Transforming Next-Gen Therapy Supply Chains Into Patient-Connected Value Chains

By Sanjay Srivastava, Laks Pernenkil, and Hussain Mooraj, Deloitte

Part 2 in a three-part series (Click here to read Part 1.)

Cell, gene, and other emerging therapies are distinctly different from traditional biopharma products. Every lot is for a named patient or small population of patients, and that lot drives direct uplift on the bottom line. Traditional supply chain management does not necessarily create patient value in emerging therapy value chains. Operations should be the backbone of a distribution model that delivers these products efficiently and effectively over the last few yards.

named patient or small population of patients, and that lot drives direct uplift on the bottom line. Traditional supply chain management does not necessarily create patient value in emerging therapy value chains. Operations should be the backbone of a distribution model that delivers these products efficiently and effectively over the last few yards.

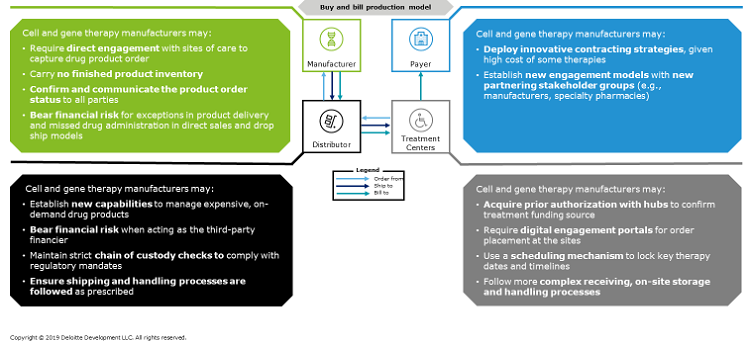

In a traditional pharmaceutical value chain for provider-administered outpatient drugs, the provider purchases a product from a pharmacy or distributor, stores the product, administers the product to a patient, and then submits a claim for reimbursement to a third-party payer. However, cell and gene therapy value chains, manufacturing, and distribution requirements generally do not align with this model (Figure 1), for several reasons:

- The flows of material, information, and financials for cell and gene therapies are driven by product characteristics (including manufacturing), price, sites of care, and site network; thus, they vary widely from therapy to therapy.

- Regulations around the quality, handling, and traceability of human cell products impact how cell and gene therapy manufacturers set up their supply chain and, ultimately, how they serve their customers and patients.

- The line between what defines a treatment center versus a pharmaceutical company is blurring as personalized therapies become localized/regionalized around the treatment center.

- Because autologous therapies require a patient’s own cells to be cultured in a tight, closed-loop supply chain, traditional distributors may have to find new ways to create value for manufacturers.

- Operations’ focus moves from using inventory to de-risk supply to providing a just-in-time (JIT) value chain with varying and hard-to-define delivery and service windows.

- Cell and gene therapies must adhere to strict treatment center planning and delivery timelines so that the product does not expire and/or the patient treatment window is not missed.

- Provider organizations serve as both suppliers and customers, requiring complex service agreements that cover aspects of handling GMP material and delivering therapies.

- Cell and gene therapies require the value chain to leverage emerging, patient-centric digital capabilities to ensure on-time and high-quality performance.

Figure 1: Cell and gene therapies have supply chain and manufacturing requirements that traditional “buy and bill” models may find difficult to accommodate. (Click on the image to view a larger version.)

As cell and gene therapies compose a growing share of biopharma companies’ product portfolios, they are stretching the capabilities of established supply chain and manufacturing processes (e.g., made-to-order products, no inventory). Smooth orchestration of the lifecycle stages of therapy order management, product manufacturing, and order delivery increasingly call for controlled operating conditions; a sophisticated and, typically, cold-/frozen-chain distribution model; and close coordination among all stakeholders, often enabled by a digital platform, patient services, or hubs.

As a result, we find biopharma organizations struggling to build bi-modal operating models that have traditional supply chains and next-generation therapy supply chains under one roof.

High-Touch Patient And Provider Management

Cell and gene therapies require a fundamental shift in supply chain operating models and how products are delivered to the point of care. Traditional biopharma majors have optimized supply chains to deliver products efficiently and effectively over the last mile. But with cell and gene therapies, it’s not about the last mile; it requires careful planning to deliver these products efficiently and effectively over the last few yards.

Biopharma companies have largely struggled with care coordination and creating value-added, wraparound services for their products, so developing the capabilities to manage cell and gene therapies’ high-touch patient and provider interactions is imperative. The issue can be particularly acute when manufacturers do not have real-time visibility into treatment center schedules and the patient and cell journey (i.e., shepherding the patient for T-cell extraction and orchestrating the cold-chain supply chain of the extracted T-cell). Order management may be further complicated by frequent cancellation and rescheduling due to patient health and other factors. If this happens within 48 hours of the apheresis date, then the manufacturing slot is likely to be lost, as it takes ~48 hours to get an apheresis kit to the clinical center and/or the point of care.

Sourcing And Manufacturing Issues

Increasingly, manufacturers have been employing digital technologies and onsite support to actively manage autologous cell order placement and treatment status. Some provide web-based portals to the treatment sites and use complex algorithms to coordinate dates between apheresis, manufacturing, and product delivery. Manufacturers also are looking into electronic health record (EHR) integration as a potential solution; however, providers thus far have been reluctant to participate due to cost, complexity, ability to scale, and patient privacy considerations.

Also, it is imperative to maintain cellular quality (e.g., apheresis materials from some diffuse large B-cell lymphoma [DLBCL] patients contain high cell impurities such as myeloid cells and or circulating tumor cells; these impurities can mislead the total viable count estimates) and to coordinate manufacturing capacity and shop floor planning to minimize cell destruction, which is complicated by their extremely short half-life.

To overcome these challenges, manufacturers have developed hub-and-spoke manufacturing footprints to accommodate initial cell processing closer to the patient and finished product manufacturing at the hub. For the latter, manufacturers have scale-out manufacturing models that improve control and robustness, embrace automation in a closed-loop process, reduce unnecessary sampling/steps, and maintain quality control, thereby improving efficiency and consistency in every batch produced. Some have also formed partnerships with industry and academic centers to facilitate process transfers and to accelerate development.

However, biopharma companies continue to experience manufacturing challenges as a result of unclear and less understood critical quality attributes (CQAs) and critical process parameters (CPPs). Also, it is typical for CQAs and CPPs to shift over the first few lots in advanced cell and gene therapy manufacturing. To better understand the manufacturing variables that impact cell expansion quality and clinical outcomes, manufacturers have begun to generate insights for the business by developing advanced analytics infrastructures to correlate manufacturing data with clinical outcomes for streamlined manufacturing processes.

In addition, manufacturers are evaluating new production strategies, processes, and tools, including virtual assistants, 3D printing, bedside manufacturing, and manufacturing-in-a-box solutions that can sustain localized treatment center demand without losing logistics and distribution time.

Distribution

As stated earlier, cell and gene therapies have unique production requirements that traditional “buy-and-build” model players may not be prepared to accommodate. Manufacturers, therefore, may need to rethink their current-state specialty distribution capabilities to address the unique challenges these therapeutic solutions present. For example, lack of stakeholder visibility into the end-to-end product journey creates issues around workflow coordination (e.g., slot capacity) and cell tracking. Geographic separation between stakeholders and regulatory requirements for logistics require robust shipping and logistics capabilities (e.g., cold chain). There are also important regulatory considerations when moving biological products across interstate/international borders:

- Scrutiny of biological and human cell materials. Certain countries outside the U.S. and EU have stringent requirements for the shipment of blood products. In addition, there are country-specific import and export requirements for vectors, vector copy number (VCN) enhancers, etc. In response, manufacturers have revised their supply chain and manufacturing process design and have completed additional materials testing to comply with these regulations.

- Country-specific customs requirements. Countries including the U.S. have specific customs regulations and valuation methodologies for each production step. For example, unfinished drug products cannot be resold across borders, even between internal entities of a company. Thus, some manufacturers have acquired licenses to sell in individual states as well as individual countries. Others have set up international manufacturing plants that fulfill regional orders to avoid international transit and conduct distribution “dry-runs” to ensure reliability in defined processes for cross-border shipments. Manufacturers also typically carry out early and frequent discussions with regulatory agencies and conduct onsite visits to explore regional considerations and customize supply chain processes appropriately.

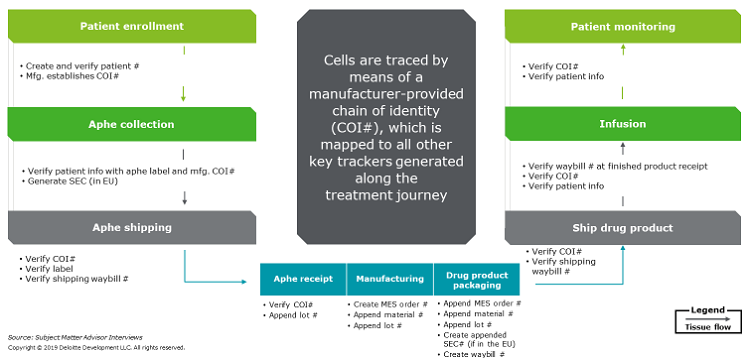

- Chain of identity (COI) and chain of custody (COC) management. Countries have different requirements for human tissue and cell products flow and traceability. Products with short half-lives that are transported across borders are further constrained by time. To address these challenges, manufacturers have customized or outsourced algorithms for track-and-trace applications (a manufacturer-provided COI number is mapped to all other key trackers generated along the journey, such as waybill and lot numbers). Manufacturers also may outsource cell handling during transportation to premium third-party, cold-chain carriers that provide on-demand and high-touch logistics services. Finally, given the heavy dependence on location and access to shipping and delivery companies, some manufacturers also have strategically built facilities in easy-to-access locations. for example, close to airports.

- Label restrictions. There are country-specific requirements for personally identifiable information (PII) and Health Insurance Portability and Accountability Act (HIPAA)-protected information on labels. For example, the EU prohibits listing a patient’s date of birth or last name; in addition, it mandates that a Single European Code (SEC) be affixed to tissue and cell products. To address these restrictions, manufacturers have designed/adopted a platform of record (COI/COC) solution that automates code mapping and have established well-defined and standardized bi-directional communication flows. They also have developed robust strategies for maintaining COI and COC to accommodate global scale (Figure 2); for example, real-time GPS tracking has been used to track cell location and condition.

- In-transit and short-term storage. The majority of finished cell and gene therapy products need to be stored at -150° to -180° Celsius or there is a risk of cell degradation. Liquid nitrogen dewars used to transport the product are bulky and cumbersome to manage. A variety of internet of things (IoT) devices are also required to monitor the temperature, humidity, light, and positioning sensors. Consequently, the logistics operations and associated IT infrastructure are complex, and the current vendor landscape is limited to few companies with the necessary capabilities. Additionally, transplant centers around the world have varying abilities to accept and store cryogenic cellular products until therapy administration. To address these challenges, manufactures are providing on-demand and high-touch logistics services to centers. They also are conducting extensive training and mock runs when onboarding and certifying sites for therapy delivery.

Figure 2: How do manufacturers manage chain of identity and custody throughout the patient journey? (Click on the image to view a larger version.)

Some manufacturers have developed new and innovative trade contracting models that deviate from traditional pharma billing and distribution constructs, adding to therapy order management complexity. For example, distributors may not provide product logistics but do process payments from providers and offer ancillary services to qualify orders (e.g., benefits verification, credit checks). Providers may carry the financial risk of reimbursement, although some manufacturers allow the provider to cancel the purchase order at any point prior to product delivery.

What Should Biopharma Companies Do To Create And Sustain Value?

Based on our observations of early cell and gene therapy development efforts, we suggest that biopharma companies incorporate the following learnings into their manufacturing and supply chain strategies:

- Cell and gene therapies require a specialized value chain, so operations should have a leading seat at the process design table.

- Because cell and gene therapy manufacturers need to establish a sophisticated distribution model prior to commercialization, they should consider aligning with non-traditional partners that can bridge capability gaps. Also, manufacturers should make sure that their digital platform, services, and requirements don’t overwhelm any of their partners.

- Competitive advantage is in execution and outcomes, not in technology. Cell and gene therapy manufacturers are building a patient-centric, clinically connected value chain; they should develop an enabling technology architecture to match.

- Talent is a big constraint. Look to unconventional sources to fill employee ranks.

The final article in this series explores challenges and lessons learned when selecting, developing, and managing a network of health care providers and treatment centers.

About The Authors:

Laks Pernenkil, Ph.D., is a principal in the Life Sciences Enterprise Operations practice at Deloitte Consulting. He leads the Supply Chain Operations Transformation and co-leads the Big Data Analytics for Life Sciences Manufacturing offerings. With more than 15 years of technical, manufacturing, product, and supply operations experience, Pernekil has delivered large-scale, complex manufacturing and supply chain operating model transformations, cost reduction engagements, and new product launches at several large biopharma and medtech clients. In addition, his experience includes third-party logistics provider selection, channel strategy, CMO selection, performance improvement, operational excellence, and market entry strategy. He has a Ph.D. in chemical engineering from MIT and an MBA from the MIT Sloan School of Management.

Laks Pernenkil, Ph.D., is a principal in the Life Sciences Enterprise Operations practice at Deloitte Consulting. He leads the Supply Chain Operations Transformation and co-leads the Big Data Analytics for Life Sciences Manufacturing offerings. With more than 15 years of technical, manufacturing, product, and supply operations experience, Pernekil has delivered large-scale, complex manufacturing and supply chain operating model transformations, cost reduction engagements, and new product launches at several large biopharma and medtech clients. In addition, his experience includes third-party logistics provider selection, channel strategy, CMO selection, performance improvement, operational excellence, and market entry strategy. He has a Ph.D. in chemical engineering from MIT and an MBA from the MIT Sloan School of Management.

Hussain Mooraj is a principal at Deloitte Consulting, leads the Next Gen Therapy practice, and is the New England regional lead for life sciences. Mooraj brings more than 25 years of experience in manufacturing, supply chain, enterprise technology, sales and marketing, and strategy consulting to his role. He works closely with senior executives from global life sciences firms, helping them transform their end-to-end businesses and build start-up organizations to launch life-saving new therapies, especially on the CAR-T and gene therapy side.

Hussain Mooraj is a principal at Deloitte Consulting, leads the Next Gen Therapy practice, and is the New England regional lead for life sciences. Mooraj brings more than 25 years of experience in manufacturing, supply chain, enterprise technology, sales and marketing, and strategy consulting to his role. He works closely with senior executives from global life sciences firms, helping them transform their end-to-end businesses and build start-up organizations to launch life-saving new therapies, especially on the CAR-T and gene therapy side.

As used in this document, “Deloitte” means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.