It's Partly Personal (Medicine): In 10 Years Outsourcing At $315 Billion

By Louis Garguilo, Chief Editor, Outsourced Pharma

You’ve got to give Towards Healthcare credit. They have the fortitude to publish a 10-year projection of how much development and manufacturing outsourcing will add up to globally.

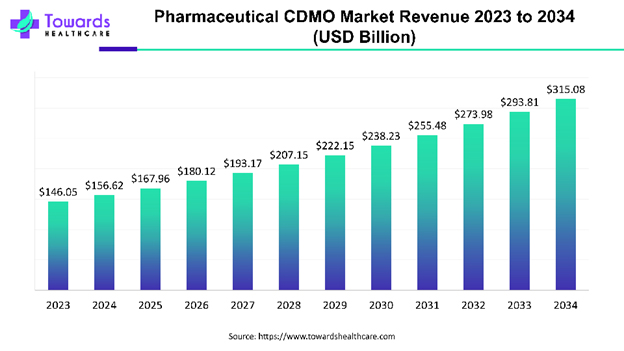

Here’s that projection charted in Pharmaceutical CDMO Market Companies, Advantages and Segmental Analysis:

Of course, it’s up to all of you to make this happen.

The above estimated global pharmaceutical CDMO market growth from $146.05 billion to $315.08 billion by 2034 comes out at a compound annual growth rate (CAGR) of 7.24%.

So although the large dollar numbers may have us catching our breath, that rate of growth certainly seems reasonable, don’t you think?

Certainly, none of us anticipates a lessening in the demand for pharmaceutical products of all kinds, and thus the need for more CDMO services.

And while currently the GPL-1 mega-sellers are one indication of how the industry continues to power forward in a large-scale way, according to the report, we should keep an eye on some smaller sponsor needs.

Growth In Personal Medicine

Interesting – and I wonder how readers feel about this – the report assigns an important stimulus of projected outsourcing growth to personalized medicine.

That is, if CDMOs, in turn, can adjust to and aid that nuanced pursuit.

The report offers the following analysis (with my edits for brevity and continuity):

The pharmaceutical industry is undergoing a transformative shift. With the growing demand for customized treatments, the need for innovative manufacturing solutions has never been greater. Traditional production methods are often ill-suited to meet the complexities of personalized medicine, creating a significant market gap.

To address this challenge, pharmaceutical companies must collaborate with CDMOs that can handle small-scale, intricate production processes while ensuring safety, efficacy, and reliability.

The challenges posed by small-scale, complex production include:

- Regulatory Compliance: Each personalized treatment needs to adhere to stringent regulatory guidelines, including those set by the FDA and EMA. Ensuring compliance with these regulations at scale can be difficult, especially when working with highly individualized formulations.

The production of personalized medicines is subject to rigorous regulatory oversight. CMOs are well-versed in navigating the complex regulatory landscape, ensuring that all products meet the necessary safety, efficacy, and quality standards. By partnering with a CMO, pharmaceutical companies can avoid delays and regulatory hurdles, ensuring that personalized treatments reach the market faster.

- Supply Chain Complexity: Managing a supply chain for personalized medicines is inherently more complex than traditional drug manufacturing. The need to track individual patient requirements and ensure timely delivery adds another layer of difficulty.

CMOs are experienced in managing small-scale production runs. Their capabilities include flexible production systems that can quickly adapt to the unique demands of individualized therapies. This allows pharmaceutical companies to produce customized treatments for a wide range of patients, from rare diseases to those with unique genetic profiles.

-----------------

Overall, the challenges inherent in pursuits for micro- or personalized-batch development and the processing of which, requires – from economical, logistical and practical standpoints – the need for “specialized manufacturing capabilities, which is where CDMOs play a critical role.”

Personally, some years ago I was concerned our rooster of existing CDMOs could not effectively take on gyrations brought upon outsourcing by, for example, cell and gene therapy, and the advent (should it materialize as successfully as this report intuits) of personalized medicine.

Those fears (for the time being) have been mostly put to bed.

Incumbent CDMOs have essentially adapted to evolving client needs and patient markets, and some new CDMO entrants are emerging as well.

I should have had more faith in one of my favorite tenets:

If the biopharma industry invents it, the CDMO industry will produce it.

Challenges Remain

Still, and as mentioned above, it hasn’t and assuredly won’t always be a smooth transition to new modalities, markets, and development, manufacturing and distribution needs.

While the report states that CDMOs are “essential partners” for sponsors in the development and production of personalized medicine, these partners will continue to face significant challenges.

A key example offered in the report is the “CDMO market is highly fragmented, with numerous players vying for a limited pool of potential customers.”

This, we are told, will lead to “extreme competition” presenting obstacles for both CDMOs and pharmaceutical companies seeking to develop personalized medicines.

This is interesting because on the one hand we note the growth of personalized medicines, but on the other, not enough customers to fill the rooster of external partners geared up to serve them.

Even more, is this competition driving some of the M&A among CDMOs creating organizations too big to help those smaller biotechs emerging with personalized solutions?

If so, quite a paradoxical development, indeed.

The report also says CDMOs “are often engaged in price wars, which can drive down profitability and limit the ability of companies to invest in new technologies or improve production processes.”

“This creates an environment where only the most cost-effective CDMOs survive, putting pressure on smaller players to deliver high-quality services at competitive prices.”

I’m sure some readers will politely disagree with the great pricing they can get at CDMOs.

Nonetheless, the report certainly is correct in stating that CDMOs must find ways to differentiate with specialized services for personalized medicine.

CDMOs that can prove their ability to handle complex, small-scale production runs while maintaining quality and compliance will be better positioned to attract pharmaceutical companies.

But absolutely, pricing will also dictate which of these survive well into the future.

To stay ahead, CDMOs will require ongoing investments in technology, infrastructure, and both human expertise and artificial intelligence.

If, as the report says, “[t]he future of personalized medicine depends on the ability of pharmaceutical companies and CMOs to collaborate effectively,” it also depends on CDMOs finding:

- investment dollars (productivity and pricing strategies)

- the right mix of customers (and enough of them); and

- the wherewithal to match the pace of technological development and changing patient markets

We’ve got a long way to a CDMO outsourcing market of $315 billion. It’ll take a lot of work to get us there, and according to Pharmaceutical CDMO Market Companies, Advantages and Segmental Analysis, personalized medicine will have been one highly successful component should we succeed.