Market Assessment: Neurovascular Thrombectomy In The U.S. And EU

By Sheryl Tang, GlobalData

Stroke is one of the leading causes of death globally, following ischemic heart disease1. The standard treatment for ischemic strokes is the administration of t-PA, a drug that works to dissolve the blood clot and re-establish blood flow. After several ground-breaking trials and generations of thrombectomy devices, thrombectomy procedures — physical removal of the blood clot — have been shown to provide significantly better patient outcomes when used in combination with t-PA, versus t-PA alone2 , for strokes resultant of Large Vessel Occlusions (LVO). These trials are one of the strongest drivers for countries to adopt this procedure as standard stroke treatment.

This article will explore the aspiration retriever market and the potential impact of Medtronic’s January release of its Riptide aspiration retriever system.

It is evident that aspiration retrievers will grow rapidly in the next 10 years, given strong clinical trial results, as well as advancing technology and techniques in the field. Based on recent procedural volume data, this section explores the high-, mid-, and low levels of adoption for two thrombectomy techniques in order to determine the overall market opportunity in the U.S. and five EU countries (France, Germany, Italy, Spain, and the UK).

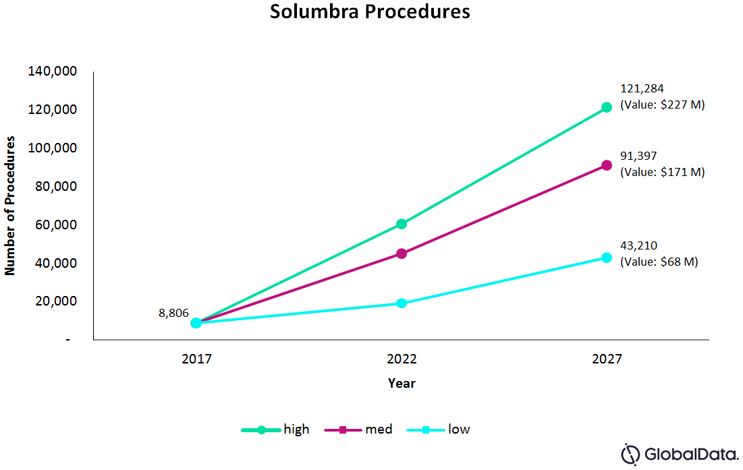

Market Analysis: Solumbra Procedures

The Solumbra technique utilizes a stent and an aspiration retriever simultaneously, with the original combination being Medtronic’s Solitaire FR and Penumbra’s reperfusion catheter. This ensures the removal of thrombus fragments during stent retrieval3.

Fig. 1 — Total number of SOLUMBRA procedures for the U.S., France, Germany, Italy, Spain, and the UK, combined

We estimate the total number of Solumbra procedures, in 2017, in the U.S. and five EU countries, to be 8,806. One of the main drivers of the Solumbra procedure is the general preference for stent retrievers, as the technology has existed longer and undergone many improvements. Furthermore, in Europe, there is widespread acceptance of using intracranial access catheters in conjunction with stent retrievers — a cheaper alternative than an aspiration retriever catheter. In low levels of adoption, this assumes that the Solumbra technique maintains its current presence in the field as being more effective than stent retrievers alone, growing at a Compound Annual Growth Rate (CAGR) of 17 percent, and making up 24 percent of all thrombectomy procedures by 2027.

Mid-level adoption rate estimates assume further improvements in catheter and stent retriever technology, and several more clinical trials showing the Solumbra technique’s effectiveness. GlobalData expects that, in mid-levels of adoption, the procedures will grow at a CAGR of 26 percent and comprise approximately 50 percent of all thrombectomy procedures by 2027.

High levels of adoption assume that, along with rapid enhancements in technology, multiple clinical trials will show the Solumbra technique as superior in achieving optimal patient outcomes safely and efficiently, compared to other techniques. This builds on the current preference for stent retrievers by a majority of specialists, and procedures could be expected to grow at a CAGR of 30 percent, making up 68 percent of all thrombectomy procedures by 2027.

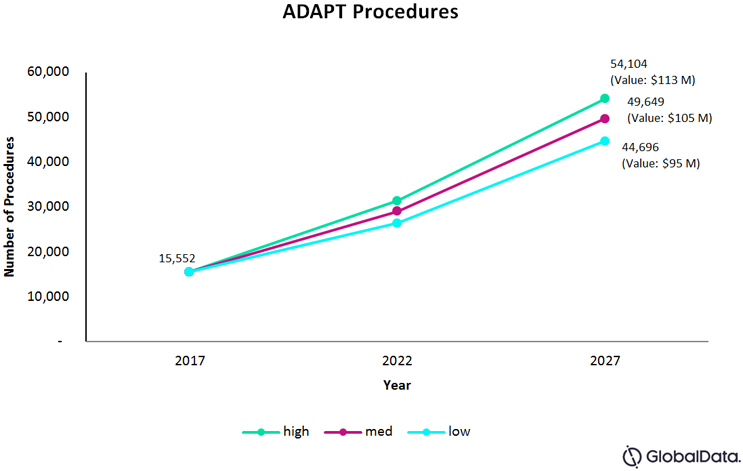

Market Analysis: ADAPT Procedures

The ADAPT technique involves the removal of the blood clot through aspiration alone. This approach has been shown to achieve effective and rapid revascularization, with significantly decreased procedure times compared to stent retrievers4. Furthermore, one study showed the ADAPT technique to provide significantly better clinical outcomes than the Solumbra technique5.

Fig. 2 — Total number of ADAPT procedures for the U.S., France, Germany, Italy, Spain, and the UK, combined

We estimate the total number of ADAPT procedures in the six previously discussed countries, in 2017, to have been approximately 15,552. Assuming that stent retrievers will continue to be the primary device of choice and aspiration technology remains fairly similar, the number of procedures will continue to follow the overall growth trends of thrombectomy at a CAGR of 11 percent, and make up 25 percent of all thrombectomy procedures by 2027.

The underlying assumptions in a mid-levels of adoption scenario are significant advancements in aspiration technology and stent retrievers, resulting in an increased preference for aspiration. The result is a CAGR of 12 percent, leading the procedure to make up 28 percent of all thrombectomy procedures by 2027.

Lastly, the high-level adoption scenario assumes significant advancements in aspiration technology, with newer players coming into the market, as well as a surge in positive clinical evidence of safety and effectiveness. Under higher levels of adoption, the number of procedures is expected to grow at a CAGR of 13 percent, making up 30 percent of all thrombectomy procedures by 2027.

Competitive Analysis: The Release of Medtronic’s Riptide Aspiration System

Medtronic’s Riptide Aspiration System is used with its existing Arc Intracranial Support Catheter to retrieve intracranial blood clots5. Prior to this release, Penumbra’s ACE was the only aspiration system FDA-approved for treating ischemic strokes.

Fig. 3 — (Left) U.S. stent retriever market shares for 2017; (Right) Aspiration retriever market shares for 2017 and predicted market shares for 2022

Medtronic’s Solitaire device has established a strong presence in the stent retriever market , possessing 62 percent of the market share in 2017. We believe that Medtronic can easily gain half of the aspiration retriever market share within the next five years for two key reasons:

- Medtronic’s strong presence in the stent retriever market and large portfolio of products in other medical device markets will prove advantageous in gaining a strong presence in the aspiration retriever market. This previously was demonstrated in the Peripheral Transluminal Angioplasty (PTA) Drug-Eluting Balloon market; Medtronic’s In.Pact Admiral was approved by the FDA in 2015 but claimed 50 percent of Bard’s market share within two years.

- The Riptide system is approved for use with their existing Arc catheter; intracranial support catheters generally cost less than Penumbra’s aspiration catheter. With the lower cost in disposables, this is a strength that will prove beneficial to Medtronic when competing against Penumbra’s ACE system.

Fig. 4 — (Left) EU (France, Germany, Italy, Spain, and the UK) stent retriever market shares for 2017; (Right) Aspiration retriever market shares for 2017 and predicted market shares for 2022

Riptide has not yet obtained CE-mark approval for use in Europe, but we expect this approval fairly soon. Currently, Medtronic still owns a significant portion of the stent retriever market, with its Solitaire retriever being the most preferred amongst specialists. Once Riptide is released in Europe, we believe Medtronic will be quick to sweep up a large portion of the aspiration retriever market, due to the same factors mentioned above: an existing presence in the stent retriever market, a large portfolio of products and established relationships within hospitals, and a system that is approved for use with a lower-cost intracranial support catheter.

Competitive Landscape Analysis: Neurovascular Accessories Market

The neurovascular accessory devices market should be monitored closely following the Riptide system’s release. Since the development of the Solumbra technique, countries in Europe have adopted the combination of intracranial support catheters and stent retrievers. Studies have demonstrated that using MicroVention’s SOFIA Catheter (of Terumo Corporation) in both the ADAPT and Solumbra techniques is safe and effective6.

Should the Riptide system be compatible with intracranial support catheters from other brands, such as the SOFIA catheter, Medtronic also will be competing against Terumo in the neurovascular accessories market. We expect the Terumo to maintain a strong position in the market, given the existing widespread use of the SOFIA catheter in Solumbra procedures.

Currently, the neurovascular accessories market is dominated by Stryker and Medtronic, followed by Penumbra and Terumo, though much of the share comes from microcatheters and microguidewires for neurovascular procedures. We believe that having an aspiration system compatible with the Arc catheter will boost Medtronic’s position closer to, or even surpassing, Stryker. Cross-compatibility also could result in Terumo gaining more market share, leaving Penumbra to fall below Terumo.

Conclusion

Advancements in technology drive continuous improvements in thrombectomy techniques.

Both the Solumbra and ADAPT procedures are expected to grow rapidly over the next 10 years, along with the overall thrombectomy market. Higher adoption rates will depend on clinical evidence of superiority, technological advancements, and new players on the market.

The competitive landscape is subject to change very rapidly, given the release of Medtronic’s aspiration system. Both Medtronic and Terumo will likely surpass Penumbra in different markets due to their existing presence within the neurovascular field through other product lines. The Riptide is evidence that, despite Penumbra’s ability to maintain a monopoly over aspiration retrievers, companies will now be able to enter the market with similar designs. We believe that, since Medtronic has developed an aspiration system compatible with their own intracranial support catheter, Terumo may be the next big player to enter this market.

About The Author

Sheryl Tang is a Medical Devices Analyst at GlobalData Healthcare with a focus on Cardiovascular devices. Her work includes the collection and analysis of quantitative and qualitative information to develop data products that forecast the characteristics of various cardiovascular device markets across the world. Sheryl’s research activities include speaking to industry leaders, as well as incorporating real-world data into data products, enabling her to have an in-depth understanding of the market.

Before joining GlobalData, Sheryl had various experiences in public health, including interning as a Community Health and Development analyst at Toronto Public Health. She has a Bachelor of Health Sciences from Western University and recently received a Masters of Public Health, which provides her with a strong understanding of the Canadian healthcare system and analysis of epidemiology data.

Sources

- World Health Organization. (n.d.). Global Health Observtory (GHO) data. Available at: http://www.who.int/gho/mortality_burden_disease/en/

- Minnerup, J. et al. (2016). Outcome after thrombectomy and intravenous thrombolysis in patients with acute ischemic stroke. Stroke, 47, 1584-1592. Available at: http://stroke.ahajournals.org/content/47/6/1584

- Kang, D. H. and Park, J. (2017). Endovascular stroke therapy focused on stent retriever thrombectomy and direct clot aspiration: Historical review and modern application. J Korean Neurosurg Soc. 60(3), 335-347. Available at: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5426444/

- Spiotta, A. M. et al. (2016). ADAPT: A Direct Aspiration First Pass Technique. Endovascular Today. 15(2). Available at: https://evtoday.com/pdfs/et0216_F7_Turk2.pdf

- Delgado Almandoz, J. E. et al. (2016). Comparison of clinical outcomes in patients with acute ischemic strokes treated with mechanical thrombectomy using either Solumbra or ADAPT techniques. J Neurointerv Surg. 8(11), 1123-1128. Available at: https://www.ncbi.nlm.nih.gov/pubmed/26667250

- Medtronic Newsroom. (2018). Medtronic receives FDA clearance for Riptide ™ aspiration system. Available at: http://newsroom.medtronic.com/phoenix.zhtml?c=251324&p=irol-newsArticle&ID=2326781

- Wong, J. H. Y, et al. (2016). Initial experience with SOFIA as an intermediate catheter in mechanical thrombectomy for acute ischemic stroke. Journal of NeuroInterventional Surgery. Available at: http://jnis.bmj.com/content/early/2016/10/27/neurintsurg-2016-012750.short?rss=1&utm_source=TrendMD&utm_medium=cpc&utm_campaign=JNIS_TrendMD-0