U.S. Pharma Tariffs And MFN In 2026: Manufacturing And Procurement Impact

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

U.S. trade actions announced in October 2025 — most notably a proposed 100% tariff on imported branded or patented pharmaceuticals — created a structural risk for global pharma supply chains, especially for clinical comparators, finished dosage forms, and patented components. At the same time, the Trump Administration pursued Most Favored Nation (MFN)-style pricing commitments that linked tariff relief to price cuts for specific channels such as Medicaid and cash-pay programs.

Entering 2026, the key change is not a rollback of tariff risk but a policy path that reduces exposure through accelerated U.S. manufacturing investment and pricing agreements that provide tariff exemptions. This paper integrates the 2025 tariff framework with late‑2025 and 2026 developments and translates them into actionable procurement and outsourcing responses.

Policy Baseline (2025): Tariff Design And Exposure

In October 2025, U.S. policy signaled a 100% tariff on imported branded or patented pharmaceuticals unless companies were actively building U.S. facilities, with generics exempt and a capped tariff (~15%) applied to certain EU- and Japan‑sourced products under a trade deal.

The U.K. and Switzerland were described as fully exposed in the base scenario, with Singapore also flagged for branded drug exposure. These conditions introduced immediate budgeting uncertainty and a longer-term incentive to move finishing, packaging, and release activities into tariff-protected jurisdictions or the U.S.1,2,3,4,

What Changed In Late‑2025 To 2026: The “Manufacture-In-U.S.” Acceleration

Into late 2025 and early 2026, the strongest observable shift has been the pace and scale of announced U.S. manufacturing expansions. Several large multinationals publicly committed multibillion‑dollar U.S. investment programs, explicitly tied to supply resilience and tariff risk.

Beyond announced capital programs, 2026 reporting shows the administration linking tariff outcomes to negotiated pricing-and-investment packages. Johnson & Johnson stated it reached a voluntary agreement to improve access and lower costs for certain U.S. patients, along with the construction of two new U.S. manufacturing facilities (North Carolina and Pennsylvania), and received tariff exemptions for relevant products.8,9 AbbVie similarly announced a multiyear agreement involving U.S. price reductions, large-scale U.S. investment commitments (including manufacturing expansions), and exemptions from tariffs and future pricing mandates.10

In parallel, February 2026 policy developments expanded the administration’s leverage beyond tariffs and manufacturing commitments, with PBM reforms under the Consolidated Appropriations Act 2026 increasing rebate transparency and pricing accountability across the distribution channel, further tightening the operating environment for branded drug pricing.11

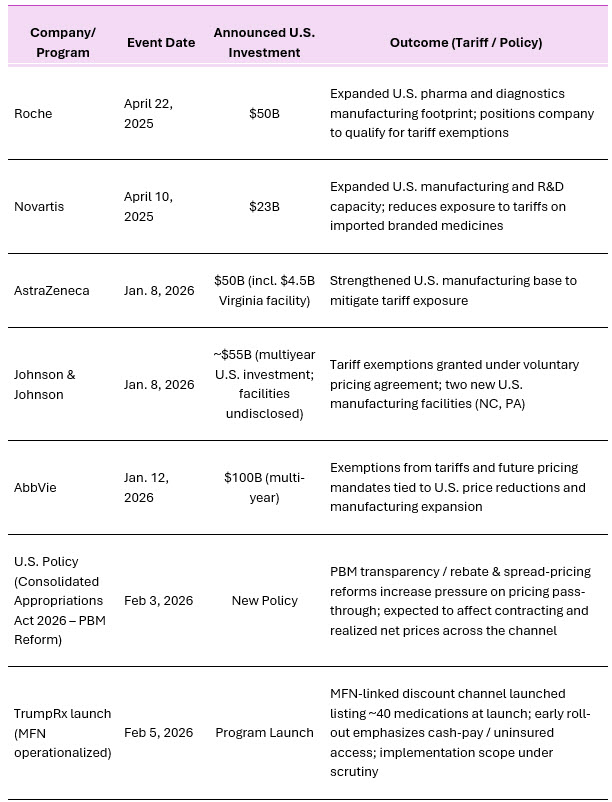

Table 1 includes major U.S. manufacturing investments and related pricing or tariff agreements announced by leading pharmaceutical companies during 2025-2026.

Table 1 - Major U.S. Manufacturing Investments and Tariff-Related Outcomes (2025-26)

Source: Company Website 5,6, Reuters 7, Financial Times

MFN Pricing As A Parallel Lever - And Why It Matters For Supply Chains

While the 2025 tariff design primarily targets imported branded/patented products, early‑2026 reporting highlights an accompanying strategy: encourage or require companies to offer lower U.S. prices (often described as aligning with prices in other wealthy nations) in exchange for tariff relief. Reuters described multiple deals of this form, with implications for launch sequencing and global price corridors.9,10

In February 2026, the launch of TrumpRx.gov operationalized this approach as a limited MFN-linked discount channel for cash-pay and uninsured patients, further linking tariff exposure to pricing program eligibility.12

For supply chain leaders, the key insight is that tariff risk and MFN-linked pricing are not independent. When pricing commitments become the “route” to tariff exemptions, the commercial model can directly influence manufacturing footprint decisions - pushing companies to localize U.S. production for operational certainty while simultaneously protecting margins through channel-specific price programs.

Value Chain Impacts (Sponsors, CROs, CDMOs, Central Labs)

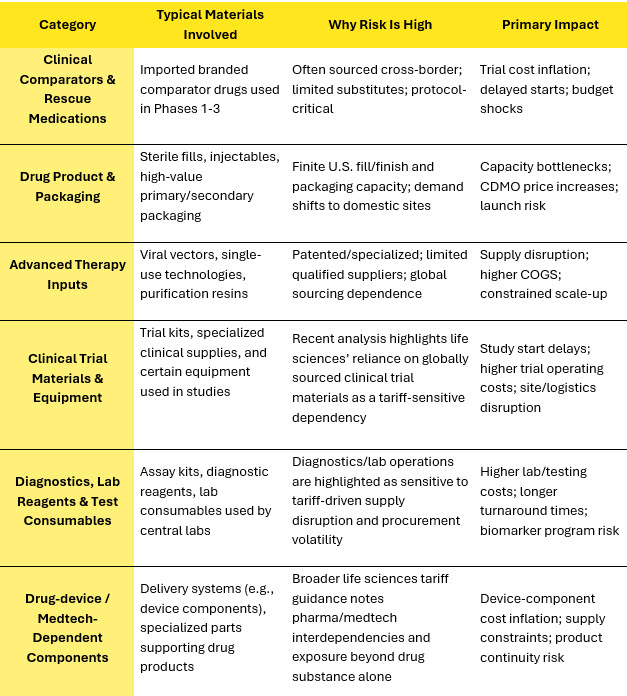

The original 2025 value-chain assessment remains directionally robust: tariffs (or tariff risk) propagate through R&D, clinical, regulatory, and commercial operations, with outsourcers inheriting exposure via comparator drugs, investigational materials, and specialized patented inputs. Table 2 shows the highest-risk categories across the pharma value chain under U.S. tariff exposure.

Table 2: High-Risk Categories Across Pharma Value Chain Under U.S. Tariff Exposure

Source: Beroe Analysis, Company Websites , Reuters7, Financial Times

Procurement And Outsourcing Playbook For 2026

Based on the 2025 framework and 2026 developments, the highest-leverage actions are:

- SKU-level exposure mapping: track branded vs. generic status, country of origin, and finishing/release site for all trial and launch-critical materials.1

- Exemption evidence: require written supplier attestations for exemption eligibility and tariff classification; treat exemptions as product-level, not company-level, unless explicitly confirmed.1

- Capacity strategy: reserve U.S. (and cap-protected EU) fill/finish, packaging, and release testing capacity early; add dual-sourcing for critical consumables and comparators.1

- Tariff/MFN clauses: insert tariff triggers and pricing-policy change clauses into CRO/CDMO/master service agreements to cap pass-through and enable sourcing reroutes.

- Scenario budgeting: stress-test portfolio economics under 0%, ~15%, and 100% cases, including a branded generics ambiguity case until final guidance clarifies classification.1

- Pricing & policy governance: define ownership and controls for MFN programs and PBM reforms to prevent tariff or pricing savings from eroding due to eligibility gaps or contract misalignment.12,13

Conclusion

Late‑2025 and 2026 developments indicate that tariffs remain a strategic constraint, but the industry is increasingly responding via accelerated U.S. manufacturing localization and negotiated pricing-and-exemption packages. For sponsors and outsourced partners, the operational priority is to treat tariff risk as a permanent governance requirement - mapped at SKU level, contractually managed across the supplier network, and integrated with capacity planning for U.S. finishing and packaging.

As MFN-linked programs and PBM reforms become operationalized, pricing assumptions must also be actively governed to prevent eligibility gaps, contract misalignment, or loss of expected pricing benefits.

The winners will be organizations that convert compliance uncertainty into supply resilience through disciplined procurement controls and early capacity reservation.

References:

- M. Ilancheran, “100% U.S. Drug Tariffs: Implications for Pharma and Outsourcing,” Beroe Inc., 2025. Available: https://www.clinicalleader.com/doc/the-effects-of-most-favored-nation-drug-pricing-on-clinical-trial-management-0001

- New York Times, “Trump Tariffs Could Raise Drug Prices, Spur Manufacturing Moves,” Sep. 26, 2025. Available: https://www.nytimes.com/2025/09/26/health/trump-tariffs-drug-prices-manufacturing.html

- Reuters, “Britain would face 100% tariff on pharmaceuticals under latest Trump plan,” Sep. 26, 2025. Available: https://www.reuters.com/business/britain-would-face-100-tariff-pharmaceuticals-under-latest-trump-plan-sources-2025-09-26/

- Financial Times, “EU and Japan secure tariff cap deal with U.S. on branded drugs,” Sep. 2025. Available: https://www.ft.com/content/62e92784-1811-4a26-b8a3-1e48ec04f787

- Roche, “Roche to invest USD 50 billion in pharmaceuticals and diagnostics in the US,” Apr. 22, 2025. Available: https://www.pharmabiz.com/NewsDetails.aspx?aid=177487&sid=2

- Novartis, “Novartis plans to expand its US-based manufacturing and R&D footprint… total investment of $23B over next 5 years,” Apr. 10, 2025. Available: https://www.novartis.com/us-en/about/investing-americas-health

- Reuters, “AstraZeneca names insider Rick Suarez head of US biopharmaceuticals unit,” Jan. 8, 2026. Available: https://www.reuters.com/business/healthcare-pharmaceuticals/astrazeneca-names-rick-suarez-head-us-biopharmaceuticals-unit-2026-01-08/

- Johnson & Johnson, “Johnson & Johnson Reaches Agreement with U.S. Government…,” Jan. 9, 2026. Available: https://www.jnj.com/media-center/press-releases/johnson-johnson-reaches-agreement-with-u-s-government-to-improve-access-to-medicines-and-lower-costs-for-millions-of-americans-delivers-on-u-s-manufacturing-and-innovation-investments

- Reuters, “J&J strikes deal with US government to cut drug prices, gain tariff exemptions,” Jan. 9, 2026. Available: https://www.reuters.com/business/healthcare-pharmaceuticals/johnson-johnson-reaches-deal-with-us-government-lower-drug-prices-2026-01-09/

- Reuters, “AbbVie to cut drug prices, pledges $100 billion for research,” Jan. 12, 2026. Available: https://www.reuters.com/legal/litigation/abbvie-us-reach-agreement-cut-drug-prices-2026-01-12/

- Mintz, “Congress Passes Landmark PBM Reform in 2026 Spending Bill,” Feb. 6, 2026. Available: https://www.mintz.com/insights-center/viewpoints/2146/2026-02-06-congress-passes-landmark-pbm-reform-2026-spending-bill

- Pharmacy Times, “TrumpRx Launches, Offering Cash-Paying Patients Discounted Drugs,” Feb. 5, 2026. Available: https://www.pharmacytimes.com/view/trumprx-launches-offering-cash-paying-patients-discounted-drugs

About The Author

Mathini Ilancheran is a research manager, R&D, at Beroe Inc. She is an expert in procurement intelligence and industry analysis, specializing in strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 37+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.

Mathini Ilancheran is a research manager, R&D, at Beroe Inc. She is an expert in procurement intelligence and industry analysis, specializing in strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 37+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.