4K Operating Room Technology Advancing, Despite Initial Doubts

By Jesse Spicer and Kamran Zamanian, Ph.D., iData Research Inc.

Surgical visualization is a key tool in the operating room. While this technology has traditionally been used for diagnostic procedures that required endoscopy, it also has useful applications in minimally invasive procedures. As the minimally invasive approach continues to become standard procedure, demand for surgical visualization equipment will continue to rise.

procedures that required endoscopy, it also has useful applications in minimally invasive procedures. As the minimally invasive approach continues to become standard procedure, demand for surgical visualization equipment will continue to rise.

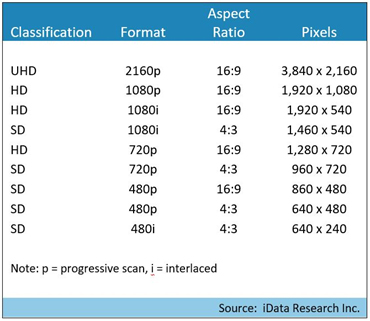

To achieve proper visualization of the lumen, a large array of medical devices is needed. An endoscopic tower typically houses all the hardware needed to produce an accurate video feed. This video equipment then is integrated with the rest of the equipment in the operating room using a high-tech router. As video resolution has progressed from standard definition (SD) to high definition (HD), the relevant hardware has been upgraded to accommodate the jump in signal complexity.

Initially, when 4K technology was proposed for the operating room, there was considerable skepticism whether the higher resolution capacity of 4K devices warranted the added cost. There was concern that the resolution of 4K exceeded what was perceptible by the human eye, depending how far the screen was positioned relative to the viewer. Compared to standard HD — which comprises about two million pixels — 4K, also known as Ultra High Definition (UHD), boasts well over eight million pixels. This upgrade in visual acuity is larger than any previous resolution enhancement and, consequently, demands the largest spike in information processing requirements.

However, the adoption rate of 4K technology in the operating room has experienced significant growth in the last few years. This growth initially came from partial system upgrades, where not all components of the surgical visualization system were upgraded to 4K. These upgrades allowed for upscaling from HD, but the resolutions achieved did not reach true 4K.

In the last two years, true 4K resolution technology has been embraced by the industry and clinical data has been reporting the benefits of this form of visualization in a variety of procedures.1 With true 4K, it becomes much easier to distinguish various pathologies while performing procedures, and the improved contrast and color gamut adds to greater clarity of the visual field. Larger surgical displays — exceeding the traditional >24” HD displays — can be used without a loss of detail, and can be placed closer to physicians, affording a superior view of the surgical landscape. True 4K displays also offer high dynamic range (HDR) technology, which delivers more visibility in darker areas.

What’s Slowing Growth In 4K Operating Room Technology?

Despite these benefits, full adoption of 4K technology requires a large investment. A primary limiter is the task of integrating the native 4K signal through a variety of distribution channels inside and outside the operating room. Streaming data, taking still pictures, recording footage, and transferring footage to the electronic health record (EHR) all require significant infrastructure to handle the load. All the hardware in this system must be able to accommodate the more burdensome 4K signal, and full 4K infrastructure has yet to be installed in many integrated operating rooms. The amount of data storage needed for electronic medical records (EMR) also is very large, requiring investments from hospitals to expand their network storage capabilities.

Another important limiter to market growth is the fact that not all integration vendors currently offer a full 4K product portfolio. The majority of the key video integration competitors — including Stryker, Karl Storz, Olympus, and Arthrex — offer 4K-ready integration components, image capture and recording capabilities, and surgical displays. When it comes to the last necessary piece of the puzzle, the surgical camera systems, only Olympus and Arthrex currently offer 4K products.

Arthrex was first to market, releasing the SynergyHD4 4K camera system in late 2014, and Olympus followed with the VISERA 4K UHD camera system in 2015. Stryker and Karl Storz have yet to release 4K camera system models, but are expected to do so in 2018 or 2019. The adoption rate of these 4K camera systems remains low, relative to HD camera systems, but unit sales are increasing at a very high rate. Once Stryker and Karl Storz release their 4K camera systems, unit sales will experience an additional spike, since these integration vendors have highly established client bases.

Manufacturers Flexing 4K Muscles In Orthopedics Community

4K technology recently was given the spotlight at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting in New Orleans, where a variety of vendors showed off their high-tech video integration setups. Stryker displayed its integrated operating room setup, featuring the AIM platform with a pair of large 4K displays. The 1588 AIM HD camera system includes five separate imaging modules, covering a wide spectrum of modalities, including Clarity, DRE, Desaturation, ENV, and IRIS. In the center of Arthrex’s booth, the company’s Synergy 4K surgical camera system was featured with premium TRUMPF surgical lighting and boom systems, all connected through a software-based platform. The setup was topped off with a single 70” wall-mounted 4K display.

Karl Storz prominently featured its 80” Collaborator 4K touchscreen wall-mounted display. This first-to-market screen is capable of displaying dozens of separate feeds, and it allows healthcare workers to drag and reorganize feeds using a touchscreen. The large display was connected to the company’s flagship HD camera system, IMAGE1 S, and outfitted with VITOM 3D, which offers surgeons the ability to expand the depth of field by using 3D glasses while performing procedures.

The significant real estate allocated to 4K visualization on the floor at AAOS 2018 serves as an indicator that 4K is here to stay, and it soon will become the standard of surgical video technology in the operating room. Initial doubts regarding the usefulness of 4K technology seem to be fading in some areas, and the continued adoption is bolstering growth in the total U.S. video and integrated operating room equipment market, which currently is valued at almost $2.3 billion.2

About The Authors

Jesse Spicer is an Analyst Manager at iData Research. He has been involved in numerous medical device market research projects over many years, including the Video and Integrated Operating Room Equipment studies, and now leads a team involved in that market and many others.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the world.

About iData Research

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries.

References