2024's Market Outlook For Cell & Gene Therapies

By Justin Culbertson and Adam Lohr, RSM US LLP

The life sciences industry is in unfamiliar territory. Headwinds exist in the form of higher interest rates, labor shortages, less funding for research-stage companies, and regulatory changes. Commercial-stage organizations appear unfaltering while research-stage companies are tossed by the seas of uncertainty. While this may sound stark for cell and gene therapy (CGT) companies, which are primarily research-stage, these companies are well equipped to navigate these challenges.

In this article, we will discuss the state of the macroeconomy, its effects on CGT companies, and the unique prospects that many of these companies have compared to the broader life sciences market.

A Quick Recap On The State Of The Macroeconomy

Interest rates haven’t been this high since the periods preceding the early 2000s recession and the Great Recession in 2008. While each of these periods had different drivers, they all ultimately resulted in depressed valuations and a subsequent period of recovery. In our current economic cycle, depressed valuations have significantly harmed funding for research-stage companies, including CGT companies. In the funding section of this article, we’ll discuss this recovery period and the real challenges ahead for the transitional year we believe 2024 will be.

Source: Bloomberg; RSM US LLP

While the prior periods of high interest rates resulted in subsequent recessions, the current economy has remained robust in terms of gross domestic product growth, strong labor markets, and consumer spending. Given these factors, it is possible that we will avoid a recession and achieve a “soft landing.” This translates directly into less restrictive financial conditions, which should support investor confidence and a higher risk appetite to aid continued support for research and development in life sciences.

Cell And Gene Therapies’ Growing Approval Pipeline

The approval pipeline for CGT continues to grow. Per Evaluate, CGT made up 10% of all U.S. FDA novel approvals in 2023, up from 7% and 6% in 2022 and 2021, respectively. With increasing groundbreaking approvals, such as the first CRISPR-based therapeutic approved for marketing in the U.S., there is significant traction going into 2024 and beyond.

These approvals also reflect the complexity and diversity of therapies in development. Per Evaluate, approximately two-thirds of the approvals in 2023 were for DNA and RNA therapeutics or gene therapies, with the remainder attributed to genome editing and cell therapies. This distribution highlights the multifaceted nature of CGT companies, and the relatively low volume of approvals precludes any broad conclusions about prevailing trends in future technologies.

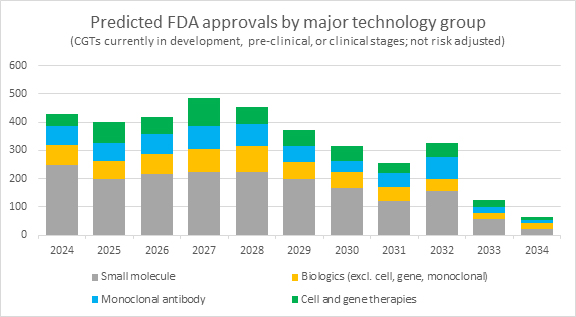

Source: Evaluate; RSM US LLP

The forecast for approvals over the next decade presents an intriguing landscape, with a balanced representation of various CGTs, with gene-modified cell therapies gaining slightly more traction than other technologies. This optimistic outlook for approvals, which forecasts a fourfold increase in 2024 and a tenfold increase by 2027, reflects not just ambition but a necessary driving force in the CGT sector. Companies in this space often embrace a forward-leaning stance, understanding that a robust vision for approvals is instrumental for attracting investment to fuel research, development, and innovation.

It is important to compare these optimistic predictions with historical approval rates. Over the past five years, the FDA has granted an average of 60 novel drug approvals annually (including Center for Biologics Evaluation and Research, or CBER, approvals), encompassing a broad spectrum of technologies beyond just CGTs. If this trend persists, one could expect that less than a quarter of the forecasted approvals for CGTs come to fruition in 2024. This disparity between optimistic forecasts and historical approval rates should not be viewed as negative but rather a reminder of the scrutiny, scientific and clinical validation and the market readiness that these products must meet. This high bar, while tempering approval rates, is a testament to the industry’s commitment to delivering transformative therapies to patients.

As CGT companies continue to evolve and mature, they should not only present innovation but also adaptability and responsiveness to regulatory standards, clinical efficacy, and patient-centric approaches. This growing pipeline is poised to redefine therapeutic landscapes, making 2024 a pivotal year for the CGT sector.

Source: Evaluate; RSM US LLP

Orphan Designation Will Play An Interesting Role In The Cell And Gene Landscape

The role of Orphan Drug designation is becoming increasingly prominent and strategic in the CGT sector. The Orphan Drug designation is granted to drugs and biologics that treat, diagnose, or prevent rare diseases affecting fewer than 200,000 people in the U.S. This status is not just a regulatory label but a catalyst for innovation and targeted patient care. The incentives it offers, such as tax credits for clinical trial costs, exemption from FDA application fees, and seven years of market exclusivity upon approval, represent significant motivators for CGT companies.

There are significant synergies and opportunities between the Orphan Drug designation and CGTs, including economic incentives and rare disease targeting. With funding becoming increasingly competitive and labor shortages driving the cost of research and development up, the incentives offered by orphan drug status may become a cornerstone for the viability and success of numerous CGTs. For this reason and as we navigate through 2024, the significance of orphan designation is expected to amplify.

The interplay between Orphan Drug designation and the Inflation Reduction Act (IRA) also creates layers of complexity. The IRA is set to have far-reaching implications across all of healthcare, including the CGT sector. One of the IRA’s focal points is the reduction of prescription drug prices, which could intersect with the orphan drug market, especially considering the typically high costs associated with rare disease treatments. While the IRA currently exempts orphan drugs approved for a single indication, CGT companies that choose to pursue additional indications may have their marketing and pricing strategies influenced.

Companies entering the orphan drug space must navigate the traditional regulatory landscape as well as these emerging policies. While orphan designation offers a pathway to market profitability and exclusivity, the broader market dynamics are influenced by policies, such as the IRA, and necessitate an adaptable approach. This adaptable approach must consider not only clinical success but also long-term sustainability, ethical pricing, market access, and post-market surveillance in an increasingly scrutinized and patient-centric environment.

According to the FDA, Orphan Drug designations continue to show significant activity, having increased 250% annually across all technologies over the past decade. According to Evaluate, over 80% of CGTs approved in the past decade have Orphan Drug designations. We expect this trend to continue through future approvals; however, this could change as manufacturing processes evolve and technologies with proven success begin targeting non-rare disease indications with larger patient populations.

Source: RSM US LLP; FDA.gov

Promising Technology Could Ease Funding Challenges For Cell And Gene Companies

Funding is crucial for CGT companies, especially since most are in the research stage and need significant investment to bring their innovative therapies to market. Currently, these companies face headwinds due to high interest rates, which have made investments more expensive and led to lower company valuations, causing losses for investors who came in during the high-valuation pandemic era. This has made private equity and venture capital investors, the traditional backers of such companies, cautious. They’re worried about not getting the right valuations, finding profitable exit strategies, and attracting additional investors to support new financing rounds.

Source: Pitchbook; RSM US LLP

Despite these challenges, funding has shown resilience, staying relatively steady through 2023; however, PE and VC investors are being more selective, focusing on companies with longer cash runways, proven success in early-stage trials, and alternative income sources, such as licensing and collaboration deals.

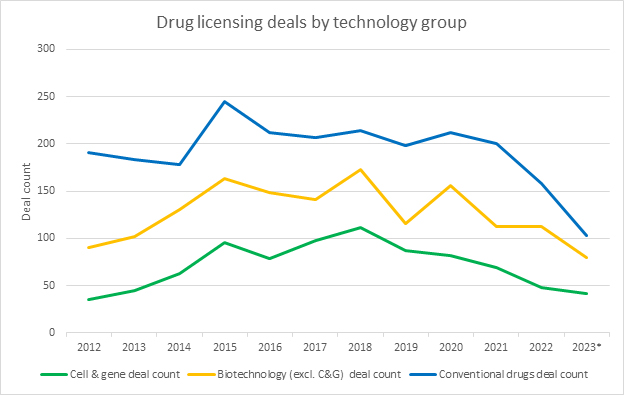

For CGT companies, having diverse income streams, particularly through licensing and collaboration, can be a significant advantage. Per Evaluate, in 2023, CGTs accounted for 19% of licensing and collaboration agreements, even though they were only 10% of novel approvals and PE and VC investment. This shows that while these companies are still in the early stages of development, their innovative technologies and potential for breakthrough treatments make them attractive partners for larger, more established companies.

Source: RSM US LLP; Pitchbook

Both 2022 and 2023 were down years for private investment into biopharma as investors looked to curb risk exposure. We are encouraged that CGT companies (which are pursuing some of the highest risk assets), kept pace with their biopharma peers in terms of long-term investment growth.

Looking ahead to the latter half of 2024, there’s cautious optimism for a rebound in funding. Signals like a predicted decrease in federal funds rates and cooling inflation might lead to a more favorable investment climate. Historically, when interest rates peak, it’s often followed by a recovery in company valuations. If this pattern holds, 2024 could be the year we see a resurgence in investment activity, with CGT companies well positioned to benefit if they meet the stricter investment criteria set by PE and VC firms.

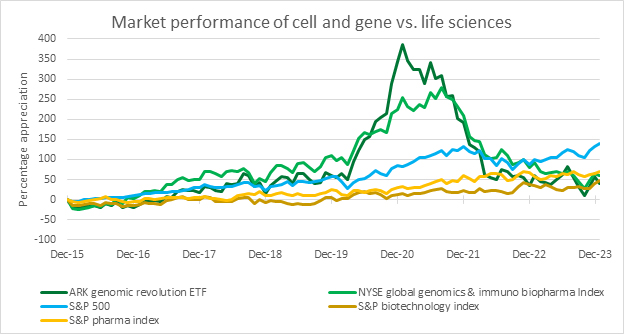

An early sign of this rebound could be the performance of publicly traded life sciences companies, including those in the cell and gene sector. According to Bloomberg, as of late January 2024, these companies are keeping pace with the broader biotech market but are trailing behind pharmaceutical companies and the general market, represented by the S&P 500. This indicates there’s plenty of room for growth.

Source: RSM US LLP; Bloomberg

The initial public offering market is another area to watch. Although the life sciences IPO market has been quieter compared to previous years, and CGT companies make up a smaller slice of it, the overall trend of recovery in funding should also be reflected in the IPO activities. Companies thinking of going public should be prepared for a 12- to 24-month journey involving meticulous planning and consultations with investment bankers, lawyers, and accountants.

Source: RSM US LLP; Pitchbook

Collaboration And Licensing Agreements Could Be Keys To Success

In the challenging economic landscape of 2024, collaboration and licensing agreements are signs of life for CGT companies. While rising interest rates have tightened funding across the industry, these strategic partnerships have remained resilient, offering a viable path forward amid macroeconomic uncertainty.

According to Evaluate, in 2022, we saw an increase in the value of licensing deals involving CGT companies, with a year-over-year increase of 29% to $62 billion. Despite our data set’s lag in reporting, which is common in the industry, early indications suggest that 2023 should continue this upward trend. More than just numbers, this is a clear sign of the industry’s confidence in the potential of CGTs. These agreements represent investment, not only in the form of dollars but also in the form of resources and expertise, paving the way for accelerated development and expanded market reach.

According to Evaluate, CGT licensing agreements made up 19% of all deals reported in 2023, even though they accounted for only 10% of novel approvals. This disparity underscores the sector’s strategic importance and the high value placed on its technologies.

Source: RSM US LLP; Evaluate

Source: RSM US LLP; Evaluate

Of the existing CGT licensing agreements reported for 2023, the largest technology is DNA and RNA therapeutics, making up 34% of the total. Gene therapy and cell therapy made up the second and third largest technologies with 29% and 27%, respectively.

Source: RSM US LLP; Evaluate

Looking ahead, CGT companies should view collaboration and licensing agreements not merely as financial lifelines but as strategic partnerships that offer mutual benefits. While these agreements can provide much-needed capital, they also can bring valuable expertise, access to new technologies, and pathways to new markets. In a time when traditional funding sources are scarce, these agreements represent a strategic pivot to drive the sector forward even in the face of economic headwinds.

Remain Agile And Flexible In A Year With Contrasting Uncertainty And Opportunity

In 2024, CGT companies will be shaped by both economic challenges and scientific promise.

These companies will need to be agile and flexible as they navigate economic pressures, leverage regulatory incentives, and embrace collaborative frameworks. By doing so, the industry can continue to experience breakthroughs, ensuring that the revolutionary treatments at its core are fully realized for patients worldwide.

Note to the reader: An inherent challenge with analyzing data for the cell and gene sector is the classification of what technologies should be included and what companies are pure cell and gene versus biotech or pharma with a diverse pipeline. There are also classification differences between sources and scientific publications. To the extent possible, the focus here is on those drugs and companies in the cell therapy, gene therapy, gene-modification, and DNA and RNA therapeutics space (collectively “cell and gene therapy” or CGT). Where appropriate, comparative data visualization between CGT and broader sectors in the biopharma space had been provided. The reader is encouraged to consider trends and market shifts as opposed to strict readings of the values reported. In addition, there may be a multi-month lag in reporting of deal activity related to private equity and venture capital (PE and VC) investment, licensing, and collaboration agreements, etc. Where noted by an asterisk (*), values may not fully reflect 2023 activity.

About The Authors:

Justin Culbertson, life sciences senior analyst at RSM US LLP, specializes in industry trends related to life sciences services to pharmaceutical and biotech companies. Justin has over 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations and similar service organizations in the ever-evolving life sciences industry. Justin also has extensive experience advising clients in new standards implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting.

Justin Culbertson, life sciences senior analyst at RSM US LLP, specializes in industry trends related to life sciences services to pharmaceutical and biotech companies. Justin has over 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations and similar service organizations in the ever-evolving life sciences industry. Justin also has extensive experience advising clients in new standards implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting.

Adam Lohr is an audit partner and senior analyst in the life sciences industry for RSM US LLP, based in the firm’s San Diego office. He was selected as a senior analyst in RSM’s Industry Eminence Program, which positions its senior analysts to understand, forecast, and communicate economic, business, and technology trends shaping the life sciences industry.