MDR's Impact On The European Trauma Device Market

By Linda de Boer and Kamran Zamanian, Ph.D., iData Research Inc.

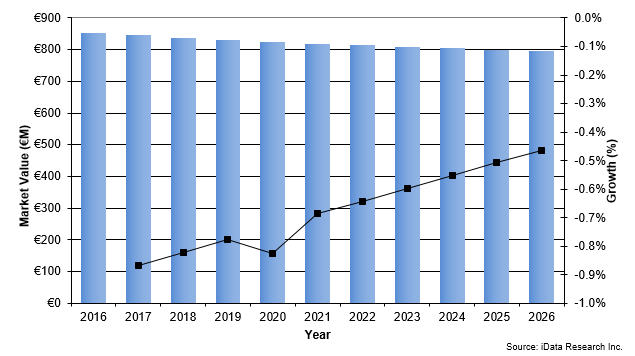

The European trauma device market, consisting of devices used for the fixation of extremities fractures, has been slowly decreasing for years and is expected to maintain a flat negative rate.1 Unit sales are forecasted to keep growing, driven by the increasing number of procedures performed. However, price pressure placed on the market by European governments and tender competition result in a decreasing market value.

decreasing for years and is expected to maintain a flat negative rate.1 Unit sales are forecasted to keep growing, driven by the increasing number of procedures performed. However, price pressure placed on the market by European governments and tender competition result in a decreasing market value.

Introduction of the new Medical Device Regulations (MDR) by the European Union (EU) is expected to shake up the entire European medical device market and could act as a major limiter for the trauma market, as well.

Figure 1-- Trauma Device Market Value Growth, 2016-2026

Additionally, the COVID-19 pandemic has severely disturbed healthcare systems in most countries. As of June 2020, over two million cases of COVID-19 were confirmed in Europe. Almost all elective surgery procedures have been postponed or cancelled. However, most trauma surgeries are classified2 as essential and acute surgeries, meaning that postponing the surgery could result in a limp- or life-threatening situation. Thus, the majority of trauma surgeries will still be performed.

MDR’s Impact on the Competitive Landscape

The EU approved the MDR in April 2017 with a planned May 26, 2020, date of application (DoA). However, due to the COVID-19 pandemic, the European Parliament has postponed the MDR DoA to May 26, 2021, to ensure the accessibility of key medical devices on the market and prevent associated shortages and delays.

The general opinion in the market is that the MDR will lead to less innovation, as the process of introducing new products will become more time-consuming and cost-prohibitive. The MDR will particularly affect the smaller, traditionally more innovative companies. These companies have spent years trying to distinguish themselves and finding a niche in a market dominated by giants, such as Depuy Synthes and Stryker. As a result of the MDR, this competitive edge could be completely lost.

Even larger companies are setting aside large sums of money to make sure their product portfolios are meeting MDR standards. Almost all companies active in the market are re-evaluating their portfolios and removing less-profitable products. Niche products used for very specific fractures are likely to disappear, as their low sales cannot recoup the costs necessary to meet MDR standards.

All these changes could result in a market that mostly sells mass-produced products to survive the higher costs associated with selling on the European market. Consequently, the overall rate of innovation within the trauma device market is expected to decline over the next few years.

European Trauma Device Market Drivers

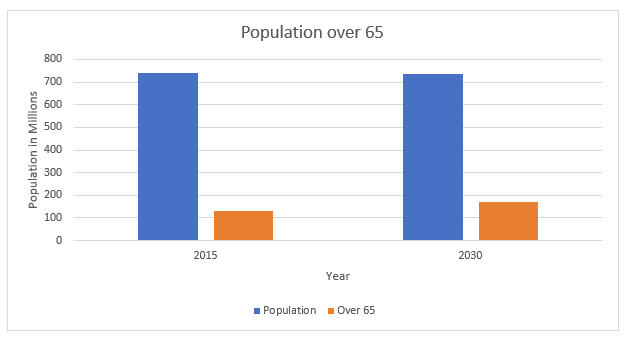

Even though innovation is an important factor for market growth, the main driver for unit growth in the market is changing demographics across European countries. The non-elective nature of trauma surgery will also ensure the market’s continued existence despite the COVID-19 pandemic.

As the European population grows and ages, unit sales will continue to grow. The aging population is an important driver for the European trauma market, as the risk for bone fractures increases with age. To illustrate, osteoporosis is a chronic condition that leads to higher bone fragility and is prevalent in more than half the European population aged 50 and older. Increasing life expectancy and the desire of the elderly population to stay more active, longer, also increase the number of fractures.

Figure 2 -- Projected Growth of Aging Demographics in relation to Overall Population, Europe, 2015 -2030. Source: iData Research Inc.

The increasing number of people with obesity and diabetes also drives trauma device unit sales in the European market. According to the World Health Organization4 (WHO), around 10 percent of people aged 25 and older have diabetes, a population expected to grow as a result of unhealthy diets and physical inactivity. Increased risk of bone fractures is among the many health risks associated with this diabetes due to poorer bone quality in patients.5

In 2008, the WHO estimated6 that over half of the European population was overweight, and around 20 percent were obese. Obesity can lead to reduction in bone mineral density and, in turn, increase the risk of bone fractures.7

Finally, the non-elective nature of surgeries using trauma devices will lead to increased unit sales for fracture fixation devices as population grows. Although some countries have established traffic safety programs, thereby reducing some of the need for fracture fixation devices, most fractures cannot be prevented. Therefore, the market will always be driven by increasing population and a higher life expectancy.

Conclusion

In the short term, the MDR will negatively impact the European trauma device market and will most likely slow innovation, decreasing the overall market value. Some niche specialty products are likely to disappear due to higher costs associated with meeting the new regulations, while market leaders are expected to trim less-profitable product lines from their portfolios.

However, the main driver for the market — changing demographics — will not be influenced by the MDR or any other regulations. An aging population and higher overall life expectancy are expected to maintain unit sales at stable negative growth rates.

A key driver for increasing market value would be a shift toward newer, more expensive devices and materials, but slackening innovation likely will prevent such a shift in the foreseeable future.

About the Authors

Linda de Boer is a Senior Analyst at iData Research. She has been involved in multiple custom and syndicated medical device market projects, publishing the European report on the trauma device market.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 15 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers their clients to trust the source of data and make important strategic decisions with confidence.

References

- European Market Report Suite for Trauma Devices – 2020, iData Research Inc.

- Coimbra, R., Edwards, S., Kurihara, H., et al. “European Society of Trauma and Emergency Surgery (ESTES) recommendations for trauma and emergency surgery preparation during times of COVID‑19 infection.” European Journal of Trauma and Emergency Surgery. Springer-Verlag GmbH Germany. 2 April, 2020. https://www.estesonline.org/wordpress/wp-content/uploads/Coimbra_et_al-2020-European_Journal_of_Trauma_and_Emergency_Surgery.pdf

- “Burden of Fragility Fractures Costing European Healthcare Systems Unnecessary Billions, New IOF Report Warns.” International Osteoporosis Foundation. 19 Oct. 2018. www.iofbonehealth.org/news/burden-fragility-fractures-costing-european-healthcare-systems-unnecessary-billions-new-iof

- https://www.euro.who.int/en/health-topics/noncommunicable-diseases/diabetes/data-and-statistics

- Jiao, Hongli et al. “Diabetes and Its Effect on Bone and Fracture Healing.” Current osteoporosis reports vol. 13,5 (2015): 327-35. doi:10.1007/s11914-015-0286-8

- https://www.euro.who.int/en/health-topics/noncommunicable-diseases/obesity/data-and-statistics

- Liu Y-h, Xu Y, Wen Y-b, Guan K, Ling W-h, He L-p, et al. (2013) “Association of Weight-Adjusted Body Fat and Fat Distribution with Bone Mineral Density in Middle-Aged Chinese Adults: A Cross-Sectional Study.” PLoS ONE 8(5): e63339. https://doi.org/10.1371/journal.pone.0063339