Incorporating Natural Hazards & Distributed Infrastructure Into Risk Management For Pharma Operations

By Mark Vessely, BGC Engineering, Inc. and Christina Vessely, Biologics Consulting, Inc.

It has been said that earthquakes do not read codes. They also don’t read or follow business interruption plans. The same can be said for other natural hazard-related events, such as Hurricane Maria in 2017 that devastated Puerto Rico for months or the costly mudslides in Santa Barbara County that resulted in 21 reported fatalities and closed a key highway between Los Angeles and Santa Barbara for 12 days in early 2018. While these natural hazard events may seem like distant topics to some in the pharmaceutical industry, there is relevance to all companies. Opportunities exist for risk management, including an important lesson in avoiding the gradual acceptance of such events as normal, until an even greater catastrophic event occurs — an event that was likely and inevitable.

The recent events in Puerto Rico offer a timely perspective on the risks to pharmaceutical organizations and products from natural hazards and disruption to infrastructure systems. Moving forward, risk management actions that fully consider such threats can help inform future decisions by those in the industry and ultimately enable sustainability in public health and business performance objectives.

Puerto Rico was at one time the fifth largest area in the world for pharmaceutical manufacturing, housing over 80 companies ranging from Abbott to Wyeth. The companies first came to Puerto Rico in the 1960s and 1970s to take advantage of federal tax incentives, which, at that time, allowed U.S.-based manufacturers to send all profits from local plants to stateside parent companies without having to pay federal taxes. While the tax incentive known as Section 936 has since expired, many companies maintained production on the island. In 2016, the pharmaceutical exports from Puerto Rico were over $14.5 billion, according to the U.S. Bureau of Labor Statistics. About 33 percent of the gross domestic product for the island was from the pharmaceutical industry and about 8 percent of the medicines used by Americans were manufactured in Puerto Rico.1 Unfortunately, production came to a halt in September 2017 when Hurricane Maria made landfall, resulting in an island-wide loss of electricity that was initially expected to take three to six months to restore. In addition to power transmission damage, supporting infrastructure systems were hit hard, including destruction of roads and bridges and damage to or disruption of other utilities, such as water treatment facilities and reservoirs.

Many companies had anticipated the potential for downtime due to hurricanes or other natural disasters. Those that had were able to maintain power for their facilities through the use of backup power generation. In some cases, facilities were even able to supply water for injection (WFI) quality water to continue operations. However, lack of electricity across the island and damage to workers’ homes and roads impacted people’s abilities to work, leaving the facilities capable of running but with insufficient staff and resources to maintain full-scale operations, as well as a new set of logistical challenges related to product distribution. In mid-2018, the industry was still feeling impacts from the disaster, with ongoing drug shortages and, notably, the shortage of IV bags, which are ubiquitous in hospitals, many smaller clinics, nursing homes, and patient homes in some cases.

Risk And Sources Of Risk

Many are very familiar with the ideas of risk assessment, risk management, and mitigation from a product development perspective and are required to perform such assessments in alignment with quality by design (QbD) principles.2 Specific tools that are used to manage risk to product quality are defined and further described in ICH Q9.3 The application of these concepts beyond product development and into the realm of business and individual risk may not be as obvious or familiar to relatively small and or less mature organizations.

The International Organization of Standardization (ISO) defines risk as the effect of uncertainty on objectives. Across nations and industries, managing risk is an important step toward achieving missions and goals. While risk can be ignored for those who so choose, risk cannot be avoided, as ignoring risk is just a form of risk acceptance — and uninformed acceptance of unknown risk at that. Thus, a goal of risk management is understanding the sources of risk and reducing the amount of unknown risk with informed treatment decisions.

When expressed mathematically, risk is the product of the probability (or likelihood) of an event or condition and the associated consequences, including both directly quantifiable values, such as potential costs, and indirect impacts, such as reputation or regional economic impacts. When assessing risk, estimates of likelihood and consequence often are approximate and based on expert judgment; however, even imprecise estimates of risk can yield better and more informed outcomes when compared to a system that accepts unknown levels of risk exposure across the organization.

All entities manage risk, whether consciously through processes and programs, or reactively and passively through uninformed acceptance. Within the pharmaceutical industry, there is much effort toward management of risk originating from sources such as regulatory requirements, operational threats, and external interruptions. Each of these sources of risk can create consequences to different business performance objectives, like those for drug safety and efficacy, financial goals, and company or industry reputation. The ongoing challenges with IV bag supply and other pharmaceutical products following a hurricane is a current example of the adverse consequences from external sources of risk.4,5,6

Outside of the pharma industry, many entities make efforts toward risk management; however, the execution success can be highly variable or aligned with different objectives. As a result, organizations with a high level of risk management maturity often will be reliant on an external network of government and business entities that have either low risk management abilities or risk management directed at different objectives. In such situations, the organizations with mature risk management practices can mitigate the risk from external sources by identifying and managing the risk “gaps” that result from uninformed risk acceptance by others or different objectives and risk tolerance in the connected entities.

Subdivision of External Risk Sources

The potential for external risk gaps that can adversely impact the pharmaceutical industry are evident when examining the multiple types of infrastructure systems that enable drug products to be reliably developed, manufactured, and transported to patients. Infrastructure systems include owned and operated facilities, such as pharmaceutical manufacturing buildings and employee housing, and this building infrastructure relies on a network of distributed infrastructure systems to provide power, water services, and transportation for commerce and employees to and from facilities. These infrastructure systems are enabling components of what is often informally referred to as the supply chain.

In the context of risk management, many of the sources of risk to the building infrastructure can be managed by the organization using the facility, because that entity is able to control decisions that influence both the likelihood and consequence of occurrence. For example, providing staff and financial resources to manage cleanroom facilities within a manufacturing plant is a step toward reducing the likelihood of an FDA compliance issue and the resulting financial and reputation consequences that would occur. There also will be external sources of risk to the building infrastructure, for which an entity has fewer options to manage the likelihood of occurrence; therefore, it may direct resources at management of consequences. An illustration of this would be an accident such as a small plane crashing into a building or a natural disaster such as a severe storm or earthquake. In these scenarios, an entity can undertake actions that reduce the consequences, such as strengthening owned buildings and having a business interruption plan; however, these actions do not reduce the likelihood of such an accident or natural hazard event. The actions only the address continuity of operations once the event occurs.

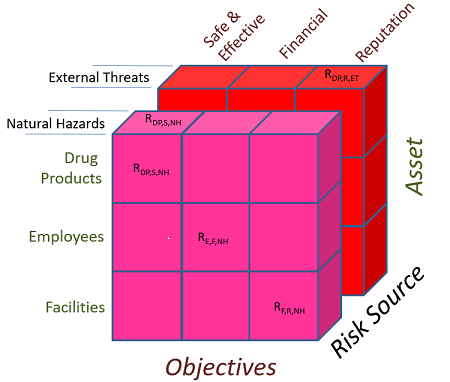

The separation of external sources of risk for risk analysis is important where there are measurable differences in the likelihood and consequence inputs and therefore different relative risk exposures and management options for an organization. This is illustrated in Figure 1, which shows “risk planes” for external business threats, such as a vehicle or a plane crashing into a building, and natural hazards, such as floods and earthquakes. While each of these risk sources is external to the organization, each also presents opportunities to manage either or both likelihood and consequence and, therefore, can be viewed with a separate plane of risk, just as there are multiple links in a supply chain.

Figure 1: External risk planes for external threats and natural hazards

When examining the external threats from the distributed infrastructure systems that support but are not controlled by an organization, the risk management scenarios become more complex because of alignment differences in risk tolerance and management among entities that enable a supply chain. For a critical industry with a high reliance on distributed infrastructure systems, such as the pharmaceutical industry, it is important for organizations to understand the differences in risk alignment before significant, unintended consequences occur through uninformed risk acceptance. As seen in Puerto Rico, disruption to power and transportation systems resulted in consequences to the pharmaceutical operations at the facility level in addition to individuals throughout the greater domestic realm of the island.

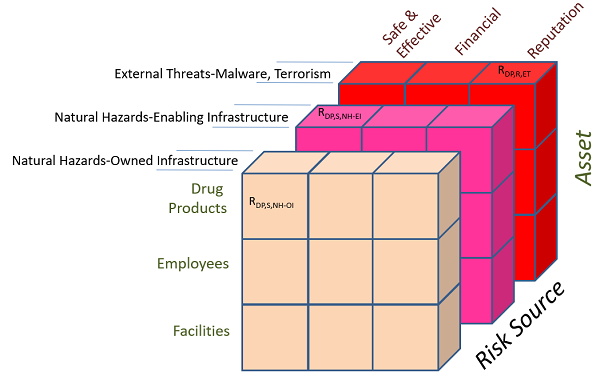

Subdivision Of The Natural Hazard Risk Source To Infrastructure

With respect to natural hazard threats, the owner or operator of pharmaceutical building infrastructure has many options to manage the external risk from hazards such as flooding and earthquakes within the confines of its facility. The pharmaceutical entities also are exposed to the risk from the enabling distributed infrastructure systems, or physical supply chain components for services such as power to facilities and transportation of products and employees. The options for a pharmaceutical entity to manage the risk from the enabling infrastructure and infrastructure owned by others are different and possibly fewer; however, there are both options and the means to make informed decisions if desired. For this to occur, risk analyses can separate the natural hazard risk source into two separate categories: natural hazards for owned/controlled infrastructure and natural hazards for the enabling distributed infrastructure systems. To illustrate this concept, Figure 2 presents the three risk planes that exist within the external risk source category discussed herein.

Figure 2: Subdivision of external risk sources into separate categories for measurement and management

The lessons from Puerto Rico before and after the hurricane suggest the importance of assessing future natural hazard risk to both the owned and enabling infrastructure for any facility in any location, as well as the local supply chain, to minimize future long-term disruption events that may be judged as intolerable. When viewing the risk planes in Figure 2, the post-event outcomes in Puerto Rico appear to support the fact that the natural hazard risk from enabling infrastructure was perhaps a weak link in a supply chain that was surrounded by robust risk management “chain links” for owned pharmaceutical infrastructure and man-made external threats. An organization performing risk analysis could further subdivide the sources of risk from enabling infrastructure into the different systems to identify which infrastructure systems contribute the greatest risk, such as power to facilities and transportation for employees and commerce.

Temporal Risk In Infrastructure Systems

Measuring and managing the risk from these three example external sources — external business impacts, natural hazards to owned infrastructure, and natural hazards to the enabling infrastructure systems — can enable an organization to reduce the frequency and magnitude of adverse consequences to operations. However, it is also important to acknowledge risk is not a static function, as risk and risk tolerance both independently change with time. Or, to put it more simply, past experience is not a good indicator of future performance. Thus, there is value in periodic in-depth review of current risks and deficiencies that ultimately need to be communicated and considered in corporate decision making. These concepts are embraced in the QbD paradigm prescribed by the FDA, which requires that risk evaluations are not performed at a single point in the product development life cycle but are living documents that must be revisited at each major project milestone and/or on a periodic basis.

As most private and enabling infrastructure systems contain assets and components that deteriorate with time, the likelihood of failure also can increase with time due to this deterioration. For example, buildings, transportation assets, and power systems experience deterioration and require operational investments to maintain reliability. In 2017, the average age of public power plants in Puerto Rico was 44 years old,7 which suggests many of the power plants were near new when pharmaceutical operations first started on the island. In the case of different but connected infrastructure systems, such as those in the Puerto Rico example, any disparity in infrastructure management practices among owners will change the level of risk to all entities. This creates a situation where the weak links in the system can become weaker — and at a faster rate than that of the connected systems or chain links. In this scenario, organizations can benefit from forecasting risk and evaluation of temporal changes in the risk for threats such as those shown in the risk planes in Figure 2.

Recognizing The Potential Of Normalization Of Deviance

When evaluating the temporal change in risk and risk tolerance, the concept of “normalization of deviance” is an important consideration in planning scenarios for those who seek to reduce the levels of unknown risk. Normalization of deviance is a descriptive term for events that were originally considered unusual but later become accepted as normal until a catastrophic event occurs and creates an unfortunate situation with greater than expected losses. Normalization of deviance can result in a gradual but unintentional increase in risk acceptance. For example, many people over 40 years old can recall exactly where they were when the Space Shuttle Challenger exploded in 1986, killing all seven crew members. This was an event caused by the normalization of deviance8 that proved to be a “predictable surprise” because there were multiple prior instances of leakage from rocket boosters that resulted in creep of acceptable practices.9 Another recent example is the Oroville Dam emergency evacuations and repairs in northern California in 2017.10 Simply stated, these events, while “unexpected,” can be shown to be likely or inevitable and thus able to be addressed in risk management programs. Perhaps with time and forensic studies, others will conclude that the consequences realized following Hurricane Maria have connections to normalization of deviance.

Considerations For Pharmaceutical Organizations

Audit And Risk Management Analysis For Both Owned And Enabling Infrastructure Systems

So, what are the considerations for those with business operations exposed to natural hazards? First, organizations can benefit from differentiation between the level of risk from natural hazard sources to owned infrastructure and to the connected infrastructure systems that enable business operations. A robust natural hazard risk management program for owned infrastructure should be matched with a similar risk management process for the enabling, often public, infrastructure systems that can directly impact the business operation. Managing the risk for owned infrastructure while blindly accepting unknown risk from natural hazard impacts to enabling infrastructure can expose an entity to consequences that in hindsight were easily identifiable.

Risk Management

When managing risk, decision options often are identified in categories of accept, treat, transfer, or terminate. By not completely auditing and managing the risk from natural hazards to enabling infrastructure systems, an organization is accepting the risk, and the level of risk is unknown – risk levels could be minor or could be substantial. While enabling infrastructure systems are not under the direct control of a private entity, the organization still has options to manage the risk versus defaulting to uninformed risk acceptance and self-insurance. This uninformed risk acceptance may be tolerable for an early stage pharmaceutical development organization with only a few employees, no commercial operations, and a primary focus on short-term objectives versus a complex organization with multiple facilities and commercial products, both domestic and international, and thousands of employees located within high-exposure areas for natural hazards such as hurricanes, earthquakes, or even tsunamis.

All organizations are exposed to external threats, including natural hazards. It is inevitable there will be impacts from natural hazards. The question is, are the resulting risks from those threats fully measured and managed across the organization and across sources of risk such as those conceptualized in Figure 2? Many business entities likely have sufficient resources to enable operations for owned infrastructure during an event through implementation of risk management steps such as backup power and water supplies, second source manufacturing operations, or business interruption insurance. However, as conceptualized in Figure 2 and evident following the Puerto Rico hurricane, there are consequences from the enabling infrastructure, such as housing for employees, transportation networks for employees and commerce, and power and water utility systems. Risk management is a valuable tool to manage these consequences versus accepting them as uncontrollable liabilities or placing a high reliance on broadly directed government recovery programs.

Acknowledging Temporal Changes In Risk

The temporal relationship of risk and the risk tolerance for natural hazard threats also should be considered. Risk management is not static, nor is risk tolerance, and periodic reviews of risk should be conducted throughout the operational life of an organization or product. Pharmaceutical life cycle management and the fact that risk assessments should be performed at each stage of product development is not a new concept, as it is referenced by the FDA and further defined by the International Conference on Harmonization (ICH).11 In the context of enabling infrastructure, pharmaceutical organizations will have a greater reliance on infrastructure systems when progressing through the product development and commercialization life cycle. In many regions, enabling infrastructure assets experience deterioration over time, meaning that as a business entity matures and becomes more reliant on infrastructure, the condition of that same infrastructure system may be declining, thus increasing the likelihood of adverse impacts. These temporal and differing alignments in risk management practices among connected but separate entities can create gaps in risk; therefore, risk management is best performed as an ongoing process.

Confronting The Normalization Of Deviance

Organizations can examine the potential for normalization of deviance to exist in risk management plans for natural hazard events that can significantly impact the organization. Pharmaceutical entities that rely on enabling infrastructure systems can perform scenario analyses for natural hazard events such as earthquakes and tsunamis or examine the lessons learned through the recent Puerto Rico hurricane recovery. These scenarios should consider the range of impacts from events that are likely, even for a low-probability event.

Hazards such as large hurricanes, flooding, strong earthquakes, and tsunamis are inevitable. When these low-frequency hazards occur, the event is “unexpected,” but there is much scientific knowledge to support their occurrence — we know where the potential for earthquakes and/or tsunamis is high or low. Additionally, the consequences of these events among the increasingly connected systems impacted by them are becoming more measurable. For example, post-event studies of the 2011 Japan earthquake and associated tsunami suggested a 1.2 percent decrease in Japan’s gross economic output the following year, with numerous business supply chain impacts documented.12,13 The impact on Japan’s manufacturing capabilities had an impact on the supply chains for pharmaceutical companies around the world that were dependent on that market for raw materials and container/closure systems used in final product manufacture.

A similar situation may exist for the San Francisco region,14 and it is not a matter of if but when. The Pacific Northwest is also within a zone susceptible to large earthquakes and tsunamis, similar to what occurred in 2011 in Japan.

Examining the San Francisco and the Seattle region examples, organizations willing to manage risk and address the potential for normalization of deviance in planning should include the analysis of natural hazard threats to both owned and enabling infrastructure systems and the resulting consequences. In these regions, normalization of deviance could inadvertently bias risk analysis outcomes — specifically because these localities have not experienced the “big one” in several generations and with a modern level of infrastructure and business interdependency.

As background, the 1906 earthquake in San Francisco had a magnitude of 7.9 and resulted in destruction of the majority of the city, with around 3,000 fatalities, well before the establishment of the modern pharmaceutical operations and infrastructure systems that now exist in the region. The 1989 Loma Prieta, CA, earthquake had a smaller — but still relatively large — magnitude of 6.9 and resulted in thousands of injuries, 63 fatalities, and many months of infrastructure disruption. While the difference in magnitude appears not to be substantial, the scale is logarithmic, meaning a future 7.9 quake would be 10 times larger in measurement and more than 30 times stronger in terms of released ground energy.

While many pharmaceutical and other business entities have routinely experienced and successfully recovered from smaller hazard events, these events have also potentially created their own normalization of deviance, whereby smaller, less-disruptive events become accepted as normal, despite the potential for harm. Thus, the acceptance of the risk from smaller events can result in a bias toward higher levels of uninformed risk acceptance. According to the U.S. Geological Survey,15 within the next 30 years, or the duration of a common home mortgage, there is a 72 percent probability of an earthquake near the size of the 1989 Loma Prieta event. The probability is 20 percent over the same duration for a larger quake like the 1906 event. To confront the potential of normalization of deviance, these event probabilities and the full range of consequences should be considered in risk management planning.

The existence of normalization of deviance within the San Francisco region can be inferred in the comments from the former leader of natural hazards research at the USGS, who recently indicated that 10 percent of the buildings in San Francisco will collapse in the next major earthquake.16 Further, up to 25 percent of buildings may not be functional — meaning they didn’t collapse but are no longer habitable. In the context of risk management, are organizations evaluating the level of risk that exists should 25 percent of their workforce lose their residence and transportation and utilities be severely compromised following a large earthquake? While it may be possible for the entity to engineer solutions and implement processes for their owned infrastructure, the enabling infrastructure for employees and the supply chain may be the weak link. Further, these statistics do not include the potential for injury or damage to public infrastructure systems, but such adverse consequences are inevitable.

Conclusion

The evidence from the 2017 Puerto Rico hurricane indicates that localized natural hazard events can have global effects on complex and well-run business operations, such as those in the pharmaceutical industry. The 2011 Japan earthquake suggests that even in one of the most robust and advanced hazard mitigation cultures, significant economic impacts will still occur. The memories of the last “major” earthquake in San Francisco region are more than 100 years old and the lessons learned occurred in a much simpler infrastructure system. Yet each day, we move closer to the inevitable next “big one” in regions such as these, hopefully with a comprehensive consideration of both static and temporal risk across all potential threats that will arise.

Pharmaceutical organizations and other critical entities are encouraged to develop risk management strategies that address natural hazard threats to both owned and enabling infrastructure and the resulting operational impacts. Reliance on codes and standards that often are formulated around broad public safety risk objectives should not be considered as a surrogate for risk management planning in the context of individual and business specific objectives. Through risk management, organizations can measure and manage risks, such as those from natural hazards, to known levels now and into the future. Finally, risk analysis should not diminish the risk from “unexpected” events that in hindsight or through robust evaluation are inevitable and unavoidable. The benefits will be valuable to businesses, employees, industry and company reputations, and, most importantly, the health of those served.

References:

- https://www.fda.gov/NewsEvents/Testimony/ucm581757.htm

- ICH Q8(R2) PHARMACEUTICAL DEVELOPMENT Current Step 4 version August 2009

- ICH Q9 QUALITY RISK MANAGEMENT Current Step 4 version dated 9 November 2005

- https://www.theguardian.com/us-news/2018/jan/10/hurricane-maria-puerto-rico-iv-bag-shortage-hospitals

- https://www.cbsnews.com/news/why-so-many-medicines-arel-in-short-supply-after-hurricane-maria/

- https://www.bloomberg.com/news/articles/2017-11-17/facing-saline-shortage-fda-prioritizes-some-puerto-rico-plants

- https://www.thestar.com/news/world/2017/09/21/puerto-ricos-electric-company-was-already-9-billion-in-debt-before-hurricanes-hit.html

- Vaughan, Diane. 1996. The Challenger launch decision: risky technology, culture, and deviance at NASA. Chicago: University of Chicago Press.

- https://mikemullane.com/product/stopping-normalization-of-deviance/

- https://damsafety.org/sites/default/files/files/Independent%20Forensic%20Team%20Report%20Final%2001-05-18.pdf

- ICH Harmonised Tripartite Guideline: Pharmaceutical Development. Q8(R2) August 2009

- http://www.brinknews.com/localized-natural-disasters-can-hurt-an-entire-countrys-economy/

- http://news.mit.edu/2011/japans-supply-chain

- https://www.nytimes.com/interactive/2018/04/17/us/san-francisco-earthquake-seismic-gamble.html

- https://pubs.usgs.gov/fs/2016/3020/fs20163020.pdf

- https://www.nytimes.com/interactive/2018/04/17/us/san-francisco-earthquake-seismic-gamble.html

About The Authors:

Mark Vessely, M.Sc., is a principal engineer at BGC Engineering, where he works with public and private infrastructure owners managing deterioration vulnerabilities and exposure to geological and other natural hazards. His current role includes working with transportation departments, government agencies, and energy transmission interests to manage performance risks to safety, asset conditions, and unplanned lifecycle cost escalation. He has 25 years of experience with design, assessment, and rehabilitation of infrastructure and has held senior engineering positions within a state department of transportation and had several consulting roles to federal, state, and local agencies addressing aging infrastructure assets.

Mark Vessely, M.Sc., is a principal engineer at BGC Engineering, where he works with public and private infrastructure owners managing deterioration vulnerabilities and exposure to geological and other natural hazards. His current role includes working with transportation departments, government agencies, and energy transmission interests to manage performance risks to safety, asset conditions, and unplanned lifecycle cost escalation. He has 25 years of experience with design, assessment, and rehabilitation of infrastructure and has held senior engineering positions within a state department of transportation and had several consulting roles to federal, state, and local agencies addressing aging infrastructure assets.

Christina Vessely, Ph.D., is a senior consultant, CMC analytics and formulation development at Biologics Consulting, where she is in responsible for supporting analytical organizations and global regulatory agency interactions for biopharmaceutical clients. Her current role includes development, qualification and validation of analytical methods, developing strategies for formulation, characterization, comparability and biosimilarity, and managing CMC strategy and execution for investigational drugs, regulatory agency briefings, and marketing applications. She has over 20 years in the biotechnology industry, with various leadership roles managing analytical development, characterization, and formulation development programs for large proteins and biologics at Insmed, KBI Biopharma, and Merck, respectively.

Christina Vessely, Ph.D., is a senior consultant, CMC analytics and formulation development at Biologics Consulting, where she is in responsible for supporting analytical organizations and global regulatory agency interactions for biopharmaceutical clients. Her current role includes development, qualification and validation of analytical methods, developing strategies for formulation, characterization, comparability and biosimilarity, and managing CMC strategy and execution for investigational drugs, regulatory agency briefings, and marketing applications. She has over 20 years in the biotechnology industry, with various leadership roles managing analytical development, characterization, and formulation development programs for large proteins and biologics at Insmed, KBI Biopharma, and Merck, respectively.