Clinical Packaging RFPs Made Easy

By Ray Sison

Managing clinical supplies is hard. Not hard like string theory — more like organizing a family vacation with your adult siblings and all their children. Clinical supplies management sits at the intersection of multiple disciplines, each with its unique perspectives and priorities. Their collective attention may be difficult to hold for something as seemingly trivial as packaging. However, clinical packaging is critical to the success of a program and a company, and an effective request for proposal (RFP) will guide you to the right packaging partner for your journey to product approval.

siblings and all their children. Clinical supplies management sits at the intersection of multiple disciplines, each with its unique perspectives and priorities. Their collective attention may be difficult to hold for something as seemingly trivial as packaging. However, clinical packaging is critical to the success of a program and a company, and an effective request for proposal (RFP) will guide you to the right packaging partner for your journey to product approval.

In previous articles, I outlined tradeoffs in taking a generic approach to writing RFPs and concluded that different modalities and supply chain segments cannot be built on a single template. Nevertheless, any RFP should answer three broad questions in detail:

- What do you want?

- How much do you want?

- When do you want it?

These RFP questions are also applicable to clinical supplies packaging. The following sections discuss important considerations in answering each.

1. What do you want?

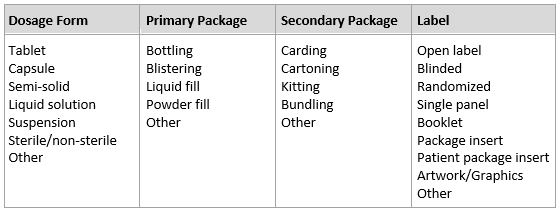

In an RFP, the “what” is the physical output the sponsor needs from the contract packaging organization (CPO). Requirements should include information and detail regarding dosage form, packaging components, and labeling. If package or label design has not been fully determined, assign initial assumptions and requirements and then request further discussion to gauge interest and level of expertise. With some foresight and internal discussions, many of these variables can be established as part of the program strategy and clearly defined in the RFP.

Table 1: Packaging Components And Labels/Labeling Variables

Instinctively. any CPO will request to review the entire clinical protocol. If the clinical protocol is not complete or contains confidential information that a sponsor does not wish to divulge — confidential disclosure agreement (CDA) notwithstanding — that’s OK. Either way, be prepared to provide or discuss a snapshot of the protocol synopsis and sections directly related to the clinical supply materials. The CPO needs this information to understand the context of the clinical trial material (CTM) and to develop strategies for packaging and logistics. Remember that the objectives of the RFP are to solicit a set of comparable proposals and select a best-fit partner. If the protocol changes during the bidding process, consider waiting until top contenders are identified or until a final CPO is selected before fine-tuning the RFP. This reduces the number of proposal versions and the duration of the bidding process.

2. How much do you want?

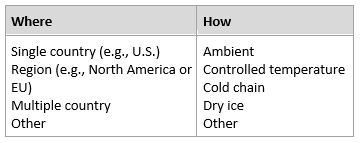

For packaging, the total should include not only the quantity of CTM projected, but also where it will be going and how it will be shipped. Even if you’ve never managed shipping, you will also be expected to be a supply chain expert. (Congratulations!) This requires knowledge of import/export duties, logistics, and shipping documentation. Lean on the CPOs to help develop a distribution strategy based on their operations, depots, inventory control, and shipments to sites. Allow some flexibility for them to provide their best strategies and engage in a dialogue to align with your needs.

Table 2: CTM Logistics

3. When do you want it?

With drug substance and drug product, a production schedule and subsequent bulk shipments are fairly straightforward. But, with clinical packaging there will likely be multiple packaging runs for each lot of bulk material (and placebo) followed by multiple shipments to each site and/or study subject. If the duration of the study exceeds the available stability data and expiry dating, resupply will be required. Further, the duration will be impacted by rates of enrollment if they deviate from the forecast. Also consider how returns will be handled (reverse supply chain), accountability, and destruction. Forecasting comes with its degree of uncertainty, So provide assumptions but allow for flexibility. CPOs have a great depth of experience with forecasting and distribution strategies. Use the RFP process to garner best practices, familiarize yourself with their tools, and discover how they can be applied to various scenarios.

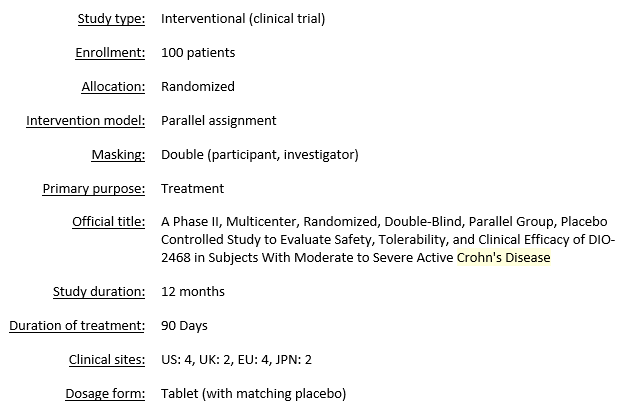

Here’s a synopsis of a hypothetical study that will illustrate RFP assembly:

Table 3: Example Study

I continue to be an advocate for a well-written executive summary — a concise set of statements that convey what is requested in the RFP. For clinical packaging, it should contain the information from Tables 1, 2, and 3 above, so that a CPO can quickly assess the project and its level of interest in bidding. My Mad Libs general approach looks like this:

[Your company] is requesting a proposal to [action], [physical output] with [data] for [use]. [Quantity] of [product] with [data set] is needed by [date].

Applied to the above example, one version may read like this:

Dionis Pharma is requesting a proposal to package, label, and distribute blinded, randomized, blister-packaged tablets for use in supporting an upcoming clinical program. Each blister card will contain a one-week supply (14 tablets) and will be cartoned in a monthly kit. The program is titled "A Phase II, Multicenter, Randomized, Double-Blind, Parallel Group, Placebo Controlled Study to Evaluate Safety, Tolerability, and Clinical Efficacy of DIO-2468 in Subjects with Moderate to Severe Active Crohn's Disease.” One hundred patients at 12 sites in the U.S., UK, EU, and Japan will be supplied with a three-month supply of CTM over a 12-month study duration. Qualified person (QP) release will be required for the UK and EU. First patient in (FPI) is expected in Q2 2019.

The RFP should consolidate and present the following information in an organized manner:

- Executive summary: See above

- Company background: Key relevant information to help the CPO qualify your opportunity

- Drug product info/safety and handling: Technical information to alert the CPO of any potential handling requirements

- Protocol synopsis: Details of the study to allow a CPO to develop an optimized packaging, labeling, and distribution strategy for the study

- Packaging description/specifications/bill of materials: Technical information to develop master packaging records and facilitate packaging operations

- Package design requirements: Further detail if package specifications are not yet determined

- Labels/labeling: Label requirements based on the synopsis and the regulatory constraints of the countries where the clinical sites are located

- Scope of work (SOW): An outline of expected activities and line item costs to be presented in a proposal, based on the information given in sections 1-7

- Milestones: Project dates that the must align with selection process and SOW execution

- Other: Assumptions, prerequisites, preliminary terms, points for further discussion, etc.

SOW Considerations

Control the level of detail you provide and request. For example, a multicenter study in four different regions could be executed using various strategies. Rather than defining where depots are required (with inventory overages, resupply, etc.), provide the clinical synopsis information and other information outlined above and look to the CPOs to determine the best strategy based on their operations and experience.

Organize the SOW so that the CPOs return a consistent set of responses and a budget that can be mapped to each category in the SOW. Clearly identify activities that can help you benchmark standard costs, e.g., project management, stand-alone package/label run, QP release, storage (per pallet, per month), pick and pack, etc.

Conclusion

Clinical packaging presents a unique set of challenges that should not be underestimated, regardless of other obstacles encountered in chemistry, manufacturing, and controls (CMC) or clinical operations. Be sure that the individuals responsible for clinical supplies management and CPO selection have the right skillsets, motivation, and communication skills to facilitate among the various external participants, such as the CRO and the CPO.

Engage in a productive dialogue with each CPO during the selection process and get input from clinical operations to best understand the study needs, as well as from CMC to align production schedules and forecasting.

Leave room for flexibility because you will need it. Your relationship with the CPO will be stretched and strained during the execution of the study, and having a positive, problem-solving attitude will help bridge communication gaps when you encounter issues beyond your control. The bidding process is the first step in building the relationship with a CPO and its operational resource at all levels.

About The Author:

Ray Sison is VP pharmaceutical outsourcing and tech transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.

Ray Sison is VP pharmaceutical outsourcing and tech transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.