2014 Trends In Strategic Outsourcing – Changes In Partner Selection

By Kate Hammeke, director of marketing intelligence, Nice Insight

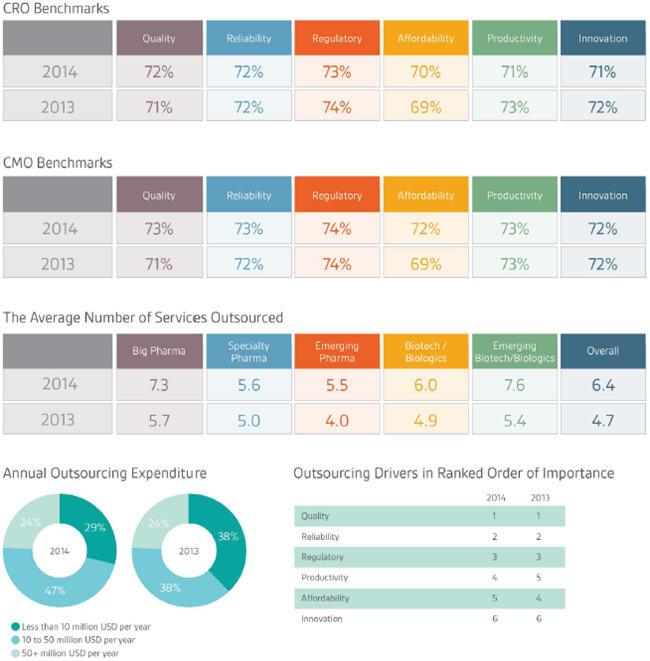

The 2014 results from Nice Insight’s annual pharmaceutical and biotechnology outsourcing survey show positive news for both sides of outsourcing relationships. Just as there was an increase from 2012 to 2013 (up 7 percent, from 31 percent to 38 percent) in respondents with an outsourcing expenditure between $10M to $50M, there was another 9 percent increase in this expenditure bracket for the year ahead. Slightly under half of all survey respondents (47 percent) stated they will spend between $10M and $50M on outsourced projects in 2014. The respondent group who will spend less than $10M on outsourced projects continues to shrink, now comprising only 29 percent of respondents. One key difference in this increase in expenditure over the 2012-2013 change was that respondents indicated they would outsource a greater number of different services — up from 4.7 on average in 2013 to 6.4 in 2014.

The 2014 results from Nice Insight’s annual pharmaceutical and biotechnology outsourcing survey show positive news for both sides of outsourcing relationships. Just as there was an increase from 2012 to 2013 (up 7 percent, from 31 percent to 38 percent) in respondents with an outsourcing expenditure between $10M to $50M, there was another 9 percent increase in this expenditure bracket for the year ahead. Slightly under half of all survey respondents (47 percent) stated they will spend between $10M and $50M on outsourced projects in 2014. The respondent group who will spend less than $10M on outsourced projects continues to shrink, now comprising only 29 percent of respondents. One key difference in this increase in expenditure over the 2012-2013 change was that respondents indicated they would outsource a greater number of different services — up from 4.7 on average in 2013 to 6.4 in 2014.

Quality, Reliability Take Top Spots

This year’s results show that, as a whole, survey respondents prioritized the outsourcing drivers as follows: quality, reliability, regulatory, productivity, affordability, and innovation. In the past three years, CROs and CMOs have taken notice that drug innovators — across all buyer groups — consistently prioritized quality and reliability in the top two positions. It becomes clear that the contract organizations have made efforts to improve upon these customer perception measures, which have in turn been reflected in improved scores offered by sponsor organizations across several categories. For example, the benchmark for quality increased among both CROs (up 1 percent, from 71 percent to 72 percent) and CMOs (up 2 percent, from 71 percent to 73 percent) from 2013 to 2014.

CMOs fared better in terms of improving upon reliability, with a 1 percent upturn, from 72 percent to 73 percent, while the CRO benchmark remained the same as last year at 72 percent. Interestingly, there was a small decrease for the CRO regulatory benchmark, down 1 percent from 74 to 73; CMOs held steady at 74 percent for regulatory for both 2013 and 2014. The small drop in averaged regulatory scores across all CROs coincided with a 5 percent downward shift in the percentage of respondents who will engage a CRO or CMO for regulatory support. These could be related. If sponsors were disappointed with the regulatory knowledge their contractors possessed, it makes sense they would be less inclined to acquire their assistance.

The prioritization of an outsourcing partner’s productivity has shifted each of the last three years, moving from fourth place in 2012 to fifth in 2013 and back to fourth for 2014 — this year edging out affordability for the first time. When it comes to how sponsors evaluated CROs’ and CMOs’ performance on this measure, the data showed a 2 percent decline in the CRO benchmark, down from 73 percent to 71 percent. However, CMOs on average maintained their scores, with the benchmark sticking at 73 percent.

In light of increased outsourcing expenditure for 2014, it was not too unexpected for affordability to drop in rank — now holding fifth position, as compared to fourth in 2013 and third in 2012. Interestingly, at the same time this measure has dropped in priority among buyers of outsourced services, both CROs’ and CMOs’ affordability scores have climbed. The affordability benchmark for CROs increased 1 percent from 69 to 70, and among CMOs, the benchmark increased 3 percentage points from 69 to 72.

There was some variation in ranking from the different buyer groups. For example, among emerging pharma respondents, affordability ranked third as compared to fifth across the other buyer groups. Biotechs prioritized productivity slightly higher than the pharma groups or emerging biotechs, but perhaps the most notable difference was that emerging biotechs ranked innovation third, whereas the rest of the buyer groups ranked innovation sixth. The innovation benchmark for both CROs and CMOs was set at 72 percent in 2013. This was another area where CROs slipped in performance, with their averaged score at 71 percent in 2014. Yet, CMOs once again maintained their scores, with the benchmark staying at 72 percent.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2013-2014 report includes responses from 2,337 participants. The survey is comprised of 240+ questions and randomly presents ~35 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions of the top 100+ CMOs and top 50+ CROs servicing the drug development cycle. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences as well as barriers to strategic partnerships among buyers of outsourced services.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.