Green Is The New KPI: Sustainability In Pharma Outsourcing

By Jeffrey S. Buguliskis, PhD, Deputy Chief Editor, Outsourced Pharma

As a lifelong Philadelphia Eagles fan, I bleed green. Sure, it's a cliché metaphor, but one we take pretty seriously here in the City of Brotherly Love. However, that dedication doesn't just end on the gridiron when the game's over. The Eagles organization began its commitment to being “green” in 2003 with the opening of their new stadium and is now considered one of the most eco-friendly teams in the NFL (tied for 1st place with the San Francisco 49ers). For instance, the team purchases sustainable aviation fuel, has installed a hydrogen refueling station, as well as solar panels and wind turbines to power their stadium. Their stadium, Lincoln Financial Field, was awarded LEED platinum status in 2024 and became the first professional sports team to receive ISO 20121 certification, an international standard designed to help organizations integrate sustainability into management practices and processes.

Yet, the Eagles' commitment to sustainability isn't just about optics—it's about operational excellence that delivers measurable results while maintaining championship performance. This same principle is now reshaping the pharmaceutical outsourcing landscape. Just as the NFL measures yards gained and touchdowns scored alongside carbon emissions reduced, pharmaceutical companies are beginning to track environmental metrics with the same rigor they apply to quality and cost. The shift is happening faster than many realize, driven by investor pressure, regulatory signals, and the recognition that sustainable operations often correlate with efficiency gains. For Contract Development and Manufacturing Organizations (CDMOs), this means sustainability is evolving from a nice-to-have differentiator to a must-have qualification for winning and keeping business.

Across biotech and pharma, “green” is fast becoming a key performance indicator (KPI) that influences which CDMOs get the work and how those engagements are governed. And, while this isn't an article from the Sunday sports section, we have to wonder: if a football franchise can make sustainability part of its operations, then surely the life sciences industry can as well…right?

Sustainability Joins the Outsourcing Scorecard

The idea that environmental performance belongs alongside cost, quality, and speed is no longer theoretical. From RFP language to partner governance, sponsors are starting to ask CDMOs for concrete plans—and numbers—on energy, water, waste, and emissions. In reporting this piece, I spoke with Rajesh Krishnan, PhD, CTO of Sonoma Biotherapeutics, and Praveen Prasanna, PhD, senior director of external manufacturing at Verve Therapeutics, about what they see as changing on the ground.

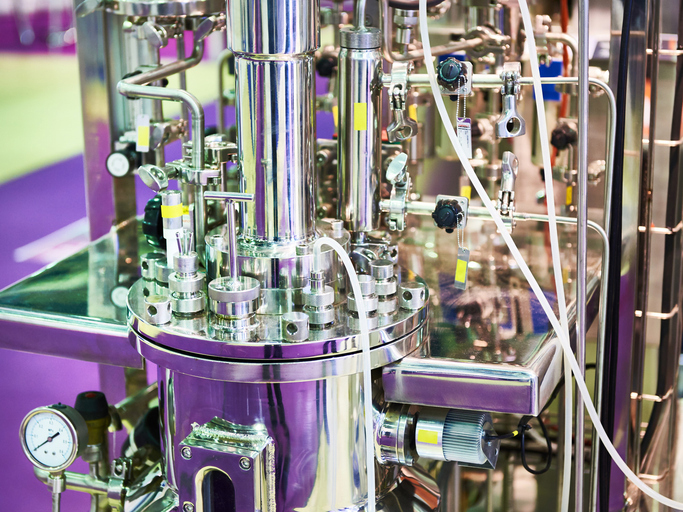

Krishnan frames sustainability expectations in two buckets: what’s required now versus what must at least be on the roadmap. “One sustainability initiative that we focus on is the capability to implement closed systems and ultimately continuous or automated production platforms which limit excessive biowaste, materials generation, and water/reagent usage,” he noted. “The platforms also reduce excessive labor requirements and reliance on manual operations, which in turn further reduce material and product waste, inefficient operating efforts, utility, and cost, by reducing performance variability due to human error.”

As sustainability moves from talking point to KPI, sponsors are asking CDMOs for hard numbers—not just promises. [EXTREME-PHOTOGRAPHER/Getty Images]

At the same time, Krishnan noted that sustainability readiness now factors into partner selection—even if specific features aren’t mandated on day one. “While neither is a mandatory feature for immediate collaborations, an absence of a plan to develop or evaluate these systems might constitute an outward search for other potential partnerships,” he explained.

Prasanna offers a candid reality check from the perspective of a fast-moving biotech. In early development, teams focus on solving technical problems and meeting timelines. Green improvements often come in “round two or three” once the core process is established. He also points to an uncomfortable truth: “We’re not a green industry.” That blunt assessment captures the gap between aspiration and execution—and why governance mechanisms, data, and practical engineering changes matter.

But what does this look like in practice? Transitioning from high-level commitments to measurable improvements necessitates targeted operational changes at both the process and facility levels.

Process and Facility Levers That Actually Move the Needle

The most immediate gains come from process choices that shrink the environmental footprint without compromising reliability or compliance. Emphasis on closed, connected operations is one example. With fewer open operations, a sponsor can run in less stringent room classifications and rely more on automation, reducing HVAC loads, labor, and error-driven scrap. These changes are measurable, including lower kilowatt-hours per lot, shorter time-in-suite, and reduced regulated biowaste. They also make it easier to scale without proportionally scaling energy demands.

Closed, connected operations can shift work into lower-grade rooms—shrinking energy use while improving consistency. [sergeyryzhov/Getty Images]

Supply chain decisions matter, too. Krishnan mentioned that his teams look for “supply chain solutions that leverage reusable and energy-efficient shipping and storage containers. Primarily, we aim to size containers, materials, and storage bags to match volumes of product output and the lowest energy-requiring conditions without jeopardizing the quality of the product or materials.” That may not seem like much, but right-sizing packaging and storage reduces both energy and material waste at scale.

Additionally, digging a little deeper and examining the “ethos” embedded in a CDMO’s design decisions for their buildings and utilities can often reveal whether sustainability is treated as operational or ornamental. For instance, facilities that reclaim water for non-critical uses, optimize HVAC control, or procure renewable electricity signal a posture that will be reflected in campaign-level metrics later. Those choices are not always in the brochure, so Prasanna recommends asking about them during diligence, which can often be revealing.

Solving One Problem Without Creating Another

While the aforementioned process enhancements deliver clear wins, the industry must also grapple with unintended consequences from previous 'improvements'—particularly in biologics and cell therapy manufacturing, where safety innovations have created new sustainability challenges. These manufacturing modalities quickly adopted single-use systems, and for good reasons—fewer cleaning chemicals, lower risk of cross-contamination, and faster changeover. But that shift created a different problem: mountains of single-use plastic that end up buried or burned.

“Use it new, use it once, because you don’t know how it’s going to perform the second time,” Prasanna explained, describing the industry’s cautious mindset about reusing shippers and components. The tension is apparent, and validated disposables helped solve contamination risk, but they’ve become a significant waste stream.

Reusable shippers and right-sized packaging reduce one-and-done waste without risking product integrity. [Serjio74/Getty Images]

Interestingly, cold chain is another hidden driver of footprint, from energy-intensive warehouses to one-and-done packaging. Here again, sponsors are starting to push for practical changes: durable, verified-for-reuse shippers; route optimization to shorten transit; and better matching of packaging to payload. The Sonoma Bio team, for instance, prioritizes right-sizing and energy-efficient storage. That translates into less dry ice, less insulation, and less over-boxing—without jeopardizing product quality.

None of this is easy, however. Sponsors must balance sterility, validation, and comparability against greener substitutions. But the direction of travel is unmistakable. The most credible progress occurs when sustainability is integrated into the process and logistics—not added on at the end.

Data and Governance: From Slogans to Scorecards

As sustainability moves from a talking point to a KPI, the question becomes: What do you measure and how do you verify it? Sponsors increasingly want facility-level data, not just corporate averages, so that programs can be compared on a like-for-like basis. Common asks include energy use per lot, solvent recovery percentage, kilograms of regulated waste per batch, percentage of onsite renewable power, and carbon dioxide equivalent (CO2e) per lot for shipping lanes. Site audits and third-party validation can determine the accuracy of metering and dashboards.

Facility-level metrics—kWh per lot, solvent recovery, waste per batch—turn green goals into accountable governance. [SCShutter/Getty Images]

The notion of “mandatory vs. roadmap” is helpful for governance. This way, a sponsor can set baseline asks—such as quarterly reporting of energy, water, and waste for campaign runs—then layer in stretch items like continuous manufacturing or renewable procurement that become contract milestones over time. CDMOs that can quantify improvement year over year will separate themselves. Those who cannot will increasingly find themselves having to justify their position.

One seemingly complementary tool that sponsors could utilize is to provide contracting that ties sustainability progress to real incentives. Improvement targets, bonus-malus structures, and remediation plans can make green KPIs more than a slide in the quarterly business review (QBR) deck. The key is to make the data a valuable tool for decision-making on both sides. For example, suppose a partner can demonstrate that closed operations reduce time-in-suite by 25% and decrease biowaste by a specific number of kilograms per campaign. In that case, it becomes easier to share the value and continue improving.

So, What Should Be Prioritized Now?

If “green” is truly becoming a KPI in outsourcing, what should sponsors be on the lookout for when selecting an outsourcing partner?

- Require a plan—and proof. Ask for a written sustainability roadmap with timelines and interim milestones. In RFPs and MSAs, specify expectations for closed/connected operations, evaluation of continuous options, and improvements to shipping and storage efficiency. If a partner can’t show a plan or recent progress, keep looking.

- Prioritize enabling technology. Give weight to CDMOs that can run closed processes in lower cleanroom classifications, recover and recycle solvents where feasible, right-size primary and secondary packaging, and use renewable power at key sites. These capabilities lower the footprint and often reduce operating costs.

- Demand metered data, not slogans. Set facility-level reporting requirements at the campaign level: kWh per lot, kilograms of regulated waste per batch, solvent-recovery percentage, percentage of onsite renewable electricity, and CO2e per lot for shipping lanes. Build audit rights and third-party assurance into contracts, and review results at QBRs.

- Incentivize improvement. Tie a few KPIs to bonus–malus or price adjustments, and include remediation plans with dates. Favor partners that show year-over-year gains and can compare programs like-for-like across sites.

- Assess culture, not just equipment. During diligence, look for signs that sustainability is operational: HVAC optimization, water reuse for noncritical utilities, reusable shipper programs, and teams empowered to challenge legacy steps. Celebrate—and reward—partners that eliminate wasteful steps or measurably cut CO2e per lot through packaging and routing changes.

By the same token, sponsors have a role to play, too. Many new programs won’t greenlight a technology change if it risks timelines or compatibility; that’s rational. But they can still ask sharper questions in diligence, set clear reporting expectations, and create room in contracts for continuous improvement. Operational reality often eclipses aspiration early in the game. The goal is to make the greener choice the easier choice as programs mature.

The industry will not transform overnight. There are trade-offs, and there will be false starts. But the shift is underway, and it is measurable. The vision of closed, automated platforms is becoming a practical reality, not a hypothetical one. Supply chain teams' insistence on right-sized, energy-efficient containers is actionable, not ceremonial. And the idea that “We’re not a green industry” is really a challenge, not a verdict. The winners in the next wave of outsourcing will make sustainability a KPI they can actually hit.

Now, back in Philly, if the Eagles organization can “bleed green,” integrate sustainability into its operations, and still win the Super Bowl, then the biotech, pharma, and outsourcing community can do the same, without sacrificing critical human health initiatives or profitability.