2025 Forecast For Advanced Therapies

By Sara Ricci, Merouane Ounadjela, and Carl Schoellhammer, Ph.D., DeciBio Consulting

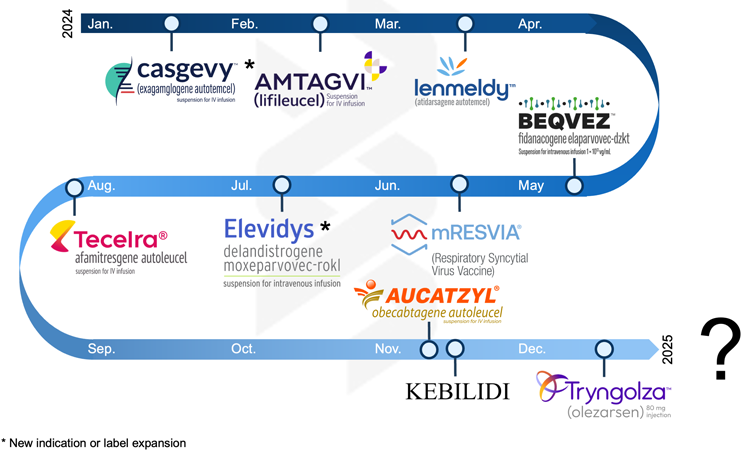

2024 was a year of recalibration and cautious progress for advanced therapies and biopharma. Cell therapies demonstrated their staying power, but questions about scalable logistics, manufacturing hurdles, and successful commercialization remained prevalent. AAV gene therapies, emerging from a difficult 2023, returned with renewed focus and cautious optimism, though the shadow of previous setbacks lingered. Meanwhile, mRNA technologies shifted decisively toward targeted in vivo delivery strategies, particularly for oncology, immunology, and inflammatory indications. However, the road ahead is likely to be long and challenging. Oligonucleotides regained attention as a proven therapeutic class with clear commercial pathways, sparking renewed interest. As we reflect on the past year’s lessons, it’s time to consider what 2025 may hold for the industry.

A Tale Of Two Cities: Oligos Succeed While mRNA's Challenges Persist

Oligos experienced a breakthrough year in 2024, with the industry refocusing on this proven modality. Notable approvals, including Ionis’ Olezarsen, and a robust pipeline marked the maturation of the oligo field beyond rare diseases. Data readouts were also key in 2024, with WaVe Life Science releasing data on its RNA-editing trial for Alpha-1 antitrypsin deficiency. This readout led to not only WaVe’s own meteoric stock rise but also a 100% aggregate increase for two other public biotechs with similar technology, Korro Bio and ProQR Therapeutics.

Beyond these data readouts, large pharma made no shortage of bets as it turned back toward the modality. Eli Lilly penned pacts with Insitro, Genetic Leap, and Haya Therapeutics, in addition to opening its $700 million Boston-based Innovation Center focused on gene therapies. Novo Nordisk, beyond its prior Dicerna buyout, now has an approved oligo therapeutic (Rivfloza) and initiated a new collaboration with Korro Bio. This is beyond well-funded new companies coming out of stealth, such as City Therapeutics.

Looking ahead to 2025, oligos are poised for continued growth, with the approval of several assets such as Arrowhead Pharmaceuticals’ Plozasiran. Strong investment interest in the modality should persist, potentially culminating in a major acquisition. Oligonucleotides are set to remain a key focus in 2025.

In contrast, mRNA remains in a phase of reassessment, struggling to determine its post-pandemic future. Moderna received FDA approval for mRESVIA, its RSV vaccine, though recent trials in infants have encountered challenges. The broader field is grappling with finding the optimal application for this promising technology. There has been a substantial push into in vivo cell therapy applications, led by companies like Tessera, Beam, CRISPR, and Editas, which recently transitioned to an in vivo-only focus. However, trials remain early, primarily targeting rare diseases in immunology and inflammation. This limited scope creates competitive challenges reminiscent of AAV’s own bloated pipeline toward the end of 2022. mRNA’s path forward is likely to mirror AAV’s journey in 2023, with delivery remaining the primary obstacle.

For mRNA, 2025 is expected to be another year of concentrated effort, with a continued focus on gene editing and in vivo cell therapy. The race for in vivo editing of hematopoietic stem cells will persist, though it’s unlikely that any candidates will enter the clinic in 2025. We expect the primary acquisitions to be in enabling technologies, particularly delivery formulations and vehicles, as well as bioprocessing advancements to improve conjugation efficiency. Similar to AAV in 2023, 2025 will be a year of refinement for mRNA, focusing on technology and bioprocessing to lay the groundwork for future success.

Cell Therapies: Proven Potential, Process Pending

Innovation in cell therapies continued throughout 2024. Casgevy, the world’s first CRISPR-based editing product, received expanded approval for beta-thalassemia. Additional notable approvals included Iovance's Amtagvi, the first approved cell therapy for solid tumors, and Adaptimmune's Tecelra, the first FDA-approved engineered T cell receptor therapy. Other approvals, such as Orchard Therapeutics' Lenmeldy and Autolus' Aucatzyl, further highlighted the field's progress.

In oncology, BCMA-targeted therapies advanced into earlier treatment lines, while next-generation technologies like dual CARs and logic-gated CARs drove innovation in engineered cell design. Beyond oncology, the field explored new areas, including autoimmune diseases and diabetes, with early efficacy data suggesting these therapies could offer long-lasting, disease-modifying outcomes. Novel cell types, such as NK cells, also showed incremental progress, and the first engineered B cell therapy reported promising early Phase 1 data.

Consolidation was a key theme in 2024, with pharmaceutical companies acquiring public and private firms, particularly those with existing partnerships that could be seamlessly integrated into their portfolios. The biomanufacturing landscape was quieter, though new systems from groups like Ori Biotech, Cytiva, and Xcell Biosciences debuted throughout the year. Demand continued to outpace supply, particularly as oncology therapies expanded into new indications. Collaborations among producers, manufacturers, and CDMOs played a critical role in bridging the biomanufacturing value chain. However, the BIOSECURE Act introduced uncertainty in the U.S.–China supply chain relationships, raising questions about long-term impacts on biomanufacturing.

Looking ahead to 2025, we anticipate two distinct narratives. In established oncology, the focus will likely be on scaling existing therapies to reach more patients in earlier treatment settings. Pharmaceutical companies will continue to invest aggressively in solutions to address scale-up challenges. Simultaneously, smaller tools providers will consolidate, strengthening major players' manufacturing capabilities. In emerging areas outside oncology, next-generation technologies like dual CARs and logic-gated CARs will undergo intense scrutiny in terms of scalability, safety, and efficacy. Similarly, therapies in non-oncology fields will face significant challenges in proving long-term durability. In 2025, we expect a significant focus on bioprocessing advancements.

AAV: Rising From The Reset

2024 marked key milestones for AAV gene therapies. FDA approvals for BEQVEZ and KEBILIDI and a label expansion for Elevidys signaled progress in the field’s ability to translate this innovative platform into safe, effective, and scalable clinical treatments. Positive developments also included Beacon Therapeutics’ $170 million Series B funding round in July and the $1.1 billion acquisition of Kate Therapeutics by Novartis in November, signaling an improving funding environment, but challenges remain. Even with tight budgets in 2024, innovation continued, with AAV manufacturers making significant strides in addressing prior limitations in production, immunogenicity, and indication selection. These advancements have led to a more focused and efficient pipeline, with development efforts diversified across a broader range of therapeutic areas and strong collaboration between stakeholders.

Commercially, Elevidys has exceeded analysts’ expectations, with strong quarter-over-quarter growth. On the precommercial side, green shoots are emerging, attracting large pharma interest, as evidenced by recent partnerships signed by Astellas with AviadoBio and Sangamo, as well as Roche expanding its collaboration with Dyno Therapeutics.

AAV therapies, now proven tools for addressing rare genetic disorders, are increasingly targeting more complex diseases like cardiovascular conditions. Emerging technologies such as AI-enabled vector design and CNS-targeting capsids hold the potential to unlock greater precision in tissue-specific targeting. Meanwhile, advancements in scalable manufacturing and high-yield producer cell lines are de-risking the pipeline by streamlining production and attracting investment. There is still room for improvement in bioprocessing, particularly in QC/QA and filtration to discriminate between empty, partial, and full capsids, but this work is ongoing.

Looking ahead to 2025, we expect continued momentum in the AAV space. Janssen and MeiraGTx's AAV5-RPGR (botaretigene sparoparvovec) is a near-term approval candidate, and there are robust late-stage pipelines from companies like Ultragenyx, RegenxBio, 4DMT, and Janssen. With maturing, potentially first-to-market assets, we anticipate a major acquisition in 2025. Additionally, mid-stage data readouts will provide additional momentum, likely leading to cautious investment in the modality. Companies will continue to face funding challenges, but success will depend on asset de-risking, clinical differentiation, and prudent cash management. Innovations in vector design and manufacturing will be critical to expanding into new therapeutic areas as 2025 shows continued momentum for the field to set the stage for new assets and commercial success through 2026 and beyond.

2025: The Year Of Refinement, Growth, And New Horizons For Advanced Therapies

Looking ahead to 2025, the advanced therapies sector stands at a pivotal moment. While oligonucleotides continue their strong trajectory, mRNA technologies, cell therapies, and AAV gene therapies face the challenge of refining their approaches to unlock their full potential, each in different and unique ways. As the industry navigates these complexities, strategic investments, technological advancements, and a focus on scalability will be key to shaping a year of continued innovation and cautious optimism. The lessons learned in 2024 will undoubtedly guide the decisions and breakthroughs that define the next chapter for biopharma.

About The Authors:

About The Authors:

Sara Ricci is a senior associate at DeciBio Consulting, specializing in the development and commercialization of genomic technologies and therapies. She has industry experience as a product manager and marketing leader, having worked with both large and emerging biotechnology companies. Ricci holds a master’s in translational medicine from the University of California, San Francisco, and a bachelor's in neuroscience from Tulane University.

Merouane Ounadjela is an associate at DeciBio Consulting, specializing in providing strategic insights to precision medicine and biotechnology companies. He has industry experience in life science venture capital, where he evaluated and supported investments across therapeutics, diagnostics, life science tools, and software. Ounadjela previously gained research experience in the Merad Lab at Mount Sinai and at Intellia Therapeutics, contributing to studies in immuno-oncology and gene editing. He holds a master’s in biotechnology from Columbia University and a bachelor’s in physiology from McGill University

Merouane Ounadjela is an associate at DeciBio Consulting, specializing in providing strategic insights to precision medicine and biotechnology companies. He has industry experience in life science venture capital, where he evaluated and supported investments across therapeutics, diagnostics, life science tools, and software. Ounadjela previously gained research experience in the Merad Lab at Mount Sinai and at Intellia Therapeutics, contributing to studies in immuno-oncology and gene editing. He holds a master’s in biotechnology from Columbia University and a bachelor’s in physiology from McGill University

Carl Schoellhammer, Ph.D., is an associate partner at DeciBio Consulting, where he leads the advanced therapies practice. He specializes in advising clients across drug development, manufacturing and bioprocessing concerns, pipeline optimization, and opportunity assessments. He previously founded Suono Bio, a venture-backed biotech from the lab of Prof. Robert Langer at MIT. Schoellhammer holds a Ph.D. from MIT.

Carl Schoellhammer, Ph.D., is an associate partner at DeciBio Consulting, where he leads the advanced therapies practice. He specializes in advising clients across drug development, manufacturing and bioprocessing concerns, pipeline optimization, and opportunity assessments. He previously founded Suono Bio, a venture-backed biotech from the lab of Prof. Robert Langer at MIT. Schoellhammer holds a Ph.D. from MIT.