Cautious Optimism For Biotechs And Their Outsourcing Partners

By Justin Culbertson, RSM US LLP

The global inflation that followed the pandemic's disruption of our economy's backbone has spread to every industry, with the life sciences community feeling its significant effects. Depending on your role within this ecosystem, these economic fluctuations may have touched your biotech organization or could do so in the future. Pre-revenue, including preclinical and clinical stage, biotechs have been the most impacted but also stand to gain the most after the economic downturn and subsequent recovery. This article will delve deeper into how small to midsize pre-revenue biotechs have been specifically impacted and what this could mean for the life sciences services organizations that support them.

Ripple Effect On Research

The deceleration of funding has had a ripple effect on preclinical and clinical stage research and development (R&D) within biotechs. Early-stage biotechs, which are primarily supported through venture capital investors, are grappling with dwindling cash reserves as potential investors have revised their investment methodology in response to the current economic environment. While many of these investors have significant dry powder, i.e., cash available for investment, they are restricting this cash to existing portfolio companies and only the most promising new candidates.

Due to these factors, early-stage biotechs have had to make strategic reductions in expenses. These reductions have been varied. Some companies have reduced their headcount, opting to operate with leaner teams, while others have decided to pursue fewer research candidates to mitigate costs. These changes have had a noticeable effect on R&D output, which currently stands at about 65% of pre-pandemic levels for these early-stage biotechs.

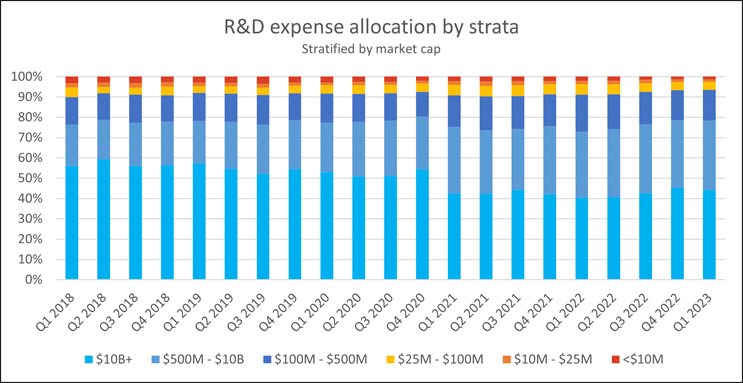

Yet, it isn’t all doom and gloom for preclinical and clinical stage R&D. Larger biotechs have managed to maintain or even increase their R&D spending. Most of these organizations are late-stage in the clinic or supported by one or more commercialized products, which have provided a financial buffer to the abrupt economic shifts early-stage biotechs have been experiencing. According to public filing data compiled by Bloomberg and analyzed by RSM, midsize to large biotechs have surged so significantly in their R&D investment that they now make up about 35% of all R&D expenditure, a substantial leap from the 20% contribution made five years ago, with much of this share being taken from Big Pharma.

Source: RSM U.S. LLP; Bloomberg LP

As midsize to large biotechs continue to increase their R&D spending, the funds are being channeled into various uses. From bolstering the headcount of skilled researchers and investing in cutting-edge lab facilities to diversifying the number of research candidates and expediting the number of clinical trials conducted, these entities are ensuring that each dollar spent yields maximum returns in driving scientific progress.

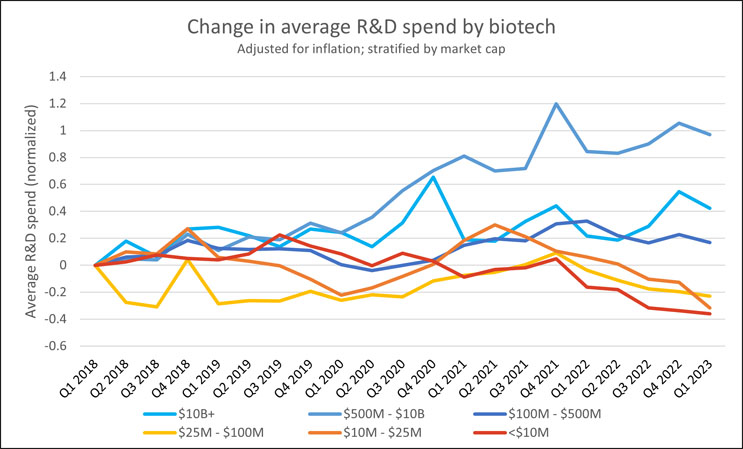

This growth in spending becomes evident when looking at the inflation-adjusted R&D spending across public biotechs as a whole. Despite the rising interest rates and economic turbulence, the industry has managed to maintain an inflation-adjusted growth rate of 7% annually over the past two years, according to public filing data compiled by Bloomberg and analyzed by RSM. In layman’s terms, this means that the industry has been increasing its R&D spend 7% faster than the rate at which general prices are rising. This sustained investment growth, particularly when compared to other sectors where investment may be stagnating or declining, is a testament to the strength of the biotech sector.

Source: RSM U.S. LLP; Bloomberg LP

Implications For Service Organizations Supporting Biotechs

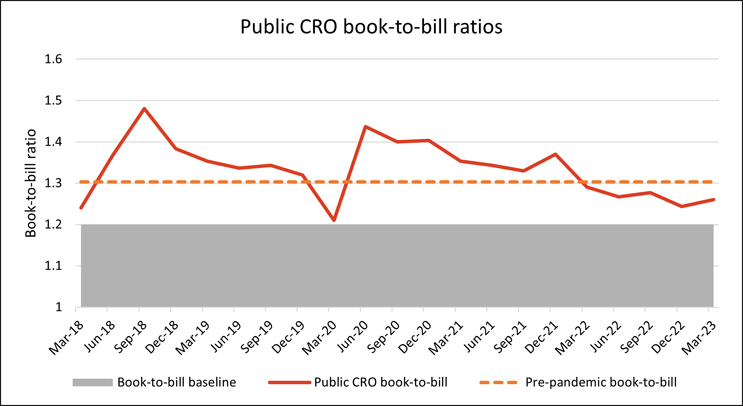

The evolving financial climate and changing demands of biotechs have direct implications for the service organizations that support them, such as CROs and CDMOs. One metric for the health of services companies is the CRO book-to-bill ratio, which measures a CRO’s ability to maintain or grow its contract backlog. A ratio greater than 1 indicates that a CRO’s backlog is growing, i.e., generating more new business than it is recognizing in revenue for the period. A ratio of 1.2 is considered healthy for the industry and a measure that public CROs continue to surpass.

Source: RSM U.S. LLP; Bloomberg LP

Evidentially, reductions in small to midsize biotech funding have led to these biotechs reducing their research footprint; however, this has not significantly impacted research demand at large CROs. Anecdotally, we expect that the burden of this reduction in small to midsize biotech research is most significantly impacting small to midsize specialty CROs, who are likely to have a larger percentage of their studies sponsored by small to midsize biotechs.

While small to midsize biotechs will lean on their CRO and CDMO partners to expedite development, cut costs, and tap into specialized expertise, larger biotechs may have different needs. As large molecule development becomes more prevalent, larger biotechs will be looking for partners with expertise in not only research but also manufacturing these molecules at scale. The CDMO market is experiencing significant demand, especially in the large molecule space, and we believe there are unique opportunities here for service providers to partner and bring their combined experience to the table with customers.

The Road Ahead

The current economic climate undoubtedly presents considerable challenges, yet the resilience and dynamism of the biotech industry shine through. In the face of adversity, businesses continue to invest in innovation, driving the discovery and development of novel solutions for numerous medical conditions; however, biotechs cannot go the road alone. They will need adept service organization partners.

Adaptability will be the hallmark of successful service organizations supporting biotechs. Those who can adjust their strategies and offerings to meet the changing needs of their biotech clients will not only survive but thrive. For instance, service organizations catering to smaller biotechs may want to consider how they can provide cost-effective, specialized services to these clients who are operating under tighter budgets. In addition, these organizations could offer more flexible pricing models or packages that bundle multiple services together at a discounted rate. Such strategies could help these partnering organizations maintain their client relationships and continue to grow, even as their clients are reducing their R&D activities.

With clinical spend being the largest expense of many biotechs, CROs should look for ways to serve their biotech clients with timely reporting on study status from a clinical operations and financial perspective. As biotechs grapple with their cash runway, they will see immense value in this level of customer service, which is often underserved on the financial side. There are also technology options that can take clinical trial expense management out of excel and allow biotechs to independently forecast clinical trial spend prior to receiving periodic reporting from their CRO. This can help biotechs come prepared to status updates with their service providers, align clinical operations and finance teams on clinical trial status, and mitigate risk related to clinical trial spend.

As the economic recovery emerges, we can expect to see new developments, new research, and new breakthroughs. Service organizations that are able to anticipate and meet the needs of the changing biotech industry will be well-positioned to succeed in this new environment.

About The Author:

Justin Culbertson, life sciences senior analyst at RSM US LLP, specializes in industry trends related to life sciences services to pharmaceutical and biotech companies. Justin has over 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations and similar service organizations in the ever-evolving life sciences industry. Justin also has extensive experience advising clients in new standards implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting.

Justin Culbertson, life sciences senior analyst at RSM US LLP, specializes in industry trends related to life sciences services to pharmaceutical and biotech companies. Justin has over 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations and similar service organizations in the ever-evolving life sciences industry. Justin also has extensive experience advising clients in new standards implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting.