More Gene Therapy Outsourcing – Can It Be Quantified?

By Louis Garguilo, Chief Editor, Outsourced Pharma

Later this year, I look forward to bringing readers an intriguing narrative about a biotech that came out of the gates with its own cGMP manufacturing facility, and why that organization’s CEO says, “I wouldn’t do it any other way.”

That organization and CEO are outliers.

Today, for example, there are plenty more gene-therapy developers (GTDs) with a very different growth and thought pattern when it comes to generating the materials and supply chains needed for development and manufacture.

This outsourcing proclivity was again confirmed in the inaugural Gene Therapy CDMO Benchmarking survey, from ISR Reports.

For starters, 56% of GTDs included in the report said they outsource all their manufacturing needs.

To be clear, a requirement to participate in the survey was that respondents are actually outsourcing gene-therapy manufacturing, so this cohort does not include those biopharma companies that in fact do manufacture in-house.

Still, at risk of repeating, what grabbed my attention was that among the confirmed gene-therapy outsourcers, well over half confirmed a complete manufacturing reliance on external partners.

Not surprising to you?

Consider that only a few years ago most novel gene-based programs would have been considered outrageously complicated – and not suitable for outside hands. If GTDs had attempted to outsource complete program needs, they most assuredly would have been faced with a lack of service-provider knowhow.

That full-scale gene-therapy outsourcing is now prevalent is a notable testament to just how far we have come as an outsourcing industry.

But let’s be careful. We are not writing the obit for the outsourcing hybrid model (mixture of internal and external support) just yet

In fact, the ISR survey also informs us that another 40% of the GTDs self-report they utilize CDMOs to augment in-house manufacturing capabilities. So the hybrid model, as I believe most of us would expect, is alive and well.

Whether all-in or hybrid outsourcing, that gene-therapy-based start-ups can rely so readily on CDMOs in effect changes the entire outlook for the industry. An example of that follows.

Enabling More

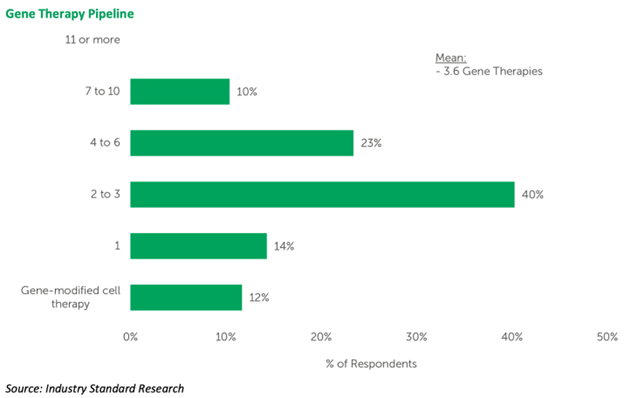

Here’s one of the many interesting charts within the report:

As you can see, 40% of GTDs in the report (and these are a mix from academic medical centers, to all-sizes biotech, and pharma) indicate they already have a pipeline consisting of 2 to 3 programs.

If we squint a bit, a combined one-third of respondents (actually exactly 33%) have from 4 to 10 candidates on route.

Back in the day, most organizations – almost always emerging organizations – got started in gene-therapy with a limited research project aimed at a specific target.

Nowadays, along with the quickening advance of science and technology – and a better understanding of the genre by investors – we can posit that CDMOs (and other service providers along the drug-therapy life cycle) are the enablers of multi-program biopharma organizations.

Therefore, not only is the gene-therapy arena spawning new-company formation, but the amount of activity per formation has dramatically increased. And as this ISR benchmarking report once again indicates, a lion’s share of that work goes to contract gene-therapy developers and manufacturers.

Which – once again – raises the question:

Can we possibly have enough CDMO capacity devoted to the development and manufacture of all these gene-therapy programs?

The answer to that is not a part of the current ISR survey nor what ISR focuses on, but Kate Hammeke, VP Market Research at ISR, did provide me with this: “Capacity measurements are always tough. We tend to find that capacity is a moving object, and can change at any point in time.”

I’ll second Hammeke’s comment. Regarding those surveys that do try (admirably) to measure capacity, the accuracy, shall we say, can be of question. I’ve shared data points from reports on capacity with my board members and others. These outsourcing professionals have in many cases said the data does not jive with their on-the-ground experiences.

There are times, such as when Covid struck, when a near universal capacity situation arises.

Mostly though, capacity turns out to be a personal, point-in-time and company-to-company experience.

When we talk to outsourcing professionals, as often as not they are happy to provide us with an earful on their difficulty in locating and then contracting CDMOs to manufacture for them within an acceptable timeframe.

At the same time, these professionals are just as willing to tell us they are happy with their current providers – and external supply chains are the way to go.

Meanwhile on the other side, CDMOs continue to advertise open capacity, available capabilities and requisite equipment and knowhow for GTDs; they insist they can meet demand for the gene-therapy developers and commercializers.

So we certainly will not unravel the supply-and-demand dynamic here, although it is always good to touch on the subject.

Bottom line: If so many of those outsourcing gene therapies today report they are successfully externalizing all of their needs, certainly some supply-demand balance must be at hand.

The Right Questions

Ultimately, though, what matters to on-the-ground professionals is what the ISR report elegantly elucidates. And that is the importance of understanding the specific attributes of the best CDMOs, and learning from your peers which CDMOs are best regarded, and optimally situated to gain your trust, and meet your needs.

In areas like gene therapy, with swiftly advancing science and technology; numerous start-ups (and established bio/pharma organizations getting into the game); more programs per GTD; and yes, on-going questions about capacity – benchmarking with your peers, and learning of their perceptions and experiences, is vital. It should be a part of your overall outsourcing due diligence.

So we’ll continue to bring readers relevant insights from surveys, benchmarking and other reports. This time, thanks to ISR for letting us share today’s thoughts.