Top 3 Trends Affecting The Dental Implants Market In 2021 And Beyond

By William Guo and Kamran Zamanian, Ph.D., iData Research Inc.

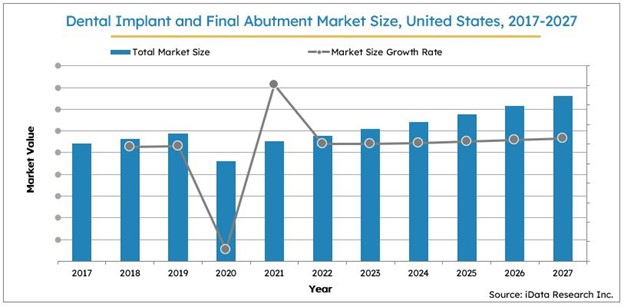

Dental implants have increasingly become the preferred treatment for edentulous individuals as practitioner expertise and supporting technology around dental implants continue to advance. More than 3 million implants were placed in the United States in 20191 before the COVID-19 pandemic forced a market-wide downturn in 2020. Nonetheless, the market for dental implants is expected to make a sharp recovery within two years before continuing its historical growth trend of 6–7% year-over-year.1

supporting technology around dental implants continue to advance. More than 3 million implants were placed in the United States in 20191 before the COVID-19 pandemic forced a market-wide downturn in 2020. Nonetheless, the market for dental implants is expected to make a sharp recovery within two years before continuing its historical growth trend of 6–7% year-over-year.1

This growth will undoubtedly be spurred not only by an aging demographic that contributes to higher rates of edentulism within the population, but also by advancements in supporting technologies such as treatment planning software and surgical guides allowing for greater precision and implant reliability. Furthermore, the implant placement procedure is becoming increasingly commonplace for general practitioners (GPs) without highly specialized training. A broad set of dynamic industry trends will continue to drive exciting transformations within the dental implant market over the coming years.

Rise in General Dentists Placing Implants

The strongest secular trend driving growth in the dental implant market is an aging demographic in the United States, coupled with a growth in the population of dentists capable of performing implant procedures. The Census Bureau estimates that by 2030, people aged 65 and older in the United States will outnumber those aged 18 and under. Because older people usually suffer a greater degree of health ailments such as edentulism compared to younger people, this shifting demographic will contribute to an increased demand for dental implants. Dental implants have increasingly become the solution of choice for edentulous patients as the reliability, comfort, and aesthetics of implants have all improved greatly due to technological advancements.

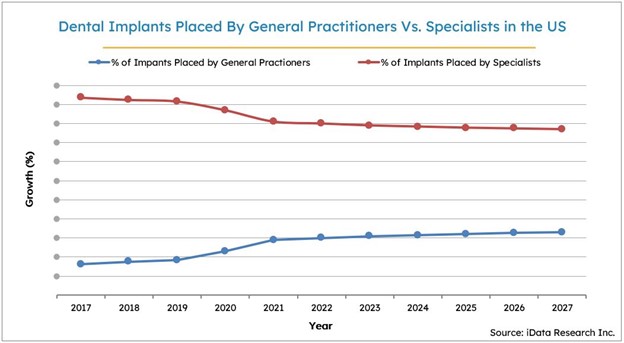

To address this growing demand, an increasing number of dentists have also begun integrating dental implant procedures into their practices. In the past, the complex implant procedure was largely limited to the purview of well-trained specialists such as oral and maxillofacial surgeons. However, recent developments in implant platforms and digital scanning technologies have lowered the barrier to entry, allowing for higher precision and a greater margin of error without sacrificing reliability. As a result, a growing number of GPs are now receiving supplementary training in implant dentistry to broaden their skillset.

Figure 1: Access the iData Research report to view more granular data.

Of the approximately 200,000 dentists currently licensed in the United States, almost 160,000 (about 80%) are GPs. The latest market study by iData Research1 shows that around 31% of all dental implants placed in 2020 were done so by GPs, which is expected to grow steadily over the next years. The forced shutdown of dental clinics in 2020 due the COVID-19 pandemic may also have contributed to an increased uptake in implant training among GPs, though these exact effects are yet to be measured.

Dental Practice Consolidations And Strategic Acquisitions

The dental implant industry has undergone a series of consolidations as the industry continues to mature. Established industry giants like Straumann Group, Envista (formerly Danaher), and Dentsply Sirona have become global market leaders in the premium implant segment. Over the past decade, each of the three companies have also performed a series of acquisitions and business mergers to expand their reach into the growing value implant market (the most notable of which are Neodent by Straumann Group, Implant Direct by Danaher, and MIS Implants by Dentsply Sirona). In the current stage of the industry life cycle, market movements will be dictated by strategies to pursue market share and profits rather than growth.

On the end-user side, the broader dental practice industry has also been consolidating into large dental service organizations (DSOs). The DSO model streamlines business operations of dental practices by outsourcing administrative non-clinical duties to experienced management teams. Additionally, the increased scale of group practice DSOs allows for greater negotiating power when securing bulk orders of items such as dental implants. These two factors together greatly reduce the material, general, and administrative costs of running a dental practice, which benefits the consumer. As a result, DSOs have greatly improved access to dental care for many Americans over the past decade.

Due to the attractive value proposition of DSOs to all parties involved (dentists, dental supply companies, and consumers), DSOs have received significant investor attention from private equity funds. Many industry insiders predicted that 2020 would be a major year for DSO transactions before the COVID-19 pandemic stalled many potential deals. However, given the sharp rebound in capital markets supported by aggressive fiscal and monetary policy, the DSO market could once again be ripe for a flurry of corporate transactions in 2021.

Value Implant Segment To Demonstrate the Highest Growth

As the competitive landscape for the dental implant market becomes more defined and avenues for innovation narrow, the remaining major players in the market will continue to pursue strategies to compete on price. The previously mentioned acquisitions of value implant brands by major players in the industry is the most evident example of this shift. While the saturated premium implant market has little room to grow, the technologies found on premium implant systems have trickled down into the value implant market, creating strong value propositions for price-conscious consumers.

The inflow of consumers into the value implant segment over the premium segment is compounded by weak economic conditions following the pandemic-induced recession of 2020. The value implant segment is poised to experience the strongest growth in the dental implant fixture market at an annualized rate of over 10% by 2027.1 Coupled with the growing presence of GPs in the implant market, the bargain of lower-cost value implants represents an attractive entry point for a large (and growing) portion of the market that implant manufacturers can leverage into higher-margin premium implant systems or supporting products.

Dental implant companies are already using such strategies, with instrument kits being included as complimentary add-ons to bulk orders of implants, and initial subscriptions to treatment planning software bundled with the purchase of digital scanners at no additional cost. As the pace of technological innovation in the market slows, business models will have to evolve to extract the greatest degree of value possible.

Expect Pent-Up Demand For Implant Procedures Following COVID-19

Figure 2: Access the iData Research report to view more granular data.

The COVID-19 pandemic and subsequent forced business closures ground all dental implant procedures to a halt in early 2020. As dental clinics across the country began to reopen in the latter half of 2020, dentists reported a large volume of pent-up demand for implant procedures, which is a promising indicator for a strong market recovery.2 Industry leaders remain confident in their respective companies’ market positioning and expect the market to recover pre-pandemic sales by the end of 2021 or early in 2022 before resuming previous growth targets. Note that given the nature of dental implant procedures, the recovery of the final abutment market will lag several months behind that of the dental implant market. Similarly, due to the nature of pre-purchased software subscriptions, the market for treatment planning software experienced a smaller drop than others and will recover faster.

Conclusion

Although the U.S. dental implant market has reached the maturity stage of its industry life cycle, there are still many exciting developments and opportunities ahead. The largest driver of growth in this market for the foreseeable future will be the growing user base of edentulous patients needing implants, serviced by a growing number of dentists trained in implant dentistry. Established implant manufacturers will continue to expand their portfolios to include robust value implant systems, while DSOs will help to extend their reach to previously underserved segments of the market. While the COVID-19 pandemic has presented challenges for manufacturers and practitioners alike, the market is poised to make a strong recovery and continue its trend of modest growth over the next six years.

References

- “US Market Report Suite for Dental Implants and Final Abutments with COVID19 Impact” (2021), iData Research.

- Envista 2020 Q2 Earnings Conference Call.

About the Authors

William Guo is a research analyst at iData Research. He has been involved in the global research of dental implant and bone graft substitute markets, publishing the reports on the U.S. market.

William Guo is a research analyst at iData Research. He has been involved in the global research of dental implant and bone graft substitute markets, publishing the reports on the U.S. market.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers their clients to trust the source of data and make important strategic decisions with confidence.