Liquid Biopsy: Market Drivers And Obstacles

By Divyaa Ravishankar, Frost & Sullivan

Liquid biopsy is a minimally invasive diagnostic tool helping not only in oncology applications, but playing an increasing role in applications including reproductive health and infectious diseases. The technology has a robust scope along the patient journey, from detecting cancer early and offering diagnosis to therapy monitoring and monitoring recurrence.

Therapy guidance is liquid biopsy’s leading application, with early cancer detection being one of the promising near-term applications, depending upon when liquid biopsy can be proven at least equivalent to current imaging and screening tests (e.g., colonoscopy, low dose CT, etc.).

Liquid biopsy uses multiple techniques, including both molecular and proteomic imaging, depending on the biomarker studied. However, next-generation sequencing (NGS) and quantitative polymerase chain reaction (qPCR) represent the major technologies currently marketed. Currently marketed tests are mostly single-gene tests based on PCR, but the market is moving towards a multi-cancer approach using NGS with a combination of artificial intelligence/machine learning (AI/ML) approaches.

Market Drivers And Restraints

Market drivers outnumber restraints in the liquid biopsy testing market in terms of the addressable market potential and healthcare cost savings. Drivers include:

- Cancer Monitoring — Treatment selection and cancer monitoring serve as short-term drivers to the adoption of liquid biopsy in the clinical spectrum, avoiding repeat or unwanted biopsies.

- Driving Investment From Venture Capitalists (VCs) —Liquid biopsy companies serve as acquisition targets and thus drive financial investment from VCs, pharma and/or medical device companies, and Tier 1 IVD Companies.

- Patient Selection Tool — Liquid biopsies are an important tool in clinical trials, aiding pharma companies in patient selection, thus accelerating enrollment and lowering costs. This is particularly important to drive targeted therapies.

- Early Cancer Screening Market — Pre-cancer screening and early detection serve as long-term growth drivers for liquid biopsy.

Market restraints include:

- Gold Standard Inhibiting Growth — Tissue-based testing and imaging remain the gold standard of care, relegating liquid biopsy to a complementary tool role.

- National Coverage Determinations (NCDs) For NGS Tests — The NCD for FDA-approved NGS tests puts undue requirements on companies manufacturing LDTs, limiting the access to comprehensive liquid biopsy. CMS has carved away the tremendous importance of liquid biopsy tests for screening, and restricts coverage to specific situations, such as recurrence, relapse monitoring, metastasis, or advanced Stage III and IV cancers. As a result, there is less incentive for companies to develop liquid biopsy tests for cancer screening. Companies also are likely to develop smaller gene panels specific to a tumor type or a limited set of targeted therapies. Currently, no plasma-based NGS tests are approved by the FDA, and repeat testing is necessary for circulating tumor DNA (ctDNA) — tumor-derived fragmented DNA in the bloodstream not associated with cells. Further, a proposed law could limit patient access to liquid biopsy where sufficient tissue is not available. In addition to Roche’s EGFR mutation test, more variants will be necessary to measure residual disease quantitation and resistance detection; in cancer care, laboratory developed tests (LDTs) classified as advanced diagnostic laboratory tests (ADLTs) are critical in identifying biomarkers that can help steer the patient’s treatment course

- Reimbursement Challenges — Limited reimbursement (non-coverage for panel-based tests) restricts the uptake of liquid biopsy testing. The NCD guidelines proved advantageous for approval of FoundationOne’s genomic profiling assay, but may work against other companies developing NGS-panel tests under the LDT scenario. If multigene NGS tests have not secured FDA approval or reimbursement coverage, it is up to Medicare administrative contractors (MACs) to approve coverage when a company seeks a local coverage determination (LCD). However, we find that most MACs lean toward the NCD to make a decision, and this is likely to create an unfavorable situation for liquid biopsy companies.

- High Cost Of Technology — Several liquid biopsy assays are based on high-throughput NGS technologies. The high cost of these technologies, and thus the assay, inhibits liquid biopsy uptake to some extent.

- Clinical Sensitivity — Clinical sensitivity presents a challenge to liquid biopsy because ctDNA is rare compared to hematological molecules found in a blood sample.

- Lack Of Clinical Utility Studies — The lack of large-scale clinical trials demonstrating liquid biopsy’s clinical utility inhibits the growth of this market.

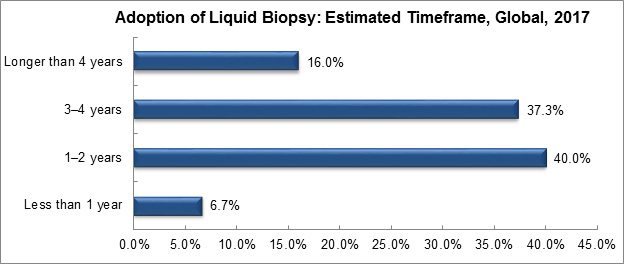

A recent survey assessed the adoption of liquid biopsy in the care continuum. The majority of survey respondents believe liquid biopsy can function as an adjunct to tissue biopsies in one to two years. However, a considerable number of respondents also felt it could take three to four years.

Graph created by, and used with permission of, Frost & Sullivan

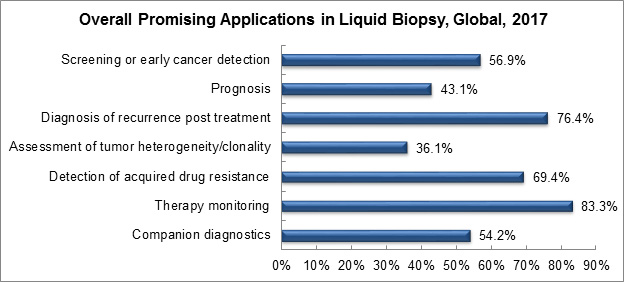

When questioned about the most promising applications of liquid biopsy, survey respondents most often indicated therapy monitoring, diagnosis of recurrence, and post-treatment follow-ups responses.

Graph created by, and used with permission of, Frost & Sullivan

Liquid Biopsy Outlook

The liquid biopsy market remains unregulated in most countries, where most tests are offered as laboratory developed tests (LDTs) with a self-pay option. This is expected to change as reimbursement procedures evolve, along with incorporating such tests in standard care guidelines. Additionally, more companies are leaning towards providing health systems with enterprise access to their tests. This initiative is based not just on test cost, but also on monetizing patient conditions indicated by the test.

To summarize, present opportunities for liquid biopsy include helping pharma companies select patients for clinical trials. Therapy monitoring and recurrence represent near-term opportunities. Finally, the early cancer screening market is a lucrative opportunity where liquid biopsy tests could potentially displace the current, predominantly imaging-based screening modality.

Companies are looking beyond circulating tumor cells (CTCs) and ctDNA, investigating exosomes and nucleosomes for their potential to diagnose cancers early. NGS remains the preferred chemistry, but the incorporation of AI/ML technology is making a difference in the competitive positioning of companies.

About The Author

Divyaa Ravishankar has over 12 years’ experience in market research and management consulting. In addition to authoring numerous reports in the area of in-vitro diagnostics, she has advised clients on market trends, implications, and strategies on diverse topics as next-generation technologies, end user and product/feature/pricing analysis, merger and acquisition target analysis, international market expansion strategies, detailed demand modeling, and competitive analysis. Ms. Ravishankar earned her master’s degree in Biological Sciences from Birla Institute of Technology.

Divyaa Ravishankar has over 12 years’ experience in market research and management consulting. In addition to authoring numerous reports in the area of in-vitro diagnostics, she has advised clients on market trends, implications, and strategies on diverse topics as next-generation technologies, end user and product/feature/pricing analysis, merger and acquisition target analysis, international market expansion strategies, detailed demand modeling, and competitive analysis. Ms. Ravishankar earned her master’s degree in Biological Sciences from Birla Institute of Technology.