The Asia-Pacific Region: A Hot Spot For Clinical Trials

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

Introduction

The Asia-Pacific region has become the hot spot for conducting clinical trials due to the ease of regulatory compliance, the low cost of conducting studies, a growing patient population, and the presence of a few top clinical institutions acting as sites. For example, the regulatory agencies in China are working toward an enhanced clinical trial process by reducing the overall review and approval process.1

the low cost of conducting studies, a growing patient population, and the presence of a few top clinical institutions acting as sites. For example, the regulatory agencies in China are working toward an enhanced clinical trial process by reducing the overall review and approval process.1

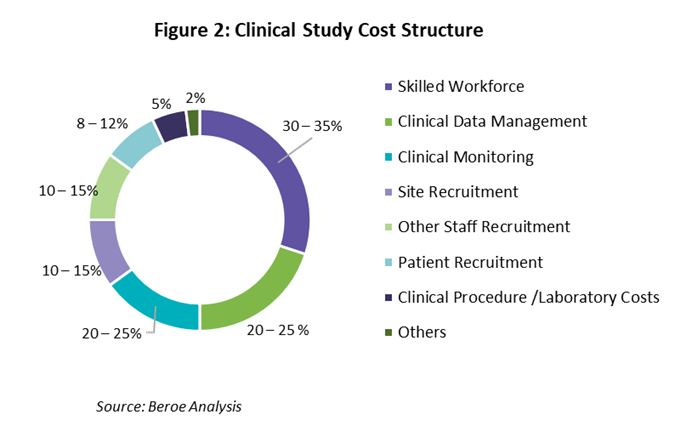

The clinical trial workforce contributes to around 30 to 35% of the overall trial cost. This makes FTE rates for clinical research a key parameter to consider. These rates are generally higher in the developed markets as compared to the Asia-Pacific region, which is why the latter is becoming an important location for conducting clinical trial studies. Also, the cost per patient across all therapeutic areas and phases is much lower in Asian countries than in developed markets.

Asia-Pacific CRO Market Overview

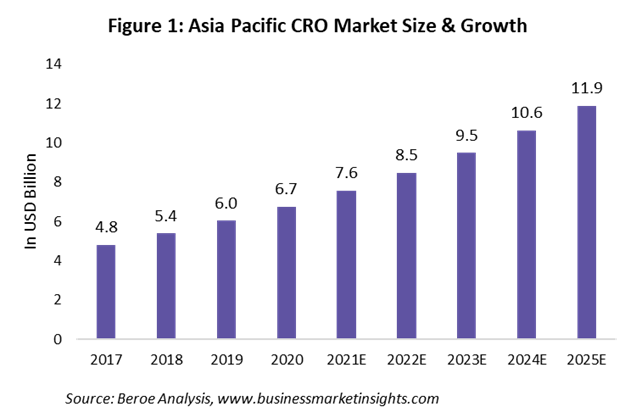

The Asia-Pacific CRO market is valued at approximately $7.6 billion as of 2021 and is forecast to reach $11.9 billion by 2025 (Figure 1). As a result of ease in regulatory approval, low FTE rates, availability of a large patient pool, and the presence of key suppliers, the APAC region is seeing a CAGR growth rate of 12% between 2017 and 2025.

The impact of COVID-19 spurred a digital revolution in the form of data mining, artificial intelligence, and Big Data technologies promoting data-driven diagnostics and digital health.2 This has caused around 65% of pharmaceutical activities to be outsourced to CROs, a number that is expected to reach 75% in the future. Along with this, the demand for innovative pharmaceutical products has put pharma companies under pressure to increase R&D spending to deliver these new products, while at the same time containing costs.3

With the workforce being the major cost driver in a clinical trial study, as shown in Figure 2 below, the lower FTE rates in APAC make it desirable for conducting clinical trials. However, labor rates vary across the Asia-Pacific region, with Australia and Japan having the highest FTE rates, followed by China, Hong Kong, and India. Malaysia and Philippines have the lowest FTE rates.

Also, the shift to performing clinical trials in developing countries has resulted in an increase in the necessary experience to conduct global trials in Asia. The skilled personnel receive training from global study staff, and the knowledge of ICH good clinical practice is being acquired across the region. International exposure among the staff means they can carry out clinical trials and use the results for EMEA and FDA submissions. Though in the past companies faced issues with quality and questionable ethics, this is changing with stringent regulations and oversight coming into place in developing countries. For example, South Korea adopted ICH-GCP in 2001, replacing its local legislation. In addition, there has been a decrease in official action-indicated notifications from FDA on-site inspections in most of APAC. This signifies the increased quality of data coming from these sites.4

Supply Market Trends

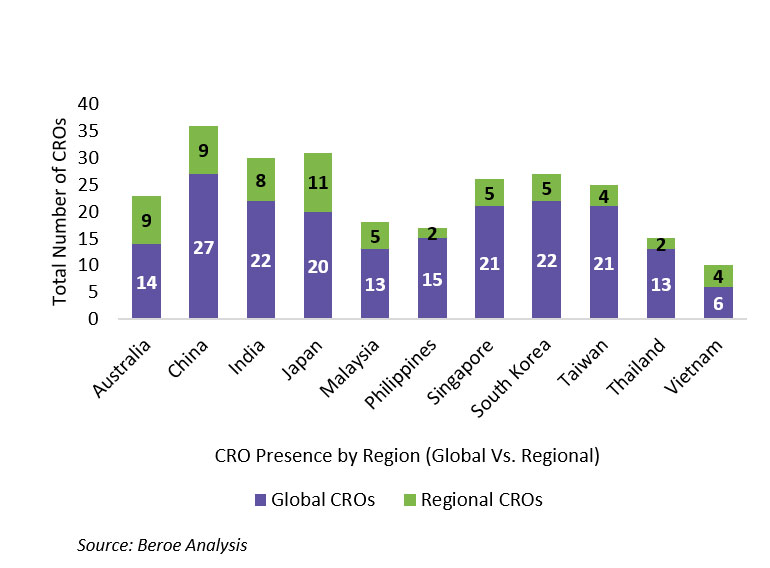

Global CROs like Covance, Icon, IQVIA, Paraxel, PPD, PRA, etc. have a very strong presence in Asia Pacific, with the service offerings across CROs having very few differences. Regional CROs have an equally strong presence, due to their local expertise. It is also estimated that regional players cost of operations are 20 to 40% less than the global ones, as they have lower overheads and are structurally less complex due to local decision-making; hence, they have greater efficiency. Key regional players like WuXi Apptec, Syngene, CMIC Group, TigerMed, and Lambda CRO have captured a good market share within their region of presence and have partnered with Big Pharma companies in their conduct of clinical trials.

Figure 3: Key CROs Having Presence In Asia-Pacific Region

Figure 4 below provides a view of the number of global versus regional CROs present in the APAC region. Based on our analysis, an average of 75% of the suppliers in a given APAC region are global players, whereas only 25% are regional players. Hence, for pharma to get the best of technology, resources, and local expertise, it is recommended they partner with a mix of global and regional players.

Figure 4: CRO Presence By Region (Global Vs. Regional)

Regulatory Landscape

The regulatory bodies in each country oversee the approval of clinical trials with the support of their national institutional review boards (IRBs). Table 1 provides a snapshot of the regulatory bodies overseeing trials across the Asia-Pacific region.

|

Table 1: Asia Pacific Clinical Trial Regulations |

|

Countries |

Regulatory Body |

Regulations |

|

Australia |

Therapeutic Goods Administration (TGA) |

Under TGA, ICH and ISO GCP standards are mandated in Australian clinical trials involving unapproved medicines and medical devices. Since Australia adheres to the highest level of GCP guidelines, its results are accepted internationally as well, by FDA and EMA. |

|

Bangladesh |

Directorate General of Drug Administration (DGDA) |

Clinical trials have to be conducted in line with the ethical principles that have their origin in the Declaration of Helsinki and are consistent with GCP and the other regulatory requirements. |

|

China |

State Food and Drug Administration (SFDA), National Medical Products Administration (NMPA) |

NMPA’s Center of Drug Evaluation (CDE) evaluates drug clinical trial applications, drug marketing authorization applications, supplementary applications, and overseas drug production re-registration applications. |

|

Hong Kong |

Drug Office - Department of Health |

For conducting clinical trials in humans, Hong Kong’s regulatory body requires a certificate for clinical trial/medicinal test, which is issued by the Pharmacy and Poisons Board. |

|

India |

Central Drug Standards Control Organization (CDSCO) |

The Drugs Controller General of India (DCGI) heads CDSCO and permits the conduct of clinical trials and regulates the sale and importation of drugs for use in clinical trials. |

|

Japan |

Ministry of Health, Labor and Welfare (MHLW), Japanese Pharmaceuticals and Medical Devices Agency (PMDA) |

Clinical trials in Japan are funded by companies that plan to obtain marketing authorization; investigator initiated clinical trials are also allowed and the grants are provided by national centers. |

|

Malaysia |

Ministry of Health (MOH) |

Malaysian regulatory bodies require Clinical Trial Import License (CTIL) for drugs imported into Malaysia and Clinical Trial Exemption (CTX) for drugs intended to be manufactured in Malaysia for clinical trial purpose or registration purpose. |

|

Philippines |

Department of Health (DOH) |

Clinical trials adhere to the highest ethical and technical standards and the final approval depends on IRB/ERB. |

|

Singapore |

Health Sciences Authority (HSA) |

Clinical trials in Singapore are funded by pharma companies, hospitals, medical technology companies, biotech companies, and government agencies, among others. Before initiating a clinical trial, approval from HSA and ethics approval from IRBs are necessary. |

|

South Korea |

Ministry of Food and Drug Safety (MFDS) |

The Pharmaceutical Affairs Act and the Bioethics and Safety Act govern clinical trials of medicinal products and medical devices, and the MFDS provides final approval to clinical trials. The trials have to be conducted under GCP guidelines. |

|

Thailand |

Food and Drug Administration of Thailand |

The Thai FDA controls the import of drugs for research purposes as well as indirectly regulating trials in humans. The approval for clinical trials is dependent on the approval obtained from both Thai FDA and its EC. |

|

Taiwan |

Taiwan Food and Drug Administration (TFDA) |

Clinical trials on humans are conducted under supervision of the Ministry of Health and Welfare and the TFDA, in accordance with the Subjects Research Act, the Medical Care Act, the regulations on human trials, the Human Biobank Management Act, the Pharmaceutical Affairs Act, and the guidelines for GCP |

|

Vietnam |

Drug Administration of Vietnam |

The Ministry of Health is responsible for clinical trial approvals, registration, oversight, and inspections and provides permission for clinical trials to be conducted within Vietnam. |

Conclusion

As a result of lower FTE rates, transportation costs, and regulatory fees, approximately 30 to 40% cost savings can be realized in trials conducted in the Asia-Pacific region in comparison to developed markets. Within Asia, the healthcare systems in Singapore, Taiwan, Korea, and Hong Kong are advanced, and many doctors in these countries have been trained in the U.S. or Europe. Due to the COVID-19 pandemic, investments have been made in leveraging digital platforms to avoid disruption in clinical trials, allowing physicians to monitor patients remotely in an efficient manner. With a favorable supply market – the strong presence of global CROs and regional CROs with local expertise – pharmaceutical companies see the Asia-Pacific region as an attractive market for conducting clinical trials.

References

1. M. Baruah, “China and the evolving regulatory landscape,” European Pharmaceutical Review, September 2019. [Online]. Available: https://www.europeanpharmaceuticalreview.com/article/98200/china-and-the-evolving-regulatory-landscape/. [Accessed February 2021].

2. BiopharmaTrend.com, “The Evolving Pharma R&D Outsourcing Industry: A Bird’s-eye View,” Biopharma Trend, February 2020. [Online]. Available: https://www.biopharmatrend.com/post/146-the-evolving-pharma-rd-outsourcing-industry-a-birds-eye-view/. [Accessed February 2021].

3. Brown Gibbons Lang & Company, “BGL Healthcare Life Sciences Insider,” August 2020. [Online]. Available: https://www.bglco.com/wp-content/uploads/2020/08/BGL-Healthcare-Life-Sciences-Insider-August-2020.pdf. [Accessed February 2021].

4. B. V. Nostrand and C. Tournerie, “How and Where to Conduct your Global Trials in APAC: A Regional Market Analysis,” Xtalks, June 2019. [Online]. Available: https://xtalks.com/webinars/how-and-where-to-conduct-your-global-trials-in-apac-a-regional-market-analysis/. [Accessed February 2021].

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on supply base optimization, risk reduction, innovation and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 35+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com and connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on supply base optimization, risk reduction, innovation and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 35+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com and connect with her on LinkedIn.