2021's Bioprocessing Year In Review & 7 Key Takeaways

By Smita Khanna, BioPlan Associates

The biopharma and bioprocessing industries have responded aggressively and effectively to the COVID-19 pandemic. However, supply chain challenges, shortages, hiring problems, and regionalization have accelerated existing trends and created the need for new strategies. These are just a few of the findings presented in BioPlan Associates’ 2021 18th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production.1 This included surveys of 140 decision-makers within bioprocessing organizations, both developers and contract manufacturing organizations (CMOs) in 25 countries and 100 industry supplier/vendor respondents. Some of the more top-level trends are discussed below.

Long- And Short-Term Effects Of COVID-19 On The Biopharma Industry

While many other industries continue to struggle with their adaptation to the pandemic, the biopharmaceutical/bioprocessing industry has adapted well overall. The most common response selected in 2021 when asked to cite “The SINGLE most important trend or operational area,” a new category, “COVID-19 pandemic response” was first, moving “Manufacturing Productivity/Efficiency” to #3 in 2021. “Viral and Gene Therapies” continued in the #2 spot.

Overall responses to COVID-19 or short-term trends include:

- Biopharmaceutical R&D and bioprocessing facilities worldwide are now expanding, functioning without much interruption, and considered essential.

- Work from home and social distancing, along with isolating groups of workers, is a new normal.

- There is an immense focus on robustness of supply chains and maintaining sufficient supplies in-house. Many facilities are now holding 12 to 18 months’ worth of supplies in storage vs. previously only maintaining six to 12 months’ supply.

- Changes in prioritization of orders and activities are pushing pandemic/biodefense-related tasks to the front of the line.

- Pandemic related considerations included the need to ramp up manufacturing, investment in pandemic preparedness, and collaboration.

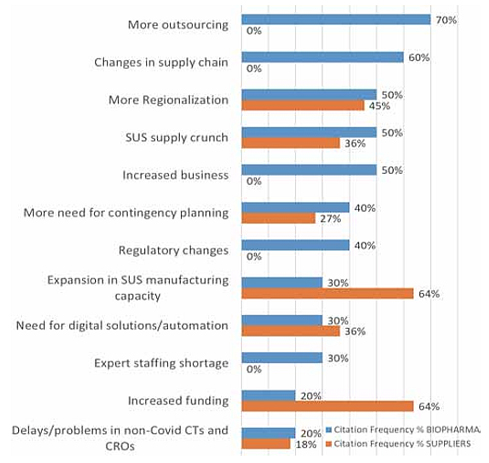

Developer and supplier company executive interviewees’ top-level responses when asked to cite the major long-term effects of the COVID-19 pandemic on the bioprocessing sector are summarized in Figure 1 below.

Fig. 1: Long-term Effects of COVID-19 on Bioprocessing

Source: 18th Annual Report and Survey on Biopharmaceutical Manufacturing, BioPlan Associates, April 2021.

The top-ranked expectations for long-term effects, those cited by ≥50% of respondents, were more outsourcing, changes in supply chains, more regionalization, and the SUS supply crunch, including worsening of current shortages. Future supply chain security issues and long-term solutions to future challenges will involve logistics, inventory, on-shoring of manufacturing, second-source suppliers, and strategies to avoid shortages of raw materials, logistics, cross-border inventory and warehousing, and staff shortages.

Bioprocessing Capacity Continues To Grow With Productivity, Titers, Reaching Plateaus

BioPlan’s Top 1000 Global Biopharmaceuticals Facilities Index (subscription database at www.Top1000Bio.com) tracks 17.4 million L of production capacity worldwide, including the 1,625 biopharmaceutical/ bioprocessing facilities. The majority of bioprocessing capacity worldwide continues to be held by a relatively small number of the largest facilities. The 100 largest facilities have around two-thirds of worldwide capacity.

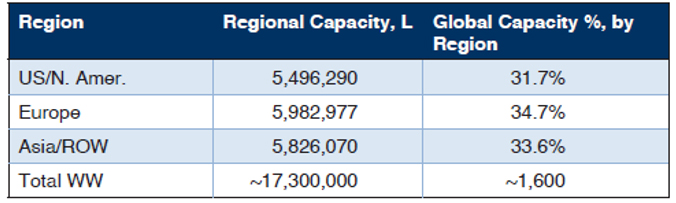

Table 1: Regional Distribution of Total Worldwide Capacities

Source: 18th Annual Report and Survey on Biopharmaceutical Manufacturing, BioPlan Associates, April 2021.

The U.S., with its greater emphasis on innovation, R&D, process development, and clinical manufacturing, numerically has the most bioprocessing facilities. Asian facilities are approaching the U.S. in terms of numbers, while their average capacity remains lower. In Asia/ROW, the capacity is highly concentrated, including a few super-sized facilities such as those of Celltrion and Samsung in S. Korea. The U.S. has the largest number of CMOs, including a good number of new cellular/gene therapy CMOs coming online.

Annual survey data and other sources confirm that bioprocessing productivity, particularly in terms of upstream titers and downstream yields (but to a much lesser extent) continue to incrementally increase. Overall, there is an incremental increase in bioprocessing titers; the annual growth or CAGR for average titers from 2008-2020 at commercial scales is currently 2.4%, while the CAGR at clinical scales is 3.5%.

The growth in capacity and productivity is augmented as budgets for new capital investments in bioprocessing equipment have grown. Companies appear to be continuing to invest in increasing productivity. But it’s also worth mentioning that high costs of biopharmaceutical products, and related government-imposed price controls, continue to be a threat to the industry. Substantive changes in how U.S. developers set prices and changes in U.S. government-imposed price controls will likely have global implications.

In addition to that overview, the industry might witness other concomitant trends as well. The seven key takeaways from the report are the following.

1. Growth In Biosimilars/Biogenerics

The many follow-on products – biosimilars, biogenerics, and biobetters — in development and entering world markets confirm the maturation of the biopharmaceutical industry.

There are around 1,100biosimilars (including biogenerics) in development or marketed worldwide, with nearly 600 now in clinical trials or marketed in one or more countries. CMOs in recent years have reported about 15% increase in business attributed to biosimilars projects.2

There are ~80 biosimilars approved as genuine biosimilars (or equivalent) in major markets, primarily the U.S. and Western Europe. Biosimilars (and biogenerics in lesser- and non-regulated international markets) are resulting in many new players entering the biopharmaceutical industry and new manufacturing facilities being constructed.

It is also noteworthy that FDA biopharmaceutical approvals have been steadily increasing. FDA and other regulators appear to also have adapted, at least in terms of performing the most basic functions including product approvals, to the near-term impacts of the COVID-19 pandemic. In the most recent full year, 2020, FDA approved 29 biopharmaceuticals. The great majority, 24 (83%), have recombinantly manufactured active agents. Recombinant monoclonal antibodies (mAbs), including derived fragments, were the product class with the most approvals, 19 (65%). One cellular therapy, one antibody-drug conjugate, and zero gene therapies received approval.

2. Bioprocessing Innovations Are A Focus

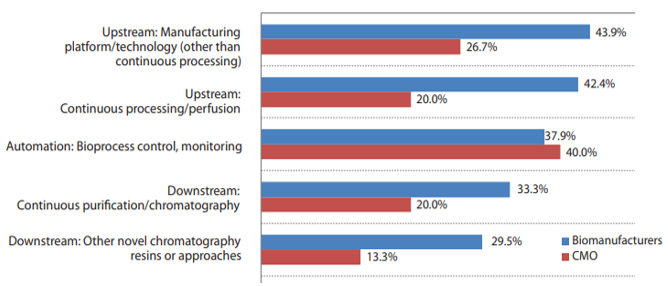

This year, when asked what bioprocessing innovations are most needed, respondents continued to very frequently cite aspects of continuous bioprocessing.

- Over 40% of respondents indicated “Upstream: Manufacturing Platform/technology (other than continuous processing” (42.2%) and “Upstream: Continuous processing/perfusion” (40.1%) to be the leading systems to be evaluated/tested within the next year.

- “Automation: Bioprocess control, monitoring” (37.9%) was also cited as an important area where evaluations will be conducted in this year.

Thus, innovative methods will gain more acceptance in coming years, owing to attributes like enhancing efficiency and productivity.

Fig. 2: Select Bioprocessing Systems/Innovations to Evaluate in Next 12 Months (Biomanufacturers vs. CMOs)

Source: 18th Annual Report and Survey on Biopharmaceutical Manufacturing, BioPlan Associates, April 2021.

3. Mammalian Systems Continue To Dominate

Mammalian cell culture continues to dominate biopharmaceutical development and manufacturing. Chinese hamster ovary (CHO) cell lines continue to thoroughly dominate mammalian production, but other mammalian cell lines are tending to increasingly be used, e.g., HEK293 for mAbs and other recombinant proteins and now also for AAV and other gene therapy viral vectors manufacturing.

4. Increased Acceptance Of Single-use Systems To Enhance Productivity And Efficiency

BioPlan estimates that ≥85% of pre-commercial (R&D and clinical) product manufacturing now involves considerable single-use systems-based manufacturing. Out of the two dozen SUS areas surveyed, well over 80% of survey respondents reported considerable current use of single-use bioprocessing equipment. Many of the trends in the bioprocessing industry, including single-use technologies, are being driven by continued desires and perceived needs for improved productivity and quality and cost reductions in manufacturing processes.

5. Stainless-Steel Bioreactors: Smaller Installations

Besides more single-use facilities coming online, a trend is continuing for reduction in volume of steel bioreactors in operation at facilities, as exemplified by the largest size stainless bioreactor on-site. There has been a trend of an overall decrease in the percentage of respondents reporting their facilities have bioreactors ≥2,000 L, with 2,000 L generally the current cutoff for use of single-use bioreactors. Essentially all bioreactors >2,000 L can be assumed to be stainless steel.

However, stainless-steel bioreactors remain favored for many applications, particularly commercial manufacturing where it often remains more cost-effective to invest in product manufacturing-dedicated facilities anchored by recyclable stainless-steel bioreactors and all the associated infrastructure. In sharp contrast, single-use bioreactors now extensively dominate use in R&D and early-phase clinical manufacturing, with an estimated ≥85% of pre- and clinical bioprocessing using single-use systems.

In this year’s survey, in a reversal from 2019 and 2020, respondents now consider “Construct new stainless-steel facility” to be an area of large importance to address to avoid capacity constraints, with 25.0% of respondents reporting, up from 14.8% in 2020. This could potentially be a response to the need for large-scale, fixed capacity to address pandemic challenges in the future.

6. Cellular And Gene Therapies' “Capacity Crunch”

In the 2021 survey, analysis of the manufacturing capacity of cellular and gene therapy facility depicts it skewed toward lower volumes. Among those involved in cellular therapies, 47.7% report less than 500 L total on-site bioreactor capacity and of those involved in gene therapies, 40.0% reported capacity of less than 500 L. A change has been noted in the use of capacities upwards of 20,000 L getting increasing numbers compared to 0% reported in previous year. We noted that the average of estimated capacities reported by respondents for their gene therapy facilities is 2,900 L vs. 2,700 L for cell therapies.

BioPlan studies also have shown that nearly 90% of cellular/gene therapy developers would prefer to manufacture using CMOs, but most are not finding the needed expertise, capacity, and/or facilities among CMOs, or there is a lack of access due to long average wait times to get new projects started. As a result, there is an inclination to build commercial manufacturing capacity in-house and an “insourcing” trend is possible. BioPlan is keeping an eye on this trend.

7. China As A Major New Biopharma Participant

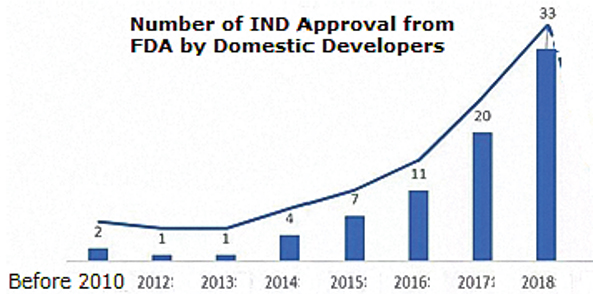

BioPlan recently published an extensive study and directory of CMOs in China (PRC) (Growth of CMOs in China, June 2020). The increase in IND applications filed by China-based developers to conduct clinical trials in the U.S. (and presumably Europe and other major markets) is accelerating, as shown in Figure 3.

Fig 3: IND Applications to the U.S. from China

Source: Growth of CMOs in China, BioPlan Associates, June 2020.

The number and size of China-based CMOs are expanding for key reasons including.

- There are more biosimilars/biogenerics and innovative biopharmaceuticals entering the clinical pipeline.

- Biologics development and their commercial scale manufacturing is relatively new in China, so use of CMOs is a necessity.

- A growing number of domestic biopharmaceutical developers; there are now over 100 companies in China developing mAbs (https://bioplanassociates.com/china-top-60/).3

- BioPlan’s Top 1000 Global Biopharmaceutical Facilities Index (free version at www.top1000bio.com) now reports China having a total of >1.5 million L bioprocessing capacity, about 9.2% of worldwide capacity.4

- Changing government laws that ruled out biopharmaceuticals being manufactured by CMOs or other third parties are now changing.

- The large Chinese population inducing growth in the market.

- Interest and expectations among Western companies for outsourcing bioprocessing to China are increasing.

Summary

Despite the global problems presented by the COVID-19 pandemic, the bioprocessing industry has been relatively effective at meeting these challenges; it has demonstrated flexibility and has been proactive in creating innovative supply chain solutions. How the industry deals, long-term, with the lessons learned will help ensure the industry is ready for future public health challenges.

References

- Langer, E.S., et al., Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 18th annual edition, BioPlan Associates, Rockville, MD, April 2021, 527 pages. www.bioplanassociates.com/18th

- Rader, R.A., "Analysis of the U.S. Biosimilars Development Pipeline and Likely Market Evolution,” BioProcess International, vol. 11, no. 6, Biosimilars supplement, June 2013, pp. 16-23.

- Xia, V.Q., et al., Directory of Top 60 Biopharmaceutical Manufacturers in China, 2nd edition, BioPlan Associates, Feb. 2017, 357 pages

- Xia, V.Q., et al., Growth of Biopharmaceutical Contract Manufacturing Organizations in China: An In-depth Study of Emerging Opportunities, BioPlan Associates, June 2020, 144 pages.

About the Author:

Smita Khanna is director of research at BioPlan Associates. She is a biopharma and healthcare market researcher/analyst. With a Ph.D. in biotechnology, she has extensive experience working in key industry segments. She has experience at the Council of Scientific & Industrial Research – Indian Institute of Toxicology Research (CSIR-IITR), India. Her expertise includes primary and secondary research and market analysis of healthcare and biopharma segments. She contributes to international publications and journals as well as research for in-depth reports. She can be reached atsmitakhanna@bioplanassociates.com, +1 301-921-5979, and www.bioplanassociates.com.

Smita Khanna is director of research at BioPlan Associates. She is a biopharma and healthcare market researcher/analyst. With a Ph.D. in biotechnology, she has extensive experience working in key industry segments. She has experience at the Council of Scientific & Industrial Research – Indian Institute of Toxicology Research (CSIR-IITR), India. Her expertise includes primary and secondary research and market analysis of healthcare and biopharma segments. She contributes to international publications and journals as well as research for in-depth reports. She can be reached atsmitakhanna@bioplanassociates.com, +1 301-921-5979, and www.bioplanassociates.com.