Evolution In The Research Used For The CMO Awards

By Nigel Walker, managing director, That’s Nice

With Nice Insight about to move into its third year of conducting primary research on the outsourcing practices of pharmaceutical and biotechnology executives, we have collected a vast amount of data on more than 100 CMOs and learned a fair amount about the information that buyers of our research want and how they can best apply it. As a result, we’ve made a few key changes to evolve the product. Nice Insight now provides more in-depth information about each profiled company, and a greater variety of segmentation options is available online to subscribers. These two developments made perfect sense, and we added a few key questions to the survey that would flesh out areas of customer interest and offer additional ways to cross-tabulate information or drill down into more specific/ refined results. However, a third customer need that was evident came as a surprise but has led to the biggest change we are likely to make.

With Nice Insight about to move into its third year of conducting primary research on the outsourcing practices of pharmaceutical and biotechnology executives, we have collected a vast amount of data on more than 100 CMOs and learned a fair amount about the information that buyers of our research want and how they can best apply it. As a result, we’ve made a few key changes to evolve the product. Nice Insight now provides more in-depth information about each profiled company, and a greater variety of segmentation options is available online to subscribers. These two developments made perfect sense, and we added a few key questions to the survey that would flesh out areas of customer interest and offer additional ways to cross-tabulate information or drill down into more specific/ refined results. However, a third customer need that was evident came as a surprise but has led to the biggest change we are likely to make.

At Nice Insight, we continually strive to be a better asset to clients by using the same methodology we advocate to our clients and the pharmaceutical outsourcing industry at large — we ask the market key questions about the strengths and weaknesses of our service offering so we can develop a more customized and valuable product. Our research on how we could deliver more useful marketing intelligence to our subscribers brought to light some conditions and limitations that influence how Nice Insight data might be applied. So, when clients relayed the nature of their marketing planning and sales cycles, and expressed concerns about whether a quarterly research cycle was long enough to gauge the impact of a new campaign reaching the audience, we began to think seriously about revising our research strategy to better fit client needs. And from September 2012, our research cycle will become annual and aligned with the timing of clients’ typical annual strategic planning.

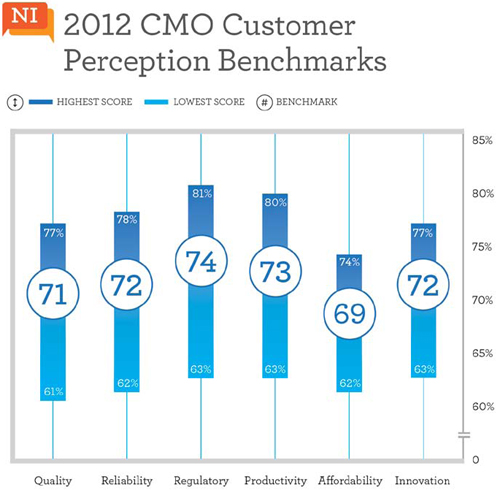

The core of Nice Insight’s research remains focused on understanding customer awareness — or how well a CMO and its service offering is known within the outsourcing industry — and customer perception — or how the business is regarded by potential and current buyers of outsourced services. Each year, the research team conducts in-depth interviews with industry thought leaders to learn which attributes they see as most important when selecting a CMO. For 2012, the key outsourcing drivers, in descending order, are quality, reliability, regulatory track record, productivity, affordability, and innovation.

Quality has remained in the leading position since the inception of Nice Insight’s pharmaceutical and biotechnology outsourcing survey, and it relates to a CMO’s ability to deliver to the standards established by the sponsor at the onset of the project. The benchmark score for quality increased from 70% to 71% from 2011 to 2012. Another promising sign of improved quality from CMOs is that the lowest quality customer perception score rose from 56% to 61%, and the highest customer perception score for quality also increased from 72% to 77%. Our goal is to help companies improve performance and provide a better platform for successful outsourcing relationships, so this is a good trend to see.

Likewise, reliability consistently has ranked second in 2011 and 2012. Contract manufacturers that receive high scores in reliability are regarded as able to meet the project milestones set forth in the master document established at the start of the project. The CMO benchmark for reliability showed the greatest increase of any driver last year, with an improvement of 69% to 72%. When considering a new contract manufacturer for a project, sponsors are typically going to focus on companies with scores at or above the industry benchmark on these crucial outsourcing drivers.

A CMO’s regulatory track record – or its reputation for cGMP compliance – moved up in priority from fourth place in 2011 to third place in 2012. This shift in ranking was almost certainly influenced by a perceived increase in FDA surveillance across the drug development industry, leading to sponsors more heavily scrutinizing prospective outsourcing partners’ compliance history. The encouraging news is that the CMO benchmark for regulatory improved over the past year from 73% to 74%. This is also the highest benchmark score across the six customer perception measures.

Contract manufacturers’ technical and scientific competence in meeting the research and development goals of a project can have a substantial impact on the project timeline. As such, productivity ranked fourth in priority – one position up from the 2011 ranking. Selecting a partner with a high productivity score also contributes to a sponsor’s ability to focus on its core competencies with confidence that outsourced aspects of the project are being fulfilled to its required standard. The CMO benchmark for productivity rose from 71% in 2011 to 73% in 2012.

Affordability received the lowest benchmark average of the key outsourcing drivers, at 69%. However, there was a modest increase of one percentage point over the last year. And interestingly, affordability dropped in priority when selecting a CMO from third place in 2011 to fifth in 2012. This change is supported by a trend we continue to see in research results – while price is important to sponsors, it tends not to be among the highest defining factors in selection decisions. At the same time, sponsors indicated that CMOs are improving their ability to provide accurate pricing on projects, which was reflected in an increase from 53% in 2011 to 62% in 2012 for the lowest scoring CMO in our survey.

As motivations for outsourcing shift from tactical to strategic, CMOs gain the opportunity to take on a more significant role in drug development. This change was part of what prompted Nice Insight to add a customer perception measure on contract manufacturers’ ability to innovate. This driver indicates the CMO’s ability to improve on the sponsor’s in-house capabilities by using or developing customized solutions. While this measure ranked sixth in priority among the overall respondent group, the CMOs fared well, with the benchmark for innovation being 72%.

Since Nice Insight began researching sponsors' preferences and practices in pharmaceutical outsourcing, it has become evident there are two distinct groups of CMOs. The first is the well-established, well-funded, and highly process-driven CMOs within Big Pharma. And the second is "everybody else." This second group tends to articulate their core competency as the reason to engage them on a project, which doesn't necessarily position them strongly for consideration. As the contract manufacturing industry continues to compress, it is essential to have a clear understanding of sponsors' needs and build messaging that focuses in on the key drivers for outsourcing.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2012 sample size is 10,036 respondents. The survey comprises 500+ questions and randomly presents ~30 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions on 170 companies that service the drug development cycle. More than 800 marketing communications, including branding, websites, print advertisements, corporate literature, and trade show booths are reviewed by our panel of respondents. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability.