The Top 3 Trends Driving Demand For Patient Monitoring Equipment

By Kamran Zamanian, Ph.D., iData Research Inc.

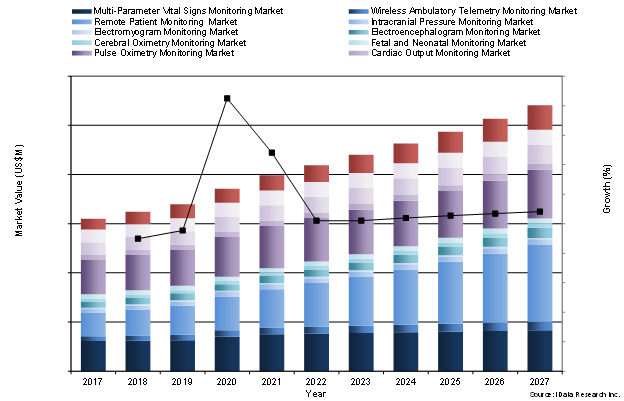

Patient monitoring equipment is a central component of every hospital’s workflow. Before the market experienced disruptions caused by the COVID-19 pandemic, the total U.S. market for patient monitoring equipment was valued at approximately $6.7 billion. Due to a sharp increase in demand for monitoring equipment in the diagnosis and treatment of COVID-19, this number has only risen during the pandemic and is expected to grow at a mid-single-digit rate through 2027. Among the fastest growing markets in this space are remote patient monitoring, temperature management, and electroencephalogram (EEG) monitoring.

Beyond the temporary spike in demand caused by the COVID-19 pandemic, the patient monitoring equipment market is also expected to grow at a moderate rate for the foreseeable future driven by an aging demographic, which contributes to further complications requiring monitoring solutions. Improved connectivity in monitors will also be a significant growth driver for this market as hospitals move toward integrated monitoring solutions to improve accessibility and analysis of patient data. Finally, technological advancements in various patient monitoring equipment markets will also drive growth as in-demand new features command higher selling prices.

Figure 1: Patient Monitoring Equipment Market by Segment, U.S., 2017-2027

Access iData’s U.S. patient monitoring equipment market report to view more granular data.

Trend 1: Demographic Growth

The strongest secular trend driving growth in the patient monitoring equipment market is an aging demographic in the United States. The Census Bureau estimates that by 2030, people aged 65 and older in the United States will outnumber those aged 18 and under.1 Heart disease is the leading cause of death in the United States, accounting for over 600,000 cardiovascular fatalities each year. Because older people usually suffer a greater degree of health ailments like heart disease compared to younger people, this shifting demographic will contribute to an increased demand for monitoring solutions to diagnose, track, and treat health issues. This trend holds for most markets related to patient monitoring but especially for those related to heart disease, such as blood pressure, cardiac output, and certain segments of remote patient monitoring.

Trend 2: Improved Connectivity And Remote Monitoring

Monitors being released today are typically equipped with connectivity features, such as the EarlyVue monitor from Philips and the CARESCAPE vital signs monitors from GE. Monitoring solutions in other markets (such as remote cardiac implantable devices, electromyogram (EMG) monitors, fetal and neonatal monitors, pulse oximetry monitors, and blood pressure monitors) are also incorporating this feature. Some personal-use blood pressure monitors are also offering smartphone connectivity capabilities for users to obtain readings, store results, analyze trends, and share data with their healthcare providers. The better connectivity and accessibility of data has spurred heavy investment in adjacent markets as well, such as the data analytics and artificial intelligence space. In 2020, Medtronic announced a series of acquisitions in the data analytics and AI space, including the British data analytics company Digital Surgery, French spinal implant manufacturer Medicrea, and U.S.-based Ai Biomed Corp.2 This series of acquisitions is indicative of a greater industry movement toward shared data streams and advanced data analytics, with demand in each market being mutually reinforced by the other.

In the same vein as improved connectivity, telehealth/remote patient monitoring has taken the spotlight as the fastest growing market within the overall patient monitoring space. In fact, this market is expected to grow from representing just under 20% of the total patient monitoring market in 2020 to nearly 30% in 2027. This rapid growth is partly spurred by the sharp increase in demand for in-home (or out-of-hospital) monitoring solutions due to the COVID-19 pandemic and the desire to minimize social contact and disease transmission vectors. However, the remote patient monitoring market has been on a secular growth trend since well before the pandemic because of its numerous advantages in patient access and reduced cost. The COVID-19 pandemic has only accelerated this trend, and the double-digit growth in this market is expected to continue well into the future.

Trend 3: Technological Advancements

There is a great deal of innovation in the patient monitoring space. In terms of vital signs monitors, these advancements include data streaming, touch screens, and compatibility with magnetic resonance imaging (MRI) machines. With regard to remote monitoring solutions, technologies are becoming more efficient, effective, and safe to use. Improvements in and the increased availability of wireless data transmission networks will facilitate the development of platforms for telehealth and remote monitoring. In various other markets like fetal/neonatal monitoring and cardiac output monitoring, there is an increased focus on the use of less invasive and non-invasive monitoring techniques. Such products include the Argos monitor from Retia Medical, with its ease of use and interoperability with existing vital signs monitors. As various patient monitors become more advanced and carry more features, they will naturally command a higher average selling price and greater clinical demand.

COVID Impact

The COVID-19 pandemic has impacted various parts of the patient monitoring equipment market differently. Some markets encompassing devices that are used in the diagnosis and treatment of COVID-19 (such as vital signs monitors and pulse oximetry and blood pressure monitors) grew significantly as hospitals purchased more equipment both to stockpile and for use in the treatment of COVID-19 patients. Other markets encompassing devices used as monitoring solutions in elective surgery (such as intracranial pressure monitoring, EMG monitoring, and EEG monitoring) shrank significantly as hospital resources were diverted toward fighting the pandemic. Regardless of the effect the COVID-19 pandemic had on each individual market, every market is expected to stabilize and return to historical forecasts by 2022.

Conclusion

Although most markets within the patient monitoring equipment space have reached the maturity stage of their industry life cycles, there are still many exciting developments and opportunities ahead. The largest driver of growth in this market for the foreseeable future will be the growing demand for patient monitoring solutions as the American population grows older and suffers from more health complications. Technological advancements in terms of accuracy and patient comfort, as well as connectivity and data analysis, will also be major growth drivers in this market for the foreseeable future. While the COVID-19 pandemic has presented challenges for some markets in the patient monitoring space, others have grown. In either case, the market is set to stabilize and continue its trend of modest growth over the forecast period.

About the Author:

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of dental and medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.