-taking during meetings, then collaborate with your colleagues at key junctures, e.g., after a site visit when information is fresh. During the final selection, a full set of notes will ensure an objective comparison is available.

Key Takeaways:

- In the selection process, defining objectives and selection criteria creates a framework for how decision will be made.

- Before initiating a bid process, identify key attributes of a successful partner from a cross-functional viewpoint.

- Use a methodical approach based on your history or a defined approach.

- Use the list of key attributes/selection criteria to guide your actions and decision making.

Pharma companies needing to outsource services often find themselves in less-than-ideal situations, needing to make critical decisions in a fast-changing environment. Having a defined approach that prioritizes the company's needs will facilitate decisions and provide a solid basis for action. Currently, Brexit is disrupting pharmaceutical supply chain operations in the EU. On the horizon, trade wars, energy prices, and climate change — to name a few — could impact future activity. Companies and suppliers have to continually adjust to the environment and often do best by implementing a proactive, methodical approach to their risk management practices.

About The Author:

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.