3 Easy Questions Every Pharma Outsourcing RFP Should Answer

By Ray Sison

Engineers often say that they are just plain lazy. Invent the wheel once, then go for a ride — don't re-invent it every time you need to go somewhere! Lazy, in this case, means efficient. In pharmaceutical outsourcing, RFP templates are a time-saving and efficient tool to initiate and control a bidding process. Using them properly allows a sponsor to collect comparable proposals that create leverage for negotiation. (If you're not using one, why not?)

you need to go somewhere! Lazy, in this case, means efficient. In pharmaceutical outsourcing, RFP templates are a time-saving and efficient tool to initiate and control a bidding process. Using them properly allows a sponsor to collect comparable proposals that create leverage for negotiation. (If you're not using one, why not?)

After a few years of refinement, I thought I had RFP development down to a single template. I could independently generate a document in 90 minutes that once took a team 40+ collective hours. Then I got lazy, which in this case means resistant to change. What startled me out of my complacency was the wide range of modalities that I confronted over time. Previously, I had focused on tech transfers for small molecules. With each new modality, I had to revisit my approach and reassess my RFP template to fit not only biologics but also Phase 3 clinical packaging, nontraditional dosage forms, and more.

If a sponsor does not use an RFP, it is often because the process is time-consuming and can be too easily offloaded to the business development (BD) representative of a visiting contract manufacturing organization (CMO). This handoff literally robs the sponsor of leverage/control and, therefore, money. If you find yourself tempted to fall into this situation, here's a process for developing your RFP quickly with the appropriate level of detail.

Back To Square One: Three Questions.

If you begin a conversation with any BD professional by mentioning the first of the following questions, they will probably finish the list for you as a rote exercise:

- What do you want?

- How much do you want?

- When do you want it?

Each modality should have its own template with customized sections of supporting information. But, at the highest level, every RFP should answer these three questions. The first "easy" question, however, is probably the hardest and requires more than a passing response.

What do you want? Hint: Don't just say "stuff" while waving your hands. The answer needs to have a detailed and specific response that includes:

- Product (physical output) – This encompasses the modalities mentioned above. You need to identify the API, then differentiate immediately among bulk drug substance or product, packaging, etc. Give additional levels of granularity as needed, e.g., sterile product vs. solid oral dose form (SODF); tablet vs. capsule; clinical vs. commercial packaging, etc. This information quickly allows a CMO to screen the product against its capabilities to determine if there is a preliminary fit.

- Information (data) – In a regulated environment, no product moves without proper documentation and/or identifying information appropriate for its stage of development. It is useful to identify what data you want to accompany the physical or experimental output of the product. For example, early development work may require a development report to select from a range of prototypes. cGMP material may require a certificate of analysis and stability data; clinical packaging may require a study of specific labels and shipping documents, etc. Requesting a certificate of analysis (COA) implies that specifications, test methods, and analytical support will be needed as part of a scope. From the data request, a CMO will infer what additional services will be required and expect that supporting information will be provided.

- Use (purpose) – This information will quickly convey to a CMO what quality system environment will be needed for product-related work that will impact handling, processing, testing, and, ultimately, cost. Early work for formulation selection or tox studies (GLP) is done in a different environment than clinical supplies for human use (cGMP) and carries a very different cost.

Thinking about a new CMO? Get the step-by-step on how to procure a CMO that fits your strategy and specific needs. Attend Ray Sison's course:

Selecting a CMO/CDMO: 11 Best Practices For Sourcing The Right Partner

Once the initial question is addressed, the next two questions are straightforward … or are they?

How much do you want? Specifying quantity alerts the CMO as to the scale of your request and is a screen to find out if manufacturing slots are available for appropriately sized equipment, i.e., batch sizes. In the lab, workflow must be managed as well. On a recent project, a client needed multiple metric tons of spray-dried material for a Phase 3 study. This information quickly screened out all but the largest suppliers. While the actual ordered quantities of any project can change, communicating the magnitude is key information for a CMO. As a critical aside, arriving at a total supply needed for clinical supplies is an often-underestimated task. It requires a methodology to convert a given proposed clinical protocol into a supply forecast and production schedule. Likewise, in commercial production, forecasting is often more of an art than a science, demanding a disciplined approach to cross-functional planning.

When do you want it? Inherent in the quantity question are delivery dates. For a CMO, this is a sanity check for realistic planning and for setting expectations. Currently, manufacturing slots for biologics or aseptic processing can be 12 months out, with stiff cancellation fees. A sponsor that sets a filing date without adequate high-level planning or input from the chemistry, manufacturing, and controls (CMC) organization and the supply chain team may develop unrealistic expectations. A delivery date of drug product six-month stability data on three registration batches for an inbound product inside of 18 months from receipt of the RFP is highly aggressive for a SODF, nearly impossible for a sterile product, and out of the question for a biologic. Working through the timing of dependent activities is not only important for the CMO, but for a sponsor as well.

Early in your discussions with a CMO, and perhaps as a topline statement in your RFP executive summary, include a succinct statement. Here's a Mad Libs style example of the request:

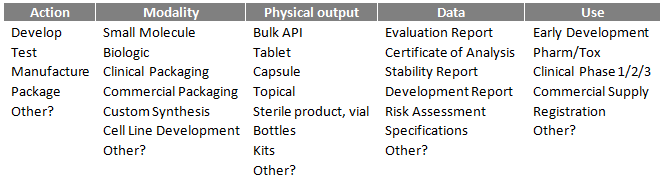

[Your company] is requesting a proposal to [action], [product] with [data] for [use]. [Product] is a [modality] in a [physical output]. [Quantity] of [product] with [data] is needed by [date].

The table below offers possible input for the above example.

Here is a completed example: Dionis Pharma is requesting a proposal to manufacture/package zolpidem tartrate, USP 10 mg, and to provide COAs and six-month drug product stability data. This material is intended for commercial use in humans. Zolpidem tartrate is a small molecule compressed into a tablet. The first three batches, totaling 600,000 x 30-count bottles are needed by Q1 2020, six-month stability data by Q3 2020.

With an RFP defined, the body of the document should now focus on company background, legal and administrative notices, supporting information, deliverables, and milestone dates. Of these, the supporting information is the most important to the CMO. Your supporting information should be focused on the modality of the request. So if your product is a tablet, provide a batch record. If you want released product and stability, provide specifications and a stability protocol. Below is a starting list of information you need to provide. Depending on the modality and use, subsets of supporting documents would be required.

- Material safety data sheet (MSDS)

- Batch record

- Stability protocol

- Drug substance specifications

- Drug product specifications

- Component specifications

- Raw materials specifications

- Formulation req specifications

- Packaging req specifications

- Process req specifications

Table of Contents for Small Molecule Commercial Tech Transfer Example:

- Executive Summary (the request)

- Company Background

- Supporting Information

- API Structure, Chemistry, Specifications, Storage and Handling

- Drug Product: Formulation, Process, Specifications, Storage and Handling

- Packaging: Components, Specifications, Labels/Labeling Information

- Analytical Test Methods: API, DP, Cleaning, Other

- Forecasts

- Project Scope

- Deliverables

- Assumptions

- Key Milestones

- Legal and Administration: Submission of proposals, legal notices, contacts

- Attachments

- MSDS

- Batch Record

- Packaging Record

- Stability Protocol

The various sections serve to provide a nearly complete profile of product information to support the RFP that is adequate for CMOs to return comparable reports. This should seed technical discussions that will help you with your selection process and contract negotiations. In future articles I will outline and explain RFP content for various modalities to help sponsors develop their own set of templates across the CMC supply chain at various stages of development and commercial manufacture. Please indicate which ones are highest priority for you in the Comments section below.

About The Author:

Ray Sison is VP pharmaceutical outsourcing and tech transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.

Ray Sison is VP pharmaceutical outsourcing and tech transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.