A Supply Market Review Of Lab Chemicals And Solvents For The Pharmaceutical Industry

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

The market for high-purity chemical production, distribution, and sales for use in pharma is highly competitive. Most of the products are made to standard specifications and are either produced by or sourced from multiple sources, such as petrochemical companies, chemical manufacturing companies, and chemical distributors. This paper discusses the lab chemicals market and supply chain and key trends that have an impact on pharmaceutical buyers.

the products are made to standard specifications and are either produced by or sourced from multiple sources, such as petrochemical companies, chemical manufacturing companies, and chemical distributors. This paper discusses the lab chemicals market and supply chain and key trends that have an impact on pharmaceutical buyers.

Lab Chemicals Market Trends

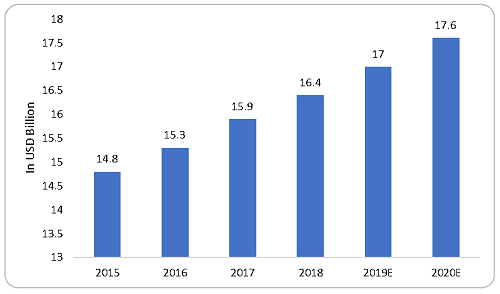

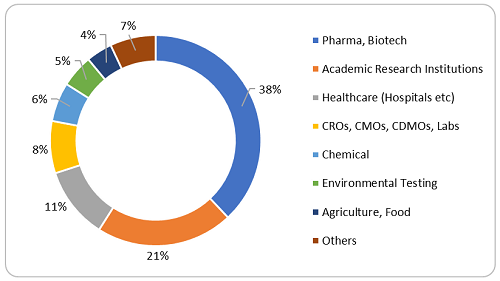

The demand for lab chemicals has increased steadily, reaching an estimated $17 billion in 2019, with an expected CAGR of 3 to 5 percent by 2020, as shown in Figure 1. This surge in demand is due to their increased use by pharma and biotech buyers, at about 38 percent of the market, followed by research institutions and CROs at 32 percent. The demand for lab consumables by the life sciences segment alone, including pharmaceutical, biotech, healthcare, and contract organizations, grew at an estimated 5 to 7 percent – a growth rate that is expected to continue.

Figure 1: Laboratory chemicals market size, 2015 – 2020E (sources: Businesswire.com, Beroe analysis)

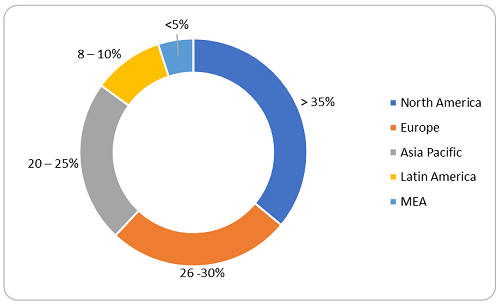

North America has the highest market share, at more than 35 percent, driven by a 3.4 percent increase in R&D investments (Figure 2). A survey by PhRMA notes that the pharmaceutical industry invested $65.3 billion in R&D in 2017. The Asia Pacific region is the fastest growing market, which is attributed to newly established research institutions. Within APAC, China is seeing the largest pharma R&D growth, as a result of economic development and increasing demand by an aging population.

Figure 2: Laboratory chemicals market share by region (sources: Businesswire.com, Mordor Intelligence, Beroe analysis)

Supply Market Overview

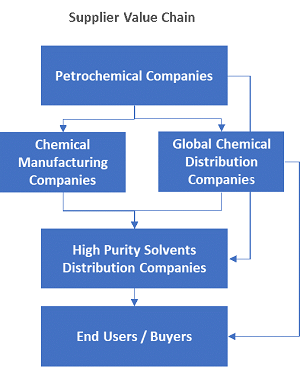

The supply market for high-purity lab chemicals is fragmented, with only a few suppliers having substantial international operations. The supply value chain of lab chemicals is shown in Figure 3.

Figure 3: Supplier value chain (source: Beroe analysis)

- Petrochemical companies (e.g., LyondellBasell, INEOS, etc.) manufacture specific high-purity grade solvents and sell only in bulk at varying frequencies, such as one railcar per quarter/month or one truckload per month. They have both truck and rail logistics capabilities.

- Chemical manufacturing companies (e.g., Pharmco, GFS Chemicals, etc.) produce high-purity solvents and other chemicals and sell in small to large volumes. They have distributors in place for global geographic capability. They have both truck and rail logistics capabilities.

- Global distribution companies (e.g., Brenntag, Nexeo Solutions, etc.) source raw materials in bulk volumes from petrochemical companies. This is further purified for grade-level solvent use across industries. They have both truck and rail logistics capabilities.

- High-purity solvents distribution companies (e.g., Tedia, Avantor, etc.) focus largely on life science grade. They source raw materials from global chemical distributors and manufacturers and, in certain cases, from petrochemical companies. This is purified, repacked, and labeled for HPLC-grade level and sold to buyers. They have truck logistics capability.

Among the key suppliers are Merck, Thermo Fisher, Avantor, Romil, Sharlau, Carl Roth, SCP Science, Carlo erba, and Analytika. They alone comprise approximately 70 percent of the market share of lab chemicals. Pharmaceutical companies comprise about 38 percent of the overall demand for lab chemicals. Suppliers view pharma industry buyers as core accounts, hence they are willing to engage in strategic partnerships and offer better options for discounts and product delivery (Figure 4).

Figure 4: Global end user demand for lab chemicals by revenue distribution (source: Beroe analysis)

Key Supply Market Trends

Acquisition of novel processing technologies, development of novel HILAQ (heavy isotope labeled azidohomoalanine quantification) labeling, acquisition of distributors, and integration with fine chemical companies are some of the key trends observed in the specialized lab chemical suppliers.

Merck has acquired Natrix Separations, which has a unique platform enabling fast and flexible manufacturing of biopharmaceuticals. Non-canonical amino acid azidohomoalanine (AHA) has been proven to be effective at measuring the synthesis and turnover of newly synthesized proteins (NSPs) in various biological samples, such as animal tissue. A recent publication by Yates et al. describes HILAQ, a new metabolic labeling method for enriching and quantifying NSPs in HEK293T and HT22 cell lines and other relevant cell lines.

Cayman Chemicals acquired Biomol GmbH to improve overall delivery of its product and to vertically integrate through acquisition of a distributor. Valiant Co., Ltd., a subsidiary of the China Energy Conservation and Environmental Protection Group, has been focusing on the manufacture of fine chemicals.

Unique processing technology and the past M&As of a given high-purity solvent manufacturer define the operational capability of the supplier.

Conclusion

Petrochemical companies that partner with global distribution companies such as Brenntag and Nexeo Solutions are preferred suppliers for buyers that want to procure crude solvent and purify it themselves by means of distillation. Every distributor has a value-adding function in the supply chain once raw materials are sourced from the chemical manufacturers. This involves purification, blending, packaging, and labeling before selling it to the end users. They are preferred partners for those who need to buy high-purity solvent in bulk quantities. For small-volume buying, lab chemical distributors are the most suitable.

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on service outsourcing contracts, category management and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 25+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on service outsourcing contracts, category management and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 25+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.