Patent Trial And Appeal Board Releases Updated Orange Book/Biologic Patent Study

By Amy C. Madl, Ph.D., and Jill K. MacAlpine, Ph.D.

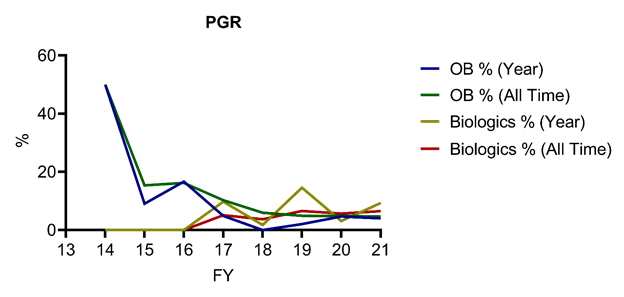

On Aug. 11, 2021, the United States Patent and Trademark Office (USPTO) published an update to its 2019 Orange Book (OB) patent/biologic patent study report, analyzing America Invents Act (AIA) post-grant proceeding outcomes for biologic patents and Orange Book‑listed patents between Sept. 16, 2012, and June 30, 2021. The updated study demonstrates that AIA petitions challenging Orange Book-listed and biologic patents represent a small and falling percentage of all petitions filed, with only 4% and 2% of all filed AIA petitions challenging Orange Book-listed and biologic patents, respectively (see Figures 1 and 2). Intriguingly, the percentage of inter parties review (IPR) petitions challenging Orange Book‑listed patents has taken a nosedive from a high of 7.9% (123 petitions) in FY15 to 0.2% (two petitions) in FY21 through June 30, 2021, while the percentage of IPR petitions challenging biologic patents has remained small but volatile over the studied period (1.6% for FY21 to date, down from a peak of 3.9% in FY17). Notably, challenges to Orange Book-listed and biologic patents make up a more substantial fraction (11.2%) of post-grant review (PGR) petitions filed between Sept. 16, 2012, and June 30, 2021, with significant year-over-year volatility but no clear upward or downward trend in number of petitions filed—likely due to the small number of PGR challenges to date (see Figure 3).

Figure 1

Figure 2

Figure 3

The decline in AIA petitions challenging Orange Book-listed patents tracks the decline in new Abbreviated New Drug Application (ANDA) case filings, which have fallen from a high of 479 case filings in 2015 to 102 in the first half of 2020.1 The parallel trajectories of ANDA case filings and AIA petitions for Orange Book-listed patents is consistent with the USPTO’s prior reporting that, between Sept. 16, 2012, and Nov. 30, 2018, 96% of challenged Orange Book-listed patents had concurrent district court litigation between the petitioner and the patent owner, with 90% of related AIA petitions filed during district court litigation. Similarly, new Biosimilars Price Competition and Innovation Act (BPCIA) case filings have been falling from a high in 2018, one year after the peak-to-date in AIA petition filings (FY17) challenging biologic patents.2 While BPCIA litigation is not as tightly connected to PTAB challenges as ANDA litigation, with only 46% of biologic patents with an AIA petition in concurrent district court litigation between Sept. 16, 2012, and Nov. 30, 2018, the downward trend observed in both forums suggests that PTAB challenges are neither displacing nor being displaced by district court litigation.

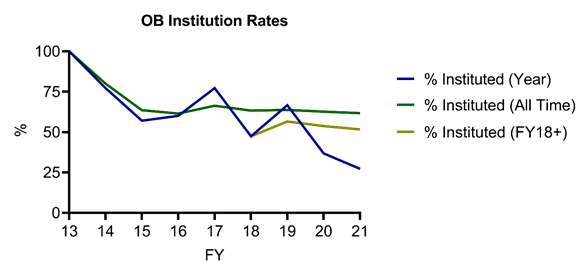

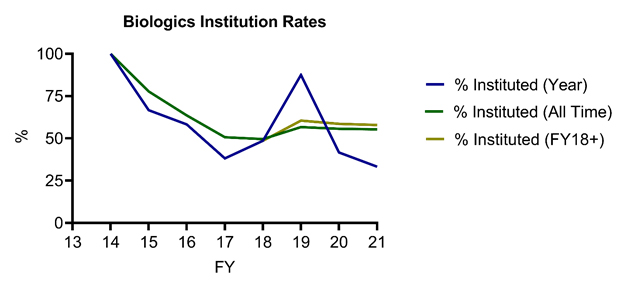

Furthermore, the USPTO’s study revealed below-average institution rates for petitions challenging Orange Book-listed and biologic patents (62% and 55%, respectively, compared to 64% for all technologies), potentially reflecting the relative strength of these patents. Notably, when joined and pending petitions are excluded, the USPTO reports an identical institution denial rate (41%) between Sept. 16, 2012, and June 30, 2021, for AIA petitions challenging Orange Book-listed and biologic patents, although the reported denial rate was higher on a patent basis for biologic patents (36%) compared to Orange Book-listed patents (32%). Of particular note for Orange Book patent owners, institution rates have been declining for petitions challenging Orange Book-listed patents in recent years, with only 52% of all such petitions instituted from FY18 and onward (Figure 4). Similarly, institution rates have been lower than the all‑time rate for biologic patents (with, for example, 42% and 33% of petitions instituted in FY20 and FY21-to-date) in recent fiscal years, with a large spike in institution rate (87.5%) in FY19 driving up overall statistics (Figure 5).

Figure 4

Figure 5

Once instituted, Orange Book-listed patents have fared better than their biologic counterparts. Of patents reaching a final written decision (FWD), all claims were found to be unpatentable in 70% of biologic patents (32 of 46 receiving an FWD), compared to 45% for Orange Book-listed patents (51 of 114 receiving an FWD). Furthermore, 26% of challenged claims and 59% of instituted claims were found to be unpatentable by a preponderance of the evidence for biologic patents, compared to 16% of challenged claims and 31% of instituted claims for Orange Book-listed patents. Moreover, disclaimer rates were higher for biologic patents, especially pre-institution, with 54 of 1,886 (2.9%) challenged claims disclaimed pre-institution and 21 of 832 (2.5%) instituted claims ultimately disclaimed. By contrast, 19 of 5,136 (0.4%) challenged claims in Orange Book-listed patents were disclaimed prior to institution, with 67 of 2,653 (2.5%) instituted claims disclaimed after institution.

These outcome differences may reflect the broader array of claims challenged in biologic patents, which, unlike Orange Book-listed patents, may cover metabolites, manufacturing methods, and packing. Illustratively, a prior analysis indicated that process and manufacture patents had the highest rate of instituted claims canceled (69%) among patent categories considered for IPR/PGR petitions filed on patents in Art Unit 1600 through May 31, 2019.3 Process and manufacture patents play a more significant role in biosimilar litigation than ANDA litigation as these patents may be asserted as part of BPCIA proceedings.

Strategy divergence may also explain some of these outcome differences. Settlement rates were higher for petitions challenging Orange Book-listed patents (23%) compared to biologic petitions (18%), although the settlement gap was smaller on a patent basis (16% for OB patents vs. 13% for biologic patents). Intriguingly, based on data presented in the 2018 Orange Book patent study report, settlement rates for petitions challenging Orange Book-listed patents have declined from 25% (68 of 268 outcomes) between Sept. 16, 2012, and Sept. 30, 2017, to 19% between Oct. 1, 2017, and June 30, 2021 (30 of 158 outcomes), possibly reflecting falling institution rates and generally favorable claim survival rates over the past nine years of AIA post-grant proceedings.

Conclusion

Although every patent and petition is unique, the 2021 Orange Book patent/biologic patent study report highlights trends that may assist both petitioners and patent owners in developing strategies for challenging and defending Orange Book-listed and biologic patents before the PTAB. Notably, biologic patent owners should be wary of a potential increase in PGR challenges going forward, as well as the relative disadvantage faced by biologic patent claims following institution. This disadvantage may be compounded in the PGR setting in view of the increased number of available unpatentability grounds, including Section 101 (subject matter eligibility) and Section 112 (written description) grounds. Moreover, biologic patent owners may see an increase in parallel district court litigation/PTAB challenges as the FDA begins to publish reference product sponsors’ biologic patent lists from BPCIA litigation in the Purple Book. These public patent lists, which were maintained under strict confidentiality prior to the passage of the Biological Product Patent Transparency Act in December 2020, may provide potential biosimilar applicants new insights into the patents that could be asserted against them in future litigation, as well as increased motivation to challenge such patents before the PTAB before seeking regulatory approval.

About The Authors:

About The Authors:

Amy Madl, Ph.D., is an associate at Finnegan, Henderson, Farabow, Garrett & Dunner, LLP (Finnegan) and provides strategic counseling on U.S. and foreign patent portfolios in the chemical, pharmaceutical, and biotechnology fields. She also assists in due diligence matters, pre-litigation investigations, and post-grant proceedings before the Patent Trial and Appeal Board of the U.S. Patent and Trademark Office.

Jill MacAlpine, Ph.D., is a partner and currently serves as the leader of the Patent Office Practice Section at Finnegan. She has extensive experience with strategic counseling, prosecution, and patent litigation matters, primarily in the chemical and pharmaceutical areas.

- Lex Machina Patent Litigation Report February 2020 (reporting 479 ANDA case filings in 2015); Pedram Sameni, Report: ANDA Litigation is Decline, IPWatchdog (Aug. 28, 2021), https://www.ipwatchdog.com/2021/08/28/report-anda-litigation-declining/id=137112/ (reporting 102 ANDA case filings in the first half of 2021 based on Patexia’s ANDA Litigation Intelligence Report).

- Joshua Whitehill & Jay Deshmukh, After Lull In Biosimilar IP Litigation, 2021 Could Bring Influx, Law360 (Jan. 7, 2021, 5:35 PM EST), https://www.kasowitz.com/media/3894/after-lull-in-biosimilar-ip-litigation-2021-could-bring-influx.pdf.

- Eric Steffe, Biopharma Patent Updates, Sterne Kessler (Oct. 25, 2019), https://www.sternekessler.com/sites/default/files/2019%20Focus%20on%20Pharma%20Conference/Biopharma%20Update%20for%20FoP.pdf.