The Impact Of Market Restrictions On The U.S. Stem Cell Biomaterials Market

By Alycea Wood and Kamran Zamanian, Ph.D., iData Research Inc.

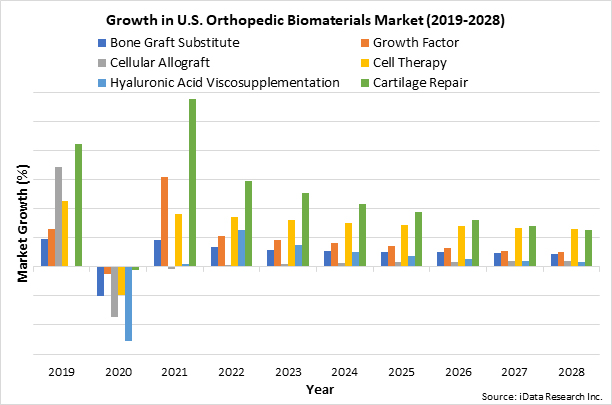

When choosing a treatment option for orthopedic procedures, biomaterials have become widely popular. Biomaterials are biomedical materials that can be safely implanted or injected into the body and are, more often than not, a form of biologically active tissue themselves.1 Their prevalence in orthopedic procedures is largely attributed to their ability to mimic the structure or properties of osseous tissue. Many products can offer a number of beneficial properties, such as promoting bone growth within the body (osteoinduction), promoting bone growth on the biomaterial’s scaffold (osteoconduction), or inducing the differentiation of stem cells into osseous tissue (osteogenesis).2,3 The orthopedic biomaterials market includes bone graft substitutes, growth factors, cellular allografts, cell therapy, hyaluronic acid viscosupplementation, and even cartilage repair devices. The U.S. orthopedic biomaterials market saw a dramatic dip and subsequent rebound in market value in 2020 and 2021 as a result of the COVID-19 pandemic. After recovery, the market is projected to see a consistently steady growth in value within the next few years. This growth is expected to be seen across all market segments apart from cellular allograft devices (Figure 1).4

Figure 1: Orthopedic biomaterials market growth trends by market segment, U.S., 2019–2028. Access iData’s U.S. Orthopedic Biomaterials report to view more granular data.

Cellular allografts may consist of either allograft bone (donated bone tissue) in conjunction with adipose-derived adult stem cells or viable cells within a cortical cancellous bone matrix.4,5 In both scenarios, the devices provide osteoconduction, osteoinduction, and osteogenesis to the site of implantation. Historically, this market had seen promising growth because of the optimal environment for bone growth they can provide.6 The cellular allograft market is projected to see a much slower rate of growth in market value in the next few years despite its market potential due to increased constraints on the market itself. These include, but are not limited to, direct federal restriction on product research, cost of product development, and product recalls.4

Federal Restriction On Stem Cell Research

There is a strong interest in the scientific community in embryonic stem cell (ESC) research, which is largely due to ESC’s high differentiability when compared to adult stem cell (ASC) lines.7 The development of new cellular allograft products, and the resulting growth in the market, is dependent on continued research into realizing the full medical potential of stem cell use. In 2019, the Trump administration eliminated federal funding of research relying on ESC tissue and instituted the National Institutes of Health (NIH) Human Fetal Tissue Research Ethics Advisory Board. This negatively impacted a large number of studies in progress while restricting the ability of new projects to commence.8,9,10 While the board was in effect, it rejected all but one application for funding.11 In April 2021, the Biden administration removed both the board and the restrictions on current projects, allowing federally funded research using ESC to continue.12 This was not the first instance where restrictions were placed and then removed on ESC research. In March 2009, President Obama signed an executive order to overturn the Bush administration’s restriction on ESC research.13

The repeated restrictions on ESC research have a number of long-term ramifications in the development and implementation of new, effective cellular allograft treatments. Scientists may need to divert their research efforts away from stem cells and into less turbulent fields, and the progress of product development slows down as studies have funding pulled; this may contribute to increased hesitancy by end users to use stem cell products. Reduced research efforts, funding, and faith in stem cell products will continue to limit the growth of the cellular allograft market.

High Development Costs

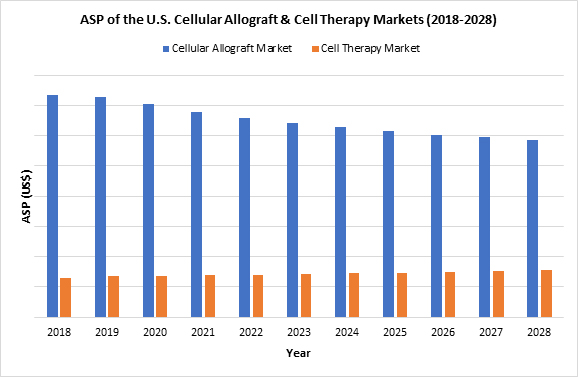

Cellular allografts tend to be notably more expensive than others within the broader cell-based biomaterials market. When compared to the cell therapy market, which uses either concentrated platelet-rich plasma (PRP) or bone marrow aspirate concentrate (BMAC) in its treatment, the cellular allograft average selling price (ASP) sits over three times higher (Figure 2).3

Figure 2: The average selling price (ASP) of the cellular allograft & cell therapy markets, U.S., 2018–2028. Access iData’s U.S. Orthopedic Biomaterials report to view more granular data.

The ASP of the cellular allograft market is so high because of the prohibitively expensive cost of developing new products. During the development process, reliable efficacy of a new product is uncertain, and using protein markers to help distinguish stem cell types can be very challenging.4,14 The increased cost of product development acts as a significant barrier to parties looking to enter the U.S. cellular allograft market. The result is fewer products entering and rejuvenating the market, and existing products sit at prohibitively high prices as they have low direct competition.4 The high cost of cellular allograft products hinders new entrants from introducing products and prevents end users from being able to afford existing ones. A broader consequence of this is end users turning to more affordable orthopedic biomaterial types to reduce procedural costs.

Product Recalls

Any product recalls within the U.S. orthopedic biomaterials market, especially within cell-based therapies, will negatively impact the use of cellular allografts. This impact is amplified when a recall occurs within the market segment itself, which was seen in the cellular allograft market as recently as June 2021. On June 2, 2021, Aziyo Biologics recalled its product FiberCel following a number of patients contracting tuberculosis.15 Recalls deter the use of cell-based products through increased distrust in the safety of the products themselves, potential public backlash against the specific product itself or, in the market more broadly, reduced reimbursement from health insurance providers as well as the introduction of more restrictive FDA protocols. This is another reason why effective, safe, cell-based products are necessary for the cellular allograft market to move forward.

Conclusion

Federal research restrictions, high development costs, and product recalls all negatively impact the growth of the cellular allograft market in the United States. These constraints contribute to the projected low growth rate in market value in the coming years despite the potential uses for stem cell therapies. To shift the tide back toward growth, the cellular allograft space will need consistent research progress through large-scale studies, more affordable product development, and strict enforcement of sanitization protocols for existing products to prevent future product recalls. The large therapeutic potential of stem cell therapy has been discussed extensively in scientific and popular literature, but it may take a while to realize it.

References

- Wang, M., & Duan, W. (2019). Materials and Their Biomedical Applications. In R. Narayan (Ed.), Encyclopedia of Biomedical Engineering. Elsevier. https://doi.org/10.1016/B978-0-12-801238-3.99860-X.

- Albrektsson, T., & Johansson, C. (2001). Osteoinduction, Osteoconduction and Osseointegration. European Spine Journal, 10, S96-S101. https://doi.org/10.1007/s005860100282

- Gilbert, S. F. (2000). Osteogenesis: The Development of Bones. In Developmental Biology (6th ed.). Sinauer Associates.

- iData Research Inc. (2021). U.S. Orthopedic Biomaterials Market – 2022. https://idataresearch.com/product-category/orthopedics/orthopedic-biomaterials/

- Mesenchymal Stem Cells. (n.d.). Nature Portfolio. Retrieved September 17, 2021, from https://www.nature.com/subjects/mesenchymal-stem-cells

- iData Research Inc. (2018). U.S. Orthopedic Biomaterials Market – 2019. https://idataresearch.com/product-category/orthopedics/orthopedic-biomaterials/

- University of Nebraska Medical Center. (n.d.). Stem Cells: Pros and Cons. https://www.unmc.edu/stemcells/educational-resources/prosandcons.html

- Reardon, S. (2019, June 5). Trump Administration Halts Fetal-Tissue Research by Government Scientists. Nature. https://www.nature.com/articles/d41586-019-01783-6

- Wadman, M. (2019, June 5). Trump Administration Restricts Fetal Tissue Research. Science Insider. https://www.science.org/news/2019/06/trump-administration-restricts-fetal-tissue-research

- Wadman, M., & Kaiser, J. (2020, July 31). Antiabortion Ethicists and Scientists Dominate Trump’s Fetal Tissue Review Board. Science Insider. https://www.science.org/news/2020/07/antiabortion-ethicists-and-scientists-dominate-trump-s-fetal-tissue-review-board

- Wadman, M. (2020, August 18). New U.S. Ethics Board Rejects Most Human Fetal Tissue Research Proposals. Science Insider. https://www.science.org/content/article/new-us-ethics-board-rejects-most-human-fetal-tissue-research-proposals

- Servick, K. (2021, April 16). Biden Administration Scraps Human Fetal Tissue Research Restrictions. Science Insider. https://www.science.org/news/2021/04/biden-administration-scraps-human-fetal-tissue-research-restrictions

- Rovner, J., & Gold, J. (2009, March 9). Obama Lifts Restrictions on Stem Cell Research. NPR. https://www.npr.org/templates/story/story.php?storyId=101653356

- Zakrzewski, W., Dobrzyński, M., Szymonowicz, M., & Rybak, Z. (2019). Stem Cells: Past, Present, and Future. Stem Cell Research & Therapy, 10, 68. https://doi.org/10.1186/s13287-019-1165-5

- Dyrda, L. (2021, June 14). Spine Allograft Recalled After 4 Patients Get Tuberculosis. Becker’s Spine Review. https://www.beckersspine.com/orthopedic-a-spine-device-a-implant-news/item/51983-spine-allograft-recalled-after-4-patients-get-tuberculosis.html

About The Authors:

About The Authors:

Alycea Wood is a research analyst at iData Research. She develops and composes syndicated research projects regarding the medical device industry, and published the U.S. Orthopedic Biomaterials report series.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.