Launching A New Drug In A Maturing Market — Lessons Learned From Recent COPD Entrants

By Kristine Mackin, Ph.D., Decision Resources Group

Chronic obstructive pulmonary disease (COPD), a global growth market worth well over $15 billion in the United States and EU5 (France, Germany, Italy, Spain, United Kingdom) alone in 2016, has long represented a lucrative opportunity for drug manufacturers. However, the proliferation of treatments and the increasing number of generic options have begun to limit the potential for emerging therapies. Despite these challenges, the newest class of drugs, long-acting beta2 agonist (LABA) and long-acting muscarinic antagonist (LAMA) fixed-dose combinations (FDCs), have succeeded in capturing a significant portion of the total patient share and are positioned for continued growth. GlaxoSmithKline’s (GSK) Anoro Ellipta and Novartis’ Ultibro Breezhaler, in particular, provide examples of successes and stumbles in this market and illustrate broader lessons pharmaceutical manufacturers should consider when launching into a rapidly maturing market.

Background On The COPD Drug Market

COPD has long been a high-value market for major players in the pharmaceutical industry, with Boehringer Ingelheim capturing well over $5 billion in COPD sales in 2015, and competitors GSK and AstraZeneca reaching nearly $3 billion and $2 billion, respectively. However, significant threats to their well-established therapies are appearing on the horizon. Boehringer Ingelheim’s sales leader Spiriva (tiotropium) is expected to face generic competition throughout Europe in the near future, and will lose exclusivity in the United States by 2019. AstraZeneca and GlaxoSmithKline have already begun to lose sales dollars to generic competitors in Europe, and applications have been filed with the FDA to launch competitors in the U.S. market, as well. As a consequence, many players in the COPD market have been looking to diversify their product portfolio.

Historically, three inhaled, long-acting drug classes have been the mainstays of COPD treatment. By sales, LABAs are the smallest class. LAMAs have long been the preferred monotherapy for COPD, while LABA therapies are most often used in combination with inhaled corticosteroids (ICS), comprising the LABA/ICS FDCs. These were long thought essential for patients experiencing exacerbations.

For some time, development activities focused on improving upon older therapies; once-daily or faster-acting LABAs or LAMAs were developed. However, physicians were often unconvinced that such therapies offered sufficient improvements over older and more familiar therapies, forcing drug developers to search for new ways to leverage their portfolios. This resulted in the novel combination of a LABA and a LAMA in one device, creating this newest class of FDC treatment.

GSK’s Anoro: First To Market In U.S., Lack Of Clinical Comparators Limiting EU Adoption

Anoro (umeclidinium and vilanterol) was the first LABA/LAMA to reach the U.S. market, launching in 2014 with mixed success. Although GSK has the advantage of being a long-term major player in the U.S. respiratory market, with the strength of Advair (salmeterol/fluticasone propionate) helping them build experience, Anoro has secured favorable formulary placement only on a minority of commercial plans. In 2015, Anoro enjoyed Tier 1 or 2 status on almost half of all commercial plans, but Boehringer Ingelheim’s Stiolto Respimat (tiotropium bromide and olodaterol) is beginning to gain ground on this therapy.

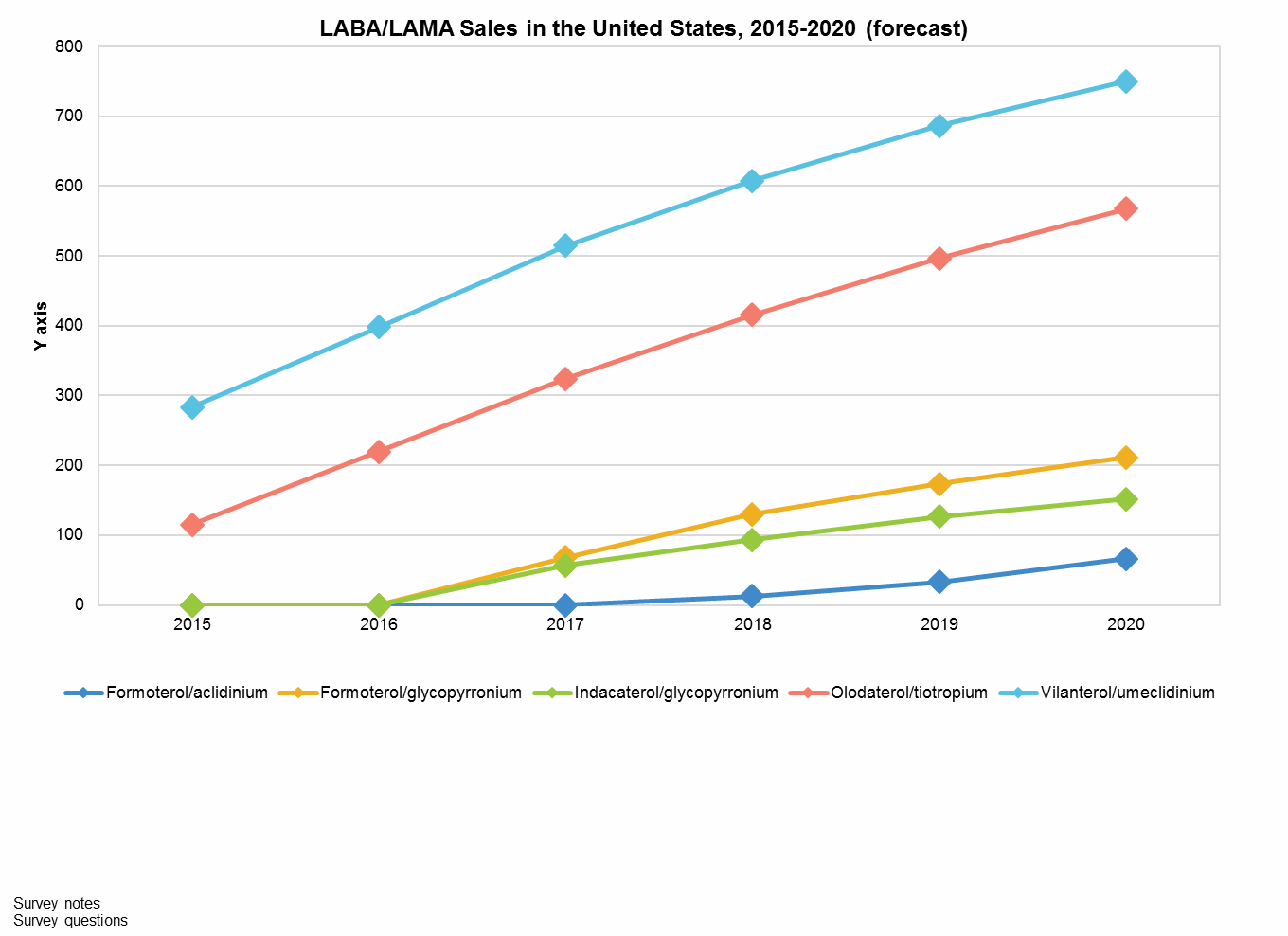

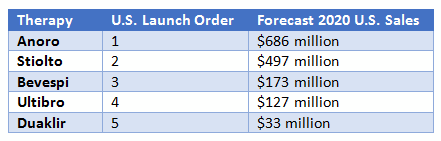

Despite this challenge, physicians report that Anoro will continue to be their preferred LABA/LAMA therapy. Drivers of this preference include familiarity, the standout advantage of being first-to-market, and perceived advantages in safety and efficacy. Anoro is currently forecast to be the sales leader among the LABA/LAMA class for the next decade. In 2015, it captured nearly $300 million in sales in the U.S., with sales forecast to continue growing robustly and the potential to reach over $750 million in this market by 2020.

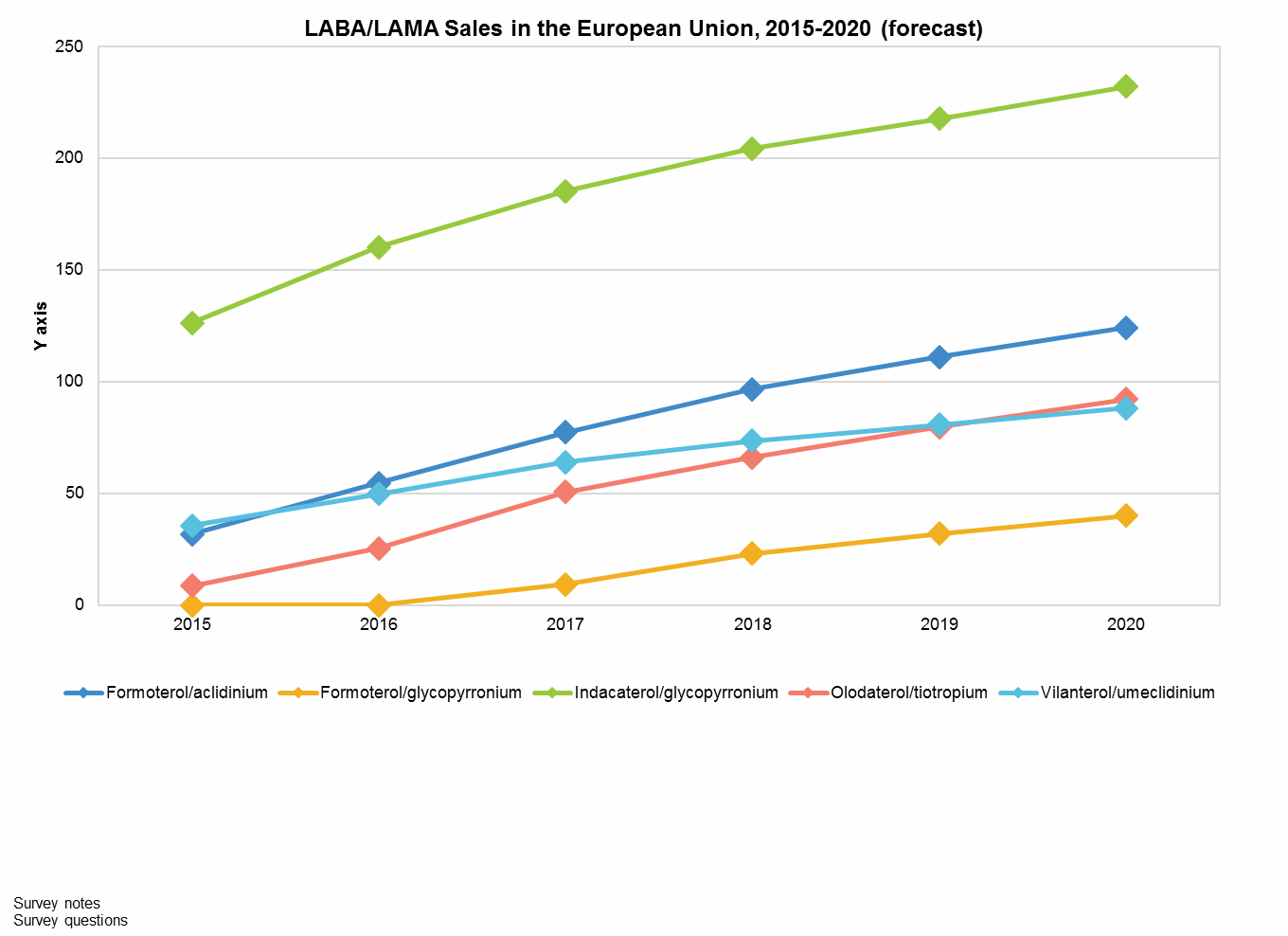

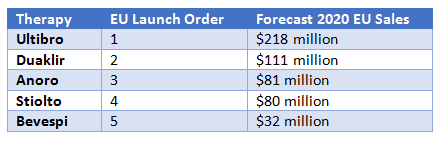

In contrast to its initial success in the U.S., Anoro has stumbled in securing patient share throughout the EU. Another LABA/LAMA, Ultibro (indacaterol/glycopyrronium), beat it to the market in the majority of EU countries. Clinical trials focused on comparing Anoro to placebo, and this data is preferred for FDA approval. However, Anoro’s later-to-market position and the lack of active comparators have prevented it from gaining preferred status in several EU countries, including Germany, holding it back from one of the major LABA/LAMA growth markets in Europe and depressing overall sales. Additionally, European physicians almost universally prefer other LABAs/LAMAs over Anoro; the perceived efficacy benefit reported by U.S. pulmonologists has not been echoed by their European counterparts. As a consequence, Anoro was able to capture less than $50 million in EU5 sales in 2015 and is expected to be fourth out of five LABAs/LAMAs in sales in the combined five major European markets by 2020.

Novartis’ Ultibro: First To Market In EU, Dosing Concerns In U.S.

As the first LABA/LAMA to reach the European market, Ultibro captured an early advantage in this region and is well positioned for continued success. As illustrated by Anoro’s enduring advantage in the U.S. market, familiarity is often crucial for physician preference. However, Ultibro has also managed to persuade payers by fielding a year-long study (FLAME) that compared it to long-term market leader Advair; results became available in 2016. Critically, this study demonstrated that Ultibro is superior to Advair in preventing exacerbations, which are an expensive and sometimes deadly consequence of COPD. This success yielded Ultibro an endorsement in the 2017 GOLD international COPD guidelines. As a result, 2015 sales in the EU were over $125 million and are forecast to surpass $225 million by 2020, enshrining it as the highest-grossing LABA/LAMA in Europe.

Despite this European success, Ultibro is not anticipated to secure a top spot in global sales. Launch in the U.S. has been significantly delayed, initially due to FDA concerns about dosing, forcing a reformulation to twice-daily dosing, and secondarily from a lengthy search for a launch partner approval. Twice-daily dosing can be an obstacle to uptake for many physicians, since many patients are less compliant with the more onerous dosing schedule. Plus, with two once-daily LABAs/LAMAs already available, pulmonologists will largely prefer these more familiar and less frequently dosed options. Additionally, although the manufacturer, Novartis, has successfully launched many drugs onto the U.S. market, Ultibro and related respiratory products were eventually licensed to Sunovion. This decision delayed the launch for over a year, making it the fourth LABA/LAMA to become available in the U.S. With the U.S. LABA/LAMA market forecast to be over $2 billion within the next decade, this will be a costly mistake.

Boehringer Ingelheim’s Stiolto: Bridging the U.S.-EU Divide?

Given the differing factors at play in the U.S. and European markets, could any single LABA/LAMA manage to optimize its sales in both regions? Stiolto (olodaterol/tiotropium) may come the closest to achieving this goal. Boehringer Ingelheim holds another long-term market leader, Spiriva, in its portfolio and was able to use this drug as a springboard for Stiolto’s launch. Physician familiarity with the well-received Respimat device, which is often cited as a reason why both Spiriva and Stiolto are preferred over other therapies, will help boost prescriptions of Stiolto. This therapy is anticipated to be comfortably in the middle of LABA/LAMA sales, surpassing $100 million in Europe in 2020.

Additional sales in the U.S. will help boost Stiolto’s overall revenue; the drug was the second LABA/LAMA in the market, and payers are beginning to shift Stiolto to preferred status, with it holding a lower tier in more plans than Anoro in 2017. Stiolto was also the first and only COPD therapy to date to secure a label including quality of life (QoL) data, and a long-term clinical trial evaluating the impact on mortality and exacerbations is expected to conclude in 2017, which could further boost its profile, if successful. This study includes tiotropium as an active comparator, which could help position Stiolto as an economical as well as efficacious choice, since it offers “two-for-one” pricing relative to Spiriva in many markets. As a consequence, sales are forecast to grow from $115 million in 2015 to over $550 million in 2020 in the United States.

AstraZeneca’s Bivespi: Dosing As A Competitive Advantage

In addition to Stiolto, the third LABA/LAMA launching on the U.S. market continues to highlight the importance of being early-to-market. AstraZeneca’s Bevespi Aerosphere (formoterol/glycopyrronium), which became available in early 2017, was the first twice-daily LABA/LAMA to launch and as such is anticipated to remain comfortably ahead of Ultibro in U.S. sales for at least the next five years. For some patients with harder-to-control symptoms, twice-daily dosing is preferred, boosting Bevespi, and as the only twice-daily option currently available it will have an opportunity to be the preferred therapy for patients who require this dosing frequency. However, Bevespi is expected to lag behind Anoro and Stiolto in the U.S., due to the familiarity gap and the increasing competition for top formulary placement.

Bevespi is anticipated to perform worse than the other LABA/LAMAs in the EU5 as it will be fifth to market; AstraZeneca already launched Duaklir Genuair (formoterol/aclidinium), becoming the first-to-market twice-daily therapy in this region. The clinical development program for Bevespi emphasized comparisons to inactive placebo rather than active comparators, a decision that is likely to make it difficult to secure favorable reimbursement in many of the European markets. These factors will hold Bevespi to the middle of the pack for LABA/LAMAs, with an anticipated $250 million in global sales by 2020.

AstraZeneca’s Duaklir: The Benefit Of A “Two-For-One” Pricing Model

As mentioned above, Duaklir is already available in the EU, but it is not anticipated to reach the U.S. market until 2019. This LABA/LAMA was the first of two twice-daily therapies to become available in Europe, and as such it will enjoy the same relative advantage Bevespi will capture in the U.S., with an opportunity to become the preferred twice-daily LABA/LAMA in the absence of any comparable competitor.

However, Health Technology Assessment (HTA) reviews for Duaklir have led to mixed results. In France, the clinical benefit was determined to be insufficient, blocking access to this market. In the United Kingdom, Duaklir is considered to be a good value, as the cost is less than the sum of the two components, resulting in it capturing a relatively high patient share in this market in 2016. However, the late launch in the U.S. and the competition against two other twice-daily therapies will depress sales in this market. Global sales will increase steadily from over $30 million in 2015 to nearly $200 million by 2020. Despite the European success, these sales will be the lowest of any LABA/LAMA, highlighting the importance of the U.S. market in achieving higher sales figures.

Lessons From LABA/LAMA Launches: What Other Drug Developers Can Learn

What lessons can emerging therapies learn from the experience of LABAs/LAMAs in COPD? First, the clinical trial program should be designed to optimize submission in the most desirable market for the drug; as illustrated by Bevespi, placebo is sufficient for FDA approval. However, active comparators are becoming increasingly important for a new therapy to secure preferential reimbursement from the nationalized healthcare systems in Europe; Ultibro demonstrates the advantages of a robust clinical trial data set in this market.

Second, being first or early-to-market is an enormous advantage, as Anoro demonstrates. Failing that, occupying a niche within disease treatment can help position a therapy within the marketplace; as with Duaklir and Bevespi in the European and U.S. markets, a different dosing schedule can boost relative sales.

Third, pricing remains an important consideration for all therapies, especially those facing a crowded market. LABA/LAMA therapies are all priced similarly, but the perceived value of offering two active agents for the price of one has helped them stand out against older therapies. Stiolto, in particular, has benefitted from a perceived pricing advantage.

About The Author:

Kristine Mackin, Ph.D., is an analyst on the immune and inflammatory disorders team at Decision Resources Group. She holds a doctorate in biochemistry from Brandeis University, where she studied the evolution of bacteriorhodopsin and the relationship between type I and type II rhodopsins. Prior to joining DRG, Dr. Mackin was involved with literature and market research for a new company pitch during an internship at PureTech Ventures in Boston.

Kristine Mackin, Ph.D., is an analyst on the immune and inflammatory disorders team at Decision Resources Group. She holds a doctorate in biochemistry from Brandeis University, where she studied the evolution of bacteriorhodopsin and the relationship between type I and type II rhodopsins. Prior to joining DRG, Dr. Mackin was involved with literature and market research for a new company pitch during an internship at PureTech Ventures in Boston.