Cell & Gene Therapy Investment Outlook In 2022 & Beyond

By Steve Kemler and Adam Lohr, RSM

Cell and gene therapies are one of the most active areas of research and investment in the development of medicine. The cell and gene therapy space is experiencing significant growth and attracting substantial investment due to its potential in targeting poorly treated diseases and the recent success of novel therapies. This active area of research and development is characterized by a surge in private investment, initial public offerings, and corporate acquisitions. We’ll examine the current state of clinical development, investment and financial performance of companies developing cell and gene therapies, and whether these conditions support the next wave of life sciences advancement or are indications of a biotech bubble.

Source: FDA and Evaluate Pharma

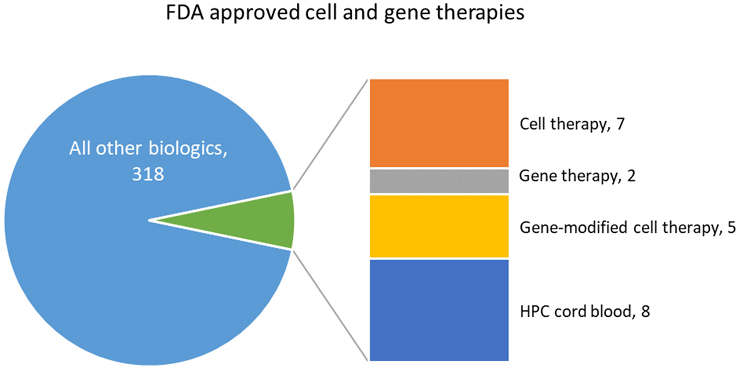

For all the media attention and investment that cell and gene therapy currently attracts, the cell and gene therapy space is still relatively new to the scene, with the first therapy approved in 2017. The number of approved treatments remains extremely small. Of the 22 cell and gene therapies approved by the FDA, 14 are cord blood-based treatments. The remaining include two gene therapies, seven cell therapies, and five gene-modified cell therapies. In total, cell and gene therapies represent just 7% of the 340 approved biologics.

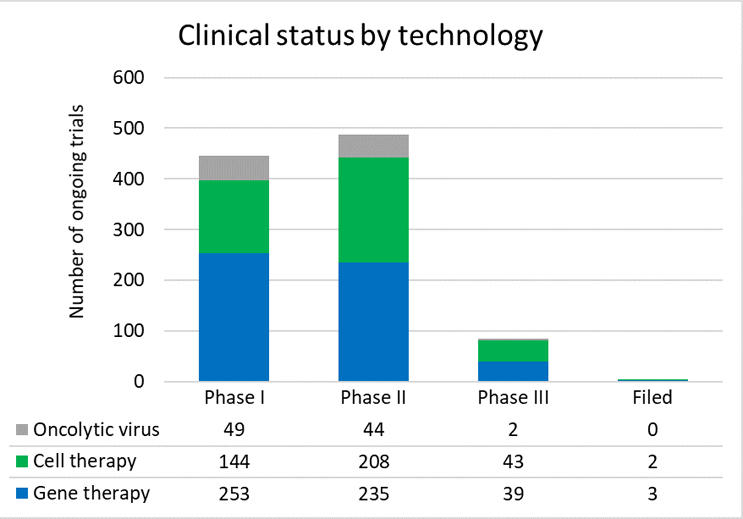

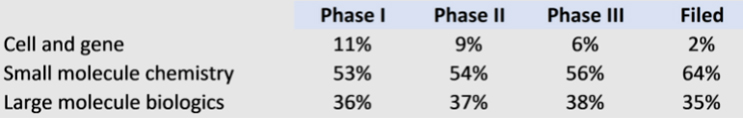

The cell and gene therapy market is showing significant growth with over 1,000 ongoing clinical trials registered with ClinicalTrials.gov. Of these, the vast majority are in Phase 1 and 2 trials, meaning that they are still far from commercialization, and most will not reach approval. This should also be put in context with the broader clinical trial landscape, where cells and genes make up only a fraction of late-stage trials. It is encouraging, however, that in such a nascent market, the proportion of early-stage cell and gene trials represents 10% of clinical activity.

Source: Evaluate Pharma

Source: Evaluate Pharma

Of the over 50 total drugs approved by the FDA in 2021, only two were cell or gene therapies. Although this is a small amount of the total approved drugs in 2021, it means the number of approved cell and gene therapies grew by 10% (or 17% if you exclude cord blood-based products).

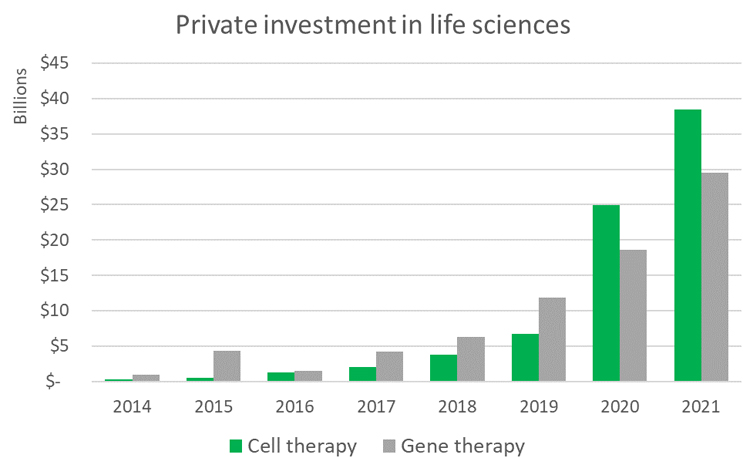

Investment Flows Rapidly To Cell & Gene Therapy Companies, But Returns Are Muted

Despite the small number of approved drugs, cell and gene therapy companies attract a growing amount and proportion of private and public investment. Although all private investment in life sciences has grown substantially over the past 10 years, notably, the investment in cell and gene therapy companies has seen remarkable rapid growth.

Source: CipherBio

Overall private equity and venture capital investment has grown, with a compound average growth rate of 18% from 2010 through 2021 for life sciences. For gene therapy, the average growth rate over that same period has been 59%. For cell therapy, it has grown 63%. This reflects growth from $362 million in investment in 2020 to nearly $68 billion in 2021 (roughly a third of all private investment made in life sciences).

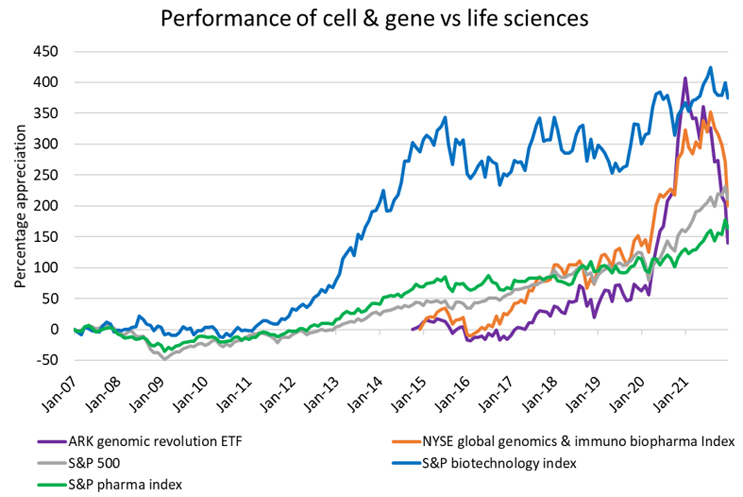

This spike in private capital has also supported emerging cell and gene companies as they enter the public markets. Using two of the largest cell and gene-focused indices as benchmarks against their biotech and pharma peers, we see that early growth was on par with biotech as it emerged half a decade earlier, but then went through a period of hyper distortion during the pandemic. As public markets adjust and the economy recovers through 2022, we anticipate cell and gene companies to return to a more metered growth trajectory that is supported by an increasing number of clinical catalysts and hopefully more regulatory approvals.

The takeaway for cell and gene companies and their investors is that it is important to separate hype from science. This is an emerging space with a massive potential opportunity, but until commercially proven, it still bears a significant amount of risk.

Source: Bloomberg

Source: Evaluate Pharma

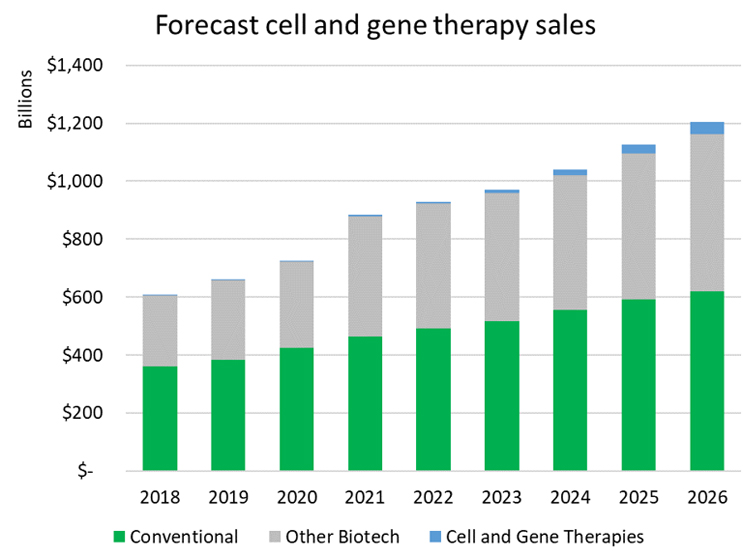

One way to contextualize the substantial growth in investment in cell and gene technologies is to look at forecasted revenue growth for the therapies that are in development. Based on worldwide sales forecasts from Evaluate Pharma, including both approved drugs and ones forecast to be approved, it is expected that conventional drug sales will grow at a compound annual growth rate (CAGR) of 6% from 2021 to 2026 and biologic sales excluding cell and gene therapies are forecast to grow from $415 billion to $541 billion, a CAGR of 5%. The cell and gene space is poised for substantial growth, with sales projected to increase from $4 billion annually to over $45 billion, over that same period, a significantly higher CAGR of 63%.

While the total dollar investment in gene therapy as well as cell therapy is only a fraction of what is put into conventional drugs and biologics, it is important to recognize the spillover effects of this growing capital. Investor interest drives innovation, encourages startups, and attracts experienced talent from competing sectors. This in turn drives results in the lab and investment portfolios. We saw this happen in the early days of biotechnology, and today traditional pharmaceutical companies continue to lose ground to their biotech peers in terms of investment, talent, and pipeline. We anticipate a similar story will play out as cell and gene therapy emerges as their own defined sector in the life sciences ecosystem.

That is not to say that cell and gene companies will not face challenges.

Despite Major Investments, Challenges Remain

Given the large volume of investment into this space, it would be tempting to assume that most major challenges related to the commercialization of cell and gene therapies have been overcome or at least mitigated in the minds of investors. However, that remains far from being true. Although individual companies may have resolved their clinical, manufacturing, and financing challenges, there remains a great deal of work to be done before sector-wide solutions can be universally applied to the cell and gene therapy market. Considerations include:

- Manufacturing

The growth and investment in cell and gene therapy are evident in Pfizer's current investment of $800 million to develop manufacturing facilities dedicated to gene therapy production from preclinical research through commercial-scale production. These three plants based in North Carolina highlight the substantial investments that will be required to scale up cell and gene therapies for broad market distribution. Additionally, a report from Bioplan and as reported before in this publication, both CMOs and biomanufacturers are planning to increase their production capacities for cell and gene therapies substantially over the next five years.

That said, the biggest manufacturing challenge is not a lack of lab space or production capacity. As new therapies are approved, a significant determinant of success will depend on whether the treatments are allogenic (based on cells from a donor) or autologous (based on cells from the patient). Treatments based on allogenic cells fit into a more traditional model of having treatment available for distribution as needed, whereas autologous treatments require modifying cells from the patients themselves to return as a treatment. This means that each dose must be made to order, introducing significant complexity and cost in treatment planning, manufacturing, and the overall supply chain.

- Pressure to closely follow the early clinical success

A 2020 analysis published in FoCUS highlights that there is a high correlation between CAR-T and T-cell receptor (TCR) clinical trials based on the volume targeting similar diseases and biological mechanisms. This increases the risk to individual companies that a failure in a trial for a similar candidate could have a significant impact on the expectations of their product. It also highlights a commercial risk in which a company could launch a successful therapy only to see rapid competition from similar CAR-T/TCR therapies that are also under development for the same disease.

Another risk for investors is that a company places too much emphasis on the success of one therapy for one indication, and then raises capital and sets forecasts for a number of additional trials using the same therapy for different indications. In the context of the cell and gene therapy market, of the 1,022 ongoing cell and gene clinical trials, only 63% include a unique therapy. While not an uncommon practice in the industry, current market hype does present an optimism bias, which can attract capital but may place unrealistic expectations on performance.

- Reimbursement

One of the largest outstanding challenges facing cell and gene therapies is that of reimbursement. Currently, the number of therapies and the volume of patients being treated is small enough that payers are willing to accept complicated and experimental approaches to reimbursements, including annuity and installment-based payments and outcomes-based reimbursement. However, it is unclear how scalable these approaches will be if the number of patients benefiting from cell or gene therapies continues to rise. Additionally, payers see frequent turnover in their beneficiaries, making longer-term contracts for treatment after it has been provided difficult to maintain.

Looking Ahead

Given the highlighted challenges, the obvious question is why so many investment dollars continue to flow into this space. The expected approvals and financial returns are part of the answer. Companies with strong cell or gene therapy pipelines have proven to be attractive acquisition targets. There is also the promise of rapid cell and gene therapy growth rate in sales compared to other biologics and conventional drugs.

While broad financial returns and a commercially viable market of treatments are still years away, if the promises of cell and gene therapies are proven true, it will be critical that investors and acquiring companies have locked-in access to the most promising researchers, intellectual property, and technology platforms. Gaining this access may turn out to be the most important return on cell and gene therapy investments

While forecasted sales growth for conventional drugs and other biologics is much higher, the robust growth forecasts for cell and gene therapies continue to draw significant attention from investors. And with ongoing strong investment, we expect that cell and gene therapies will continue to advance through trials, gain approval, and provide substantial long-term returns in patient health and investor portfolios.

About The Authors:

About The Authors:

Stephen Kemler is a director and life sciences senior analyst at RSM US LLP. He forecasts and communicates economic, business, and technology trends shaping the life sciences industry. He also participates in the Philadelphia Alliance for Capital and Technologies (PACT) medtech series and is involved in multiple regional and national life sciences initiatives. Previously, he provided services for a multinational CRO and also worked at a medical technology company. He can be reached on LinkedIn.

Adam Lohr is an audit partner and life sciences senior analyst at RSM US LLP. In addition to providing assurance services to his clients, he also sits on RSM’s national life sciences team and leads the San Diego office life sciences practice. His senior analyst responsibilities include advising the firm’s life sciences clients and client servers as they work to navigate the rapidly changing industry environment. Adam regularly writes, presents, and advises on capital markets, digital transformation, policy, and other issues transforming the life sciences. He focuses on high-growth companies that are globally active in the life sciences, technology, and consumer products industries. He specializes in providing financial audit services and helping clients respond to technical, regulatory, and economic changes that impact their business.

Adam Lohr is an audit partner and life sciences senior analyst at RSM US LLP. In addition to providing assurance services to his clients, he also sits on RSM’s national life sciences team and leads the San Diego office life sciences practice. His senior analyst responsibilities include advising the firm’s life sciences clients and client servers as they work to navigate the rapidly changing industry environment. Adam regularly writes, presents, and advises on capital markets, digital transformation, policy, and other issues transforming the life sciences. He focuses on high-growth companies that are globally active in the life sciences, technology, and consumer products industries. He specializes in providing financial audit services and helping clients respond to technical, regulatory, and economic changes that impact their business.