Billions Of Dollars In CDMO Secondary Packaging Of Biologics

By Louis Garguilo, Chief Editor, Outsourced Pharma

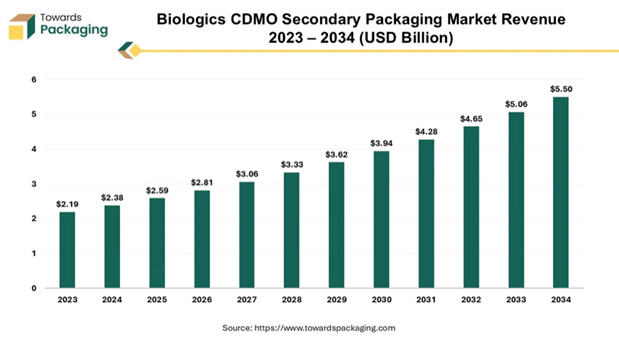

In February, a report was released projecting the biologics CDMO secondary packaging market could rise from $2.59 billion this year to USD $5.50 billion by 2034. That’s an annual growth rate of 8.75%.

Projecting so far into the future, as I habitually stipulate when quoting such lengthy extrapolations, is, ahem, subject to revisions.

That, though, does not cast shadows on the data or analysis upon which this projection is made, as we’ll detail momentarily.

But I did purposefully lead this editorial with the specific month the report came out this year.

Any market projection/analysis of a segment of our supply chain published prior to the April U.S. “tariff tantrum” inserts an extra dose of scrutiny.

Must everything marketwise, you may ask, be blanketed by of our time of tariffs?

Only time will tell.

As I dared to explore earlier, there’s even the possibility today’s tariff tiff may lead to relatively quick resolutions of trade barriers, offering the potential for positive supply-chain outcomes.

For now, though, the Trump administration has undoubtedly instilled the possibility of complications across our global supply chains.

But with that, perhaps conversely, we should consider market analyses like the one we are about to pursue and that were released prior to April of this year can offer additional value.

These reports become our benchmarks; vehicles to help measure through the coming months and years short- or long-term tariff influences on our market segments.

Which brings us back to secondary packaging services at CDMOs.

Expanding Packages And Services

Deepa Pandey, Principal Consultant at Towards Packaging and author of the report at hand, says the prognosis for the rapid development in the secondary packaging market is “driven by the increasing demand for biologic drugs, the growing importance of temperature-sensitive packaging, and the evolving healthcare landscape.”

The “Biologics CDMO Secondary Packaging Market Research Insight” report reminds us the biologics sector of our industry – vaccines, monoclonal antibodies, gene therapies, etc. – require specialized packaging solutions to ensure safety, stability, and efficacy.

Tariffs or no tariffs, do we believe these fundamentals will change? I don’t think we do.

For those less familiar with the term “secondary packaging,” forgive me for not defining earlier.

Secondary packaging refers to the outer layer of protection that enhances product safety during storage and transportation.

“It plays a crucial role in protecting these sensitive drugs from contamination, temperature fluctuations, and transportation damage,” says Pandey.

“For biologic drugs, which are highly sensitive to temperature changes, this packaging becomes even more crucial. CDMOs play a pivotal role in designing, testing, and implementing specialized packaging solutions tailored to industry regulations and market demands.”

And CDMOs performing secondary packaging for biologics are “experiencing unprecedented expansion.”

“Pharma and biotechs have agreed partnering with these external partners is cost-effective, compliant, and offers innovative solutions,” says Pandey. CDMO solutions include cartonization, labeling, tamper-proof packaging, and cold chain solutions—ensuring these life-saving medications reach patients safely and effectively.

A Quick Look At The Market

Of the projected growth suggested by the above chart from the report, here are some interesting segmentations:

- North America dominated the market in 2024, accounting for the highest share, attributed to the well-established pharmaceutical sector and stringent regulatory standards. North America’s investment in R&D and drug development is fueling the demand for high-quality packaging solutions; in the U.S. and Canada there’s increased demand for biologic drugs, personalized medicine, and temperature-sensitive vaccines.

- Asia Pacific is expected to grow at the fastest rate, fueled by increasing investment in pharmaceutical infrastructure and healthcare advancements. However, Asia Pacific is expected to register the highest CAGR over the forecast period. “Government initiatives, investments in pharmaceutical manufacturing, and growing healthcare infrastructure are key drivers of market expansion.”

- China, Japan, India, and South Korea particularly are witnessing rapid advancements in biopharmaceuticals, and they are producing cost-effective packaging solutions, “making them attractive hubs for pharmaceutical outsourcing.”

- Boxes emerged as the leading segment by type in 2024, given their ability to store bulk quantities of biologic products, such as vaccines.

- Ampoules led the (primary) market in 2024, owing to their sterile and temperature controlled nature – ideal for sensitive biologics.

- Leading secondary packaging CDMOs mentioned in the report include: WuXi Biologics; FUJIFILM Diosynth Biotechnologies; Samsung Biologics; Thermo Fisher Scientific; and Rentschler Biopharma.

- There certainly are more providers, and with this projected growth, others will enter the market. For now, says the report, these biggest providers continue to innovate, and expand to meet demand.

Wrap It Up As An Evolution

Deepa, author of the report, says an important driver of industry growth is automation. “It’s playing a critical role in the evolution of biologics secondary packaging.”

Likewise, she asserts, smart packaging solutions, such as temperature-sensitive indicators, RFID tracking, and real-time monitoring systems, are becoming increasingly prevalent and advanced.

“Both AI and smart packaging technologies enhance supply chain transparency and improve the efficiency of pharmaceutical logistics,” she says.

Of this future for biologics secondary packaging in CDMOs, Pandey concludes “it’s brimming with opportunities.”

As biopharmaceutical companies continue to innovate and expand – and they will – the need for specialized packaging solutions will grow exponentially.

As for those specialty packagers and CDMOs providing services and products, those companies investing in high-tech solutions such as smart sensors and digital tracking are certain to gain a competitive edge.

And as you might expect but should be highlighted, the outsourcing of all packaging services to CDMOs is on the rise, and these external providers are offering new and varied cost-effective as well as regulatory-compliant solutions.

We are still a long way from a $5.5 billion market. Tariffs and who knows what could potentially knock us off that trajectory. But again, the underlying fundamentals are solid.

This report, and others like it, are great benchmarks of a very specialized segment of our industry. Don’t keep them locked away in a box.