U.S. Bone Repair Devices: Trochanteric Grip Market Stalls, Cerclage Cables Take Off

By Kamran Zamanian, Ph.D., iData Research Inc.

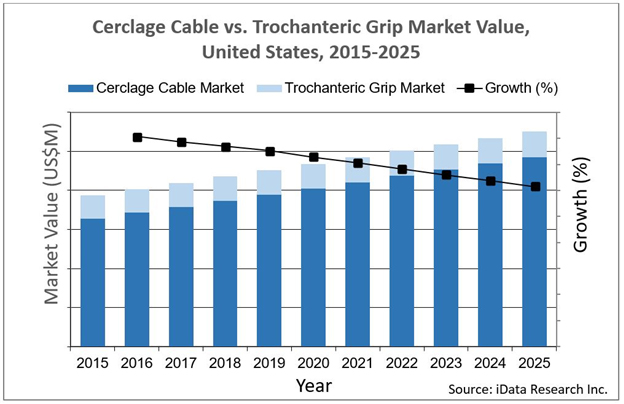

Approximately 75,000 procedures were completed in 2018 using cerclage cables and trochanteric grips, devices used in the repair of broken or surgically altered bones. This procedure volume is increasing every year, although that entire growth is in the cerclage cable market. This U.S. market growth has been relatively steady in recent years, primarily due to the continually aging population.

the repair of broken or surgically altered bones. This procedure volume is increasing every year, although that entire growth is in the cerclage cable market. This U.S. market growth has been relatively steady in recent years, primarily due to the continually aging population.

Aging Population and Osteopenia/Osteoporosis

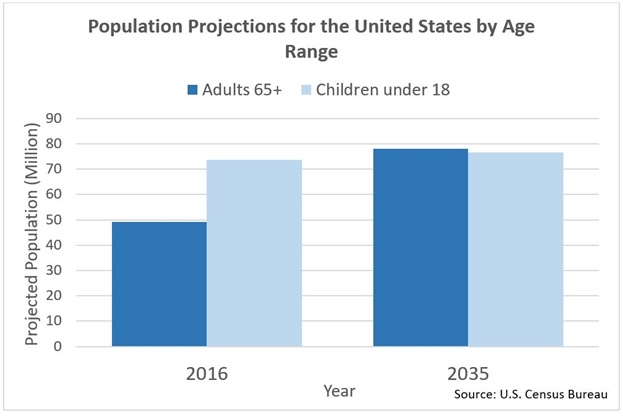

As life expectancy continues to rise, the elderly population in the U.S. continues to rise. The U.S. Census Bureau projects that the elderly population in the United States will increase by over 50 percent by 2035, reaching 78 million. This is in comparison to a mere 13 percent increase in the overall U.S. population by 2035.

For the first time in U.S. history, the elderly population is projected to outnumber the under-18 youth population, with elderly individuals accounting for 21 percent of the overall population by 2030. Therefore, the prevalence of conditions that affect the elderly, such as osteopenia and osteoporosis, will see a concurrent rise and increase the need for these trauma devices.

When osteopenic/osteoporotic bones are fractured, it can be extremely difficult to achieve a stable bone implant construct with a traditional plate-and-screw combination, as the holding power of the construct is substantially decreased. Cerclage cables can be used to hold bone plates in place, increasing the stability of the construct and allowing for proper fracture healing.

Growth in the U.S. cerclage cable market can be attributed to an aging population whose care demands total hip arthroplasty (THA) and total knee arthroplasty (TKA) procedures more than ever previously reported. Along with increasing THA and TKA volume comes the unfortunate reality that a certain percentage of procedures result in periprosthetic fractures. In these cases, cerclage cables and trochanteric grips can be used to treat the fracture, as screws and nails are generally contraindicated in these situations.

A number of major competitors are benefitting from this market growth, as well as some newer competitors who are bringing novel technology into the market.

Growth and Innovation in Cerclage Cables

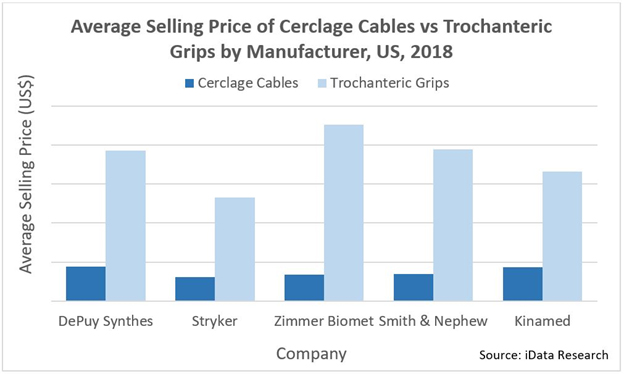

DePuy Synthes and Zimmer Biomet are the cerclage cable market’s major competitors. DePuy Synthes’ cable system offers an ergonomic, compact instrument, designed to be compatible with DePuy Synthes plates. With DePuy Synthes being the largest competitor in the plate-and-screw market, it stands to reason that the associated cerclage cables are sold in high volume. DePuy Synthes is likely to remain a top competitor in this market in the long term, despite commanding a higher price compared to competing products.

Zimmer Biomet’s Cable-Ready system is also a well-known cable with high sales volume, as is Stryker’s Dall-Miles cable system. With an abundance of research behind its clinical success, and product prices that are below the market average, Stryker has seen success in gaining market share.

Cerclage cables are generally made from metal, including all cables produced by these major competitors. The downside to metal cerclage cables is that metal cables can fray, leading to the release of metal debris, soft-tissue irritation and, potentially, breakage, which can harm the patient and/or cause wire-stick injury to the surgical team. Cerclage cables can also strangle blood vessels nourishing the bone, reducing blood supply and inhibiting fracture healing.

Smaller competitors have entered this market, offering alternative solutions that may address issues surrounding metal cable use. Kinamed introduced its SuperCable system in 2003. This cable is made from nylon and ultra-high-molecular-weight polyethylene (UHMWPE) material, creating a flexible cable with a fatigue strength higher than metallic cables.

For years, Kinamed was the only company to offer a non-metal cerclage cable, allowing it to obtain a significant market share despite the device’s premium price (compared to the average selling price in the cerclage cable market). However, in recent years, other companies have risen to challenge Kinamed.

In 2015, DSM Biomedical received FDA clearance for its Dyneema Purity radiopaque cerclage cable. While this cable is also made from UHMWPE, it has the advantage of being radiopaque, allowing visualization before and after surgery. Additionally, in 2017, Arthrex received FDA clearance for its FibreTape cerclage cable (also made from UHMWPE).

Trochanteric Grips and Stalled Growth

A major use of trochanteric grips is in femoral osteotomy procedures, where the bone is cut, reshaped, and realigned. The use of trochanteric osteotomies in THA has decreased, and the trochanteric grip market has seen a concurrent stall in market growth.

However, the variety of trochanteric osteotomy procedures, along with trochanteric grip usage in trochanteric fracture and periprosthetic fractures, enabled this market to only marginally decrease. These products have also been able to keep a premium pricing level due to the implants’ complexity, rendering the market flat.

In the trochanteric grip market, Zimmer Biomet’s Cable-Ready Greater Trochanteric Reattachment System holds the highest market share, despite also having the highest average sale price. Zimmer Biomet’s system is followed by Stryker’s Dall-Miles Trochanteric Grip and DePuy Synthes’ Trochanteric Reattachment Device. As in the cerclage cable market, DePuy Synthes commands a higher price than the market average, while Stryker is priced below-average.

Overall, the cerclage cable market is seeing growth, accounting for the majority of procedure volume increases in bone repair, while the trochanteric grip market remains stagnant. This poses an opportunity for innovators, as well as a warning to those focusing efforts on trochanteric grips. As with any changing market, future players’ success will depend on those ready and willing to take advantage of new technology while pivoting from the old.

About the Author

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the medical market research industry.

About iData Research

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries.

References

Trauma Devices Market Analysis, Size, Trends | 2019-2025 | MedSuite, iData Research