The Global CMO Wars: No More Us Vs. Them (Part 2)

By Louis Garguilo, Chief Editor, Outsourced Pharma

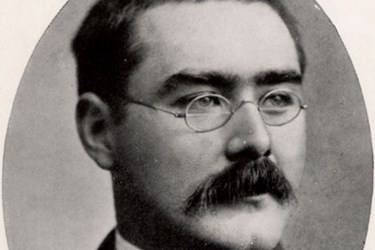

The opening of Rudyard Kipling’s “The Ballad of East and West” – a “border ballad” that seemingly remains ever in vogue and relevant – is often quoted: “OH, East is East, and West is West, and never the twain shall meet.” Of course this single line leads most to misinterpret the meaning of the early-1900s poem, but we’ll get to that later.

Relevant to all of us now: How long will we carry on our border wars between outsourcing service providers in the East and West? One continues to claim the other has lower standards of quality and lesser abilities, and the other that the first is over-priced and over-estimated.

This battle was taken up – in public, and thus courageously, I might add – at the Outsourced Pharma Conference in San Francisco (November 2-3). We arrived at some answers, much insight, and comments such as these from Ravi Kiron, Managing Partner, Biopharma Strategy Advisors, Inc., who spent twenty years combined at Pfizer and J&J:

“We’ve talked about this in outsourcing for as long as I can remember. Costs have always been an issue; quality has always been an issue. But all these years later, the industry still hasn’t come up with some solution to help both sides. We have examples of Indian and Chinese CMOs raising quality, and U.S. companies with strategies to reduce costs. Ultimately, everybody wants quality products at affordable prices. Why can’t we as an industry take charge of our own destiny and build in a solution for all?”

Sponsors Can “Switch” The Subject

Perhaps 2015 is the tipping point that bridges the East-West divide within outsourcing. Why?

Because economics, politics, and questions of human welfare have always served as ultimate catalysts to end internecine strife. We are at critical junctures for all three of these: economics in the sense of the growing costs to discover, develop and manufacture new drugs, despite more global options; politics in the sense of legislators and other groups pressuring the pharma industry to lower prices, and calls for regulating the pricing of drugs; and human welfare in the sense of widening public concern over global access to drugs, and protecting consumers by raising quality standards.

Sponsors can apply the glue that stops the outsourcing industry from dividing itself into East and West – and thus inhibiting its advancement. David Enloe, CEO of Althea, sees positive signs on this front. “I’ll tell you what has changed,” he says, “The ‘us versus them’ [sponsor vs. service provider] dynamic is almost gone. I’ve been astonished at the use of the word “partner” more recently; sponsors actually mean it. It seems collectively our industry has decided getting things right the first time really matters. The time, money, and commitment to the relationship is there.”

That commitment to the relationship has to include between service providers as well. Michael Brinkley, VP Quality, Endocyte, explains: “We have 24 synthesis-steps for an API we are manufacturing … in five countries. There’s a 16-to-18-month lead-time just to get from starting material to that finished API. But we’ve learned to manage that. Our material starts in India, goes through China, then through Western Europe, and it’s finally finished in the U.S. Yes, there’s always risk, but we’ve learned to mitigate those risks to the extent possible.”

It’s easy to see what’s at stake for manufacturers if the outsourcing pieces don’t fit business models. Balu Balasubramanian, a 25-year veteran of Bristol-Myers Squibb and currently managing director, Pharma Innovation Sourcing Center LLC, comments that “delays in getting materials from one partner to another – for whatever reason – risk entire operations. In the biologics area, for example, we decided we had to build our own manufacturing site, because the parts could not work together. The risk to any part of the chain is of course a risk universal to all parts, and to the sustainability of the industry.”

To promote an industry with uniform standards, wring out that risk, and take full advantage of outsourcing, sponsors need a favorable cost-benefit analysis to move projects around. Enloe of Althea, in preparation for the San Francisco conference, had members of his team take a look at “switching costs” by putting together a cost analysis for different outsourcing scenarios.

The first scenario is if a single CMO gets a sponsor’s project from phase one and keeps it through phase three and into commercial batches. The next are if the project is transferred from one CMO to another at phase two or phase three. “When we looked at the dollars,” said Enloe, “the difference was not as much as I would have expected. It was a couple million dollars on about a $19 million total project cost.” However, Enloe cautions, because of where we are currently as an industry, the time lost in less-than-smooth transfers, the real challenges of validation, and other resultant delays to market, are the real risks. “Those risks can be massive,” he adds.

Those risks can also be largely mitigated by eliminating our us vs. them mentality so the entire industry can become a more cooperative and reliable working unit.

Broadening The Cost Analyses

Attendees and panelists in San Francisco spoke about the need for sponsors to broaden their business analyses when it comes to picking providers, and putting together a supply chain. Kyle Chisholm, marketing manager at Pfizer CentreSource, provided clues within the framing of his questions: “We’ve heard about both quality-related topics and pure costs. But what type of all-inclusive economic models do you use to evaluate a CMO? Do you put the two together in a broader context of the cost of quality, and the probability and costs associated with encountering a quality incident? Do you take a holistic approach in discounting that cost delta, with probabilities associated with each CMO, to give you a fully integrated value proposition?”

Brinkley of Endocyte says, “Yes, you’ve got to do that broad cost-benefit analysis. Believe me, as the head of quality, I’d rather go to a site and turn the project over to them, walk away, and then twelve weeks later get my vials. I’ve never found a site where you could do that anywhere in the world. You have to invest the time, the energy, you need to do the transfers … you need all sides involved. That won’t go away. What we want is for it to work a lot better from a cost, quality, and provider-to-provider standpoint.”

Unfortunately, we’ve learned that even with the progress gained from innovation, science and technologies, and new business models, an outsourcing house divided against itself stymies the maturity and advancement of the entire drug industry. It adds to drug costs (when outsourcing should be reducing those costs), and can impact health care universally. Sponsors can lead in mending the breach, but as Kiron of Biopharma Strategy Advisors is getting at above, outsourcing as an independent industry needs to bring itself together. There is a future where pricing evens out, and quality is raised, around the world.

And as my always perceptive readers have already intuited, if you read Kipling’s ballad until the end, you’ll see that mutual respect and trade dissolves the borders of East and West.

-------------

Thank you to everyone who spoke up during the session, “Getting real: How much is outsourcing my project going to cost?” and to panelists: Michael Brinkley, VP Quality, Endocyte; David Enloe, President & CEO, Althea; Maninder Hora, SVP Pharma Development and Manufacturing Operations, Nektar; and pre-conference help from Balu Balasubramanian, Managing Director Pharma Innovation Sourcing Center LLC