Biopharma Supply Chains At Industry 4.0

By Louis Garguilo, Chief Editor, Outsourced Pharma

One day you’ll select your CDMO based more on its communication and AI capabilities than on the humans who work there. Once selected, your machines and systems will connect directly to those at your partner’s, interact directly with your ERP (enterprise resource planning)-approved needs, and bypass the human interaction needed today to manage drug supply chains.

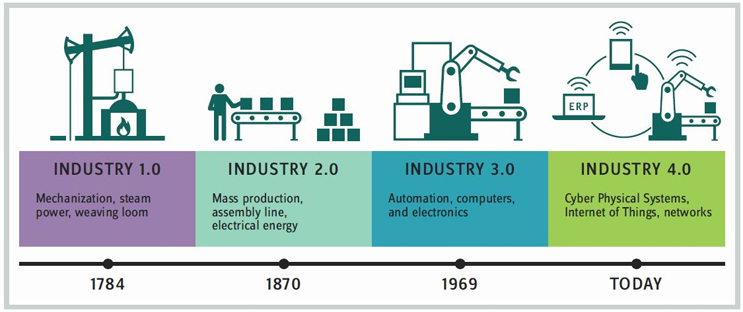

No, that day may not occur in 2019, but the next 12 months will continue to build a bridge to that future. Already, advanced machines designed and implemented for serialization reside at service providers to relay information to systems at drug sponsors. Biopharma companies have built “smart” facilities. Blockchain technologies for supply chain integration and management are being laid out. Still, to get to a full digital dialogue, drug sponsors and CDMOs alike will need to muster their resources and usher in what the rest of the world already calls Industry 4.0. (See graphic of industry progressions to 4.0.)

Darren Dasburg, VP and head of learning and development global operations at AstraZeneca, has thought a lot about Industry 4.0 and that coming magical era in our supply chain future. (His ideas are his own and don’t necessary represent those at AZ.)

“Today, our internal network of professionals at pharmaceutical companies drives a supply plan through our partners,” says Dasburg. “But in the not-too-distant future, that same information may be allowed to flow directly to a service provider’s machines. This will engage and then lock production for our needs, as well as for dozens of other clients of the CDMO.”

Dasburg sees a future in which long hours of haggling over supply terms within contracts, acquiring production time slots, worrying about quantities, and relying on project managers are recalled as elements of a bygone era. “The limits to our productivity today are amazing,” he says. “I promise you, someday the biggest IoT [Internet of Things] machines will know right down to the moment of diagnosis to postulate the drug volumes and country needs for the drug sponsor, and as importantly, for your CDMO to take action on.” His only caveat: “Provided quality can be upheld, the vertical integration we as clients have required will likely be allowed to ebb away to trusted partners who know how to apply the 4.0 design.”

He explains further: “This real evolution to Industry 4.0 — the interconnection of all locations, machines, and computers — allows real-time decision making in every capacity, from determining whether the product meets a spec, to whether the production line even needs to run because sales are low. People may see this interconnectivity as adding complexity to our internal networks, and thereby driving even more resources into our plants, while driving us humans away from reasoned sourcing solutions. I disagree, because the flow of information will inherently change the way we work and create new opportunities for valuable internal resources.”

The change, thinks Dasburg, will lead to soaring productivity and profitability. Regarding the latter, this technolution (my contribution to the English language), will include “a relentless financial assessment of risk-reward and the make-versus-buy decision when it comes to outsourcing drug development and manufacturing.”

But here’s the (multi-) million-dollar question: If “the machines” via AI do determine it is better to “buy,” will there be CDMOs tech-capable enough to receive the news and win the orders? Dasburg thinks so. “CDMOs have a vested interest in differentiating themselves with their 4.0-level connectivity and machine learning. CDMOs will want to enact strategies for reaching into our businesses to help extract billable services.” He continues: “Outside partners with tight margins will fight hard to pry directly into our resident operations.” To survive in this world, service providers will need a mixture of connectivity, hardware, software, and if you will, brainware, for the chance to win customers’ orders. “Would a supplier install instrumentation in our warehouse to watch inventories, or would they even take possession of our warehouse goods, until we actually need them?” asks Dasburg. “Sure, if the long-term need offsets the costs and intellectual property rights can be maintained.”

COUNTING BACKWARD FROM 4.0

Industry 4.0 — i.e., the fourth industrial revolution — has been readily defined and identified. The term itself is said to have been introduced in German manufacturing circles to bundle all that was happening in the digital world into a cohesive package for an advanced level of applied manufacturing and supply chain management. The semiconductor industry is perhaps the most advanced implementer to date. But closer to home, even the FDA appears on board, starting with its acceptance and actual promotion of moving from batch to continuous manufacturing. The key now is in connecting one smart factory to another smart factory and (yes, it is coming) a drug sponsor’s procurement and supply-ordering systems to a CDMO’s production line.

“Biopharma 4.0,” then, will pull from the following disciplines/ technologies: simple and complex automation, advanced manufacturing and processing technologies, machine learning, cloud computing, ERP systems, special application programs (SAPs), manufacturing execution systems (MESs), AI, and augmented reality (AR), and of course the largest descriptor of it all, the IoT. It will be built on the shoulders of the past three industry techolutions: simple mechanization (1.0), mass production (assembly) line capabilities (2.0), and applied computing and automation (3.0).

Some of this has in fact arrived. Biopharmaceutical manufacturing already includes machines collecting process and product data, and machines at one location are starting to connect with other machines via the — yet another term — Industrial Internet of Things (IIoT). Consider the “Big Data” we collect from equipment sensors and process analytical technologies (PATs). This manufacturing data is used to communicate and analyze what is happening “in process” and uses prescriptive data analytics to predict what happens in response to changes. Sanofi, for example, recently announced the building of a vaccine manufacturing plant in Toronto that will include advances in technology, automation, simplification, analytic methods, and work environment. This is part of what the company describes as an ambition to create a slew of digital factories. But again, to get to a full 4.0, the company would have similar facilities at external manufacturers as well, and all would be connected to Sanofivia cloud-based solutions and a blockchain-like network.

For his own company, Dasburg can envision a chain of communication something along these lines:

Drug sponsor procurement software/machine ► AZ blockchain for qualified suppliers ► CDMO order processing machine ► CDMO automated processing line ► data from processing back to AZ’s MES ► data on delivery to AZ fulfillment center ► And with all that communication going on and business being done …

HUMANS CAN RELAX

Will we biological beings have a role in this digital supply chain? Dasburg starts his reply broadly: “I’ve read in several years I won’t be holding a phone anymore because of devices in my ear that work through embedded computers in every room. Those computers will recognize me and know that I need certain information. The computers/ systems/machines will sort through all the communications that took place the day before — perhaps as many as 500,000 communications companywide — and present only those important to me for my role and position. It will all be processed via AI overnight.”

He continues: “Today we are at the same point as jet fighters. The limiting element of a tactical fighter plane and its mission is the pilot. She can’t take too many Gs and slowly processes only so much information. We have limited ability to communicate fast enough; we are the emerging biologic-limiting condition of our biobiopharma operations. We already recognize this as we use instrumentation in our batches to make processing decisions every day that are far too risky to calculate manually or to “eyeball.” Now think of our drug supply chains spread throughout the world and the increased speed we need today to make supply decisions. People can’t act fast enough to keep up with the decision making in the supply chain, especially today when zero inventory is the goal, personalized medicine the trend, and financials must drive so much of operations decision making and outsourcing.”

BIOTECH REALITY CHECK FOR TECH

We’ve come to the part of the “future” article where we usher in our reality check — or the “as things stand today” homily. Here you will meet the CEOs of two biotechs, the first organization a bit more established than the second, for added perspective. Marilyn Bruno leads Aequor, a California-based company with a platform of natural marine products that produce new chemical entities controlling bacterial contamination and infection. Maria Maccecchini heads Pennsylvania-based QR Pharma, a specialty pharma company developing novel treatments for Alzheimer’s, Parkinson’s, and other neurodegenerative disorders.

Bruno very much appreciates the discussion above. She also knows bigger biopharma companies are fortunate to have been able to afford Industry 3.0 and now plan pathways to 4.0. She says it’s exciting, but “Aequor, like many early-stage companies, in fact operates closer to Industry 1.0 or 2.0. on a practical level.”

Industry 4.0 utilization of CDMOs in custom drug production seems far down the road from where Aequor operates. “Frankly,” Bruno says, “the CROs and CDMOs for discovery and development we contract with have their own closed, in-house data systems, sometimes not even aligned with the formats required by most regulatory authorities. They rarely have systems compatible with each other, making even fundamental data management for regulatory trials a challenge.”

However, considering Bruno’s background — over 35 years in international management, finance, trade, and law; experience as a stock and commodity broker on Wall Street; and having served in the U.S. Foreign Service as an economic officer — it’s no wonder her real focus on 4.0 is on how it all gets financed. “What we certainly can foresee clearly is that we’ll need plenty of money if we were to participate in this future scenario of 4.0 for manufacturing.”

I’ve purposely kept discussion of dollars to a minimum to this point. Bruno now makes the appropriate interjection. Besides wondering how biotechs like Aequor will afford 4.0 technologies, she questions how requisite investments will be made by the CDMOs participating in this supply chain of the future. Big Pharma’s pushing — and paying for — its techolution is one thing, but getting your CDMOs to invest? Or to even become financial partners in this tech transformation? Dasburg did point out that to do so would be a competitive advantage to external partners vying for biopharma business, but still, how do they get there?

Bruno actually has an idea for the service providers. “One way CROs and CDMOs could attempt to help themselves is by lobbying their legislators for tax credits and other types of incentives for R&D and the development, for example, of new drugs to address unmet needs — such as antimicrobial resistance (AMR). This could help move the needle in technology and science at the same time. Australia could be a model. It has been offering these tax credits, and its service providers are in fact benefiting.” Our industry, politicians, and most importantly patients, she adds, are looking for “new heroes to address the threat of AMR. Perhaps there is a tech, funding, and scientific nexus here.”

Unfortunately, the current state of affairs, according to Bruno, was downgraded when “Big Pharma walked away from developing new anti-infectives, citing comparatively low ROI.” Did this have anything to do with outdated technologies? Either way, she says, when potential outside investors see this exodus of Big Pharma, they, too, walk away, “leaving micro companies to compete for a low number of public funding opportunities and grants, and these grants don’t include IT upgrades. Instead, government incentives could be directed to the service providers specifically for their modernization to facilitate specifically working with micro companies. New technological opportunities for advancing cooperation and partnerships in advanced areas might at least serve as a boost to moving us all closer to a 4.0-like environment.”

As for QR Pharma CEO Maccecchini, she also enjoys the discussion Dasburg has introduced into our contract development and manufacturing world. To her, what we are doing is reaching far into the past as well as the future for real perspective on the whole picture of manufacturing and contract manufacturing in particular. “And if Aequor operates closer to 1.0 or 2.0,” she says, “QR Pharma is a sub-1.0 company.” She explains that when the company was formed in 2008 and started working with material obtained from the inventor, “It turned out that a) it was about 30 percent pure, and b) some batches were something else totally. The manufacturing process resembled more the work of an alchemist mixing liquids and solids on a burner.” QR Pharma turned to external sources for help with cGMP material to conduct animal tox studies, file an IND, and start Phase 1 human studies. “And, we had to start from scratch,” she adds.

Maccecchini located two contractors who could manufacture the material under cGMP. Each manufactured a new batch; even though both batches had the requisite purity levels, they also contained different impurities. Somehow QR Pharma found its way forward in this admittedly low-tech scenario. Currently, Maccecchini says they have had three progressively larger batches synthesized: “They were all manual, and at best 1.0.” The problems with automation at this early stage, she says, are multiple, and include biotechs facing the potential of negative results “that would kill the project,” neither the CDMOs nor the biotechs having the financial means to upgrade the process, and the smaller sponsors that work with CDMOs having little or no incentive to automate.

Following on Bruno’s comments about pharmas moving away from anti-infectives, and therefore, VCs being reluctant to invest further, Maccecchini says the same is true for Alzheimer’s and Parkinson’s disease. “In the last 20 years, every Phase 3 study testing a drug that may slow the progression of neurodegenerative disorders has failed. Why would QR, a micro company, know better? So while medium to large service providers may consider upgrading their systems to 3.0 or 4.0, the small CDMOs who manufacture our 5 kg of cGMP material don’t even consider it.”

So we’ve learned this from Dasburg at bigger pharma and Bruno and Maccecchini at small and micro biotechs: On the one hand, we have a vision of the 4.0 supply chain very much starting to clarify and in some areas near realization. On the other, the remnants of a lower-tech survival- mode model persist for some biotechs. Let’s hope we can improve on both ends in 2019.

NOTE: Darren Dasburg has moved on from AZ to pursue an entrepreneurial future in patient-centered biotech.